Insurers can play a key role in strengthening mental health & wellness resilience, according to a new report from analysts at Swiss Re Institute.

A recent survey from Swiss Re highlighted that the COVID-19 pandemic has impacted mental health wellbeing in Europe, with 40% of those below the age of 35 reporting a deterioration in their mental health status.

Swiss Re Institute survey among 11,000 consumers worldwide shows that the pandemic has led to a greater focus on health and financial security. This has resulted in more online insurance purchases and a greater willingness to share personal health data, especially among the younger generation.

2022 markets surveyed include: US, UK, France, Germany, South Africa, Brazil, Poland, Mexico, Australia, New Zealand, India, Japan, Singapore, Thailand, Malaysia, Vietnam, South Korea, Singapore, Hong Kong and Mainland China.

Findings from the survey also showed that awareness of mental health has become a top priority across all age groups and that demand for associated healthcare solutions, including digital services, is rising (see How Artificial Intelligence AI is Modernizing the HealthCare Industry?).

The Key Takeaway:

- Over half (60%) of respondents in emerging markets are increasingly concerned with their health as a result of the pandemic – almost 20 percentage points more than in advanced markets

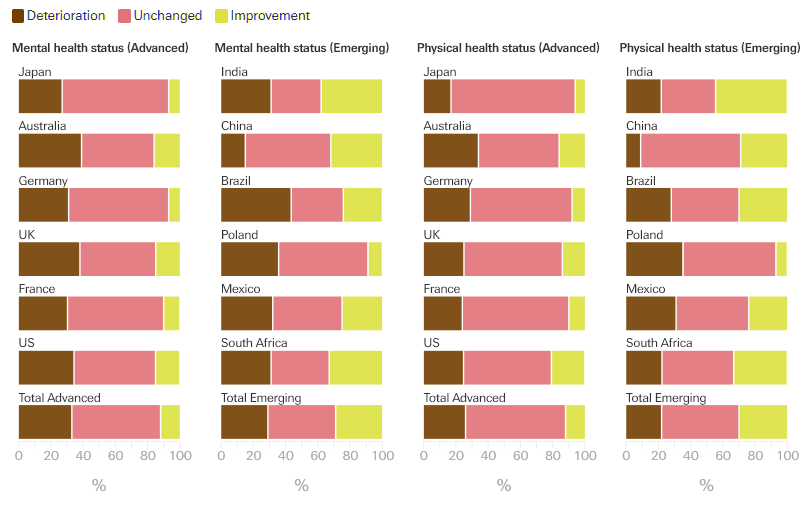

- In advanced markets, one third of the population surveyed reported a deterioration in their mental health during the prior year

- Globally, 40% of respondents are concerned about the adequacy of their existing level insurance coverage

- Among the under-40s, 54% have researched new or additional policies in the six months preceding the survey

The pandemic pivot from traditional working and shopping has been dramatic, as many people do their jobs from home, purchase online and turn to digital apps to help them manage busy lives.

Therefore, Swiss Re analysts noted that providing services to younger generations through health apps is one key area where insurers can help improve mental health resilience in the region.

In general, the variety of mental health support platforms, such as telehealth & H&W apps, is multiplying beyond traditional medical services, and their adoption is highest among the younger generation.

We find that mental health professionals are among the preferred recommendation channels through which youths would download and use H&W apps, while close to 80% of younger Europeans would be ready to share personal data for improvements in health and insurance services.

Insurers can play a very strong role within mental health resilience, as they can promote preventive care by integrating digital tools into policies, and also joining forces with new market players.

For those insurers that manage to follow and focus on the habits of the younger and more tech-savvy customers, will be best positioned for the future of mental healthcare.

COVID-19 has taken a toll on people’s mental and physical wellbeing, with many more expressing concern about their health since the start of the pandemic. In advanced markets, a third of the population surveyed reported a deterioration in their mental health over the past 12 months.

Analysts see two complementary actions: Firstly, incentivise consumer use of diagnostics and care tools through policy-integrated telehealth platforms and apps could help to lower the overall cost of mental healthcare services, and also promote the adoption of sound lifestyle habits and trigger preventive actions.

Many insurance consumers said their mental and physical health took a hit during the pandemic

This year’s survey was global in nature, an extension of our 2021 and 2020 Asia-Pacific specific surveys. The results provide valuable insights for life & health (L&H) insurers. For instance, we find that COVID-19 has affected insurance purchasing decisions: in advanced markets, respondents looking to purchase insurance say they will pay close attention to cover details, while in emerging markets, consumers say the priority is having coverage for different risks. Intention to buy new policies is highest in emerging markets.

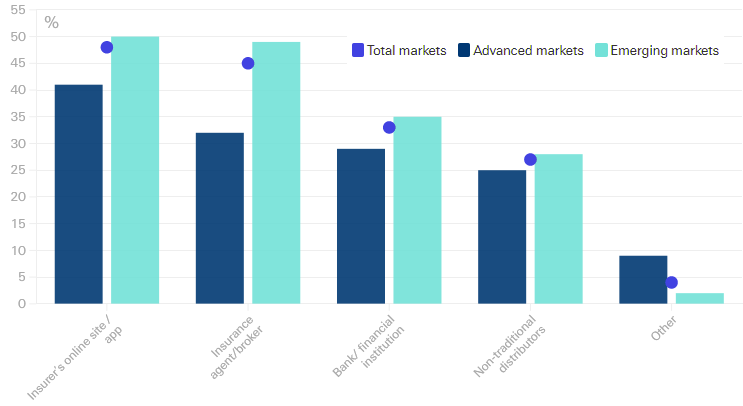

Online platforms stand out as the dominant purchase channel for insurance policies globally. Digital touchpoints for health and insurance management have gained in popularity, particularly among younger cohorts.

We expect the convenience and swift processing potential offered by digital platforms to become more popular over the next decade.

The usage of health & wellness (H&W) apps is particularly high among younger people. Apps for weight control, healthy eating and stronger physical health likewise trigger consumer interest. Survey respondents say the ability to develop lifestyle habits, track health improvements, and learn from the programmes offered on the apps keeps them engaged.

Digital touchpoints for health and insurance management

By strengthening links with existing apps and mental health providers, this could allow insurers to move into an established pool of younger customers that are looking for mental health support services.

The sudden shock to healthcare systems and accelerated digital adoption, among other behavioural changes, has had a profound impact on people’s livelihoods. As a result of this, many consumers continue to express concern regarding their health resilience and how well they are insured for potential health shocks in the future

Jérôme Jean Haegeli, Swiss Re’s Group Chief Economist

The ensuing report, Digital touchpoints build physical and mental health resilience, reveals that changes in consumer health concerns and financial security have led to a reprioritisation of policy importance, triggering a further shift to more online insurance purchases.

Insurance purchase channels in the past 6 months

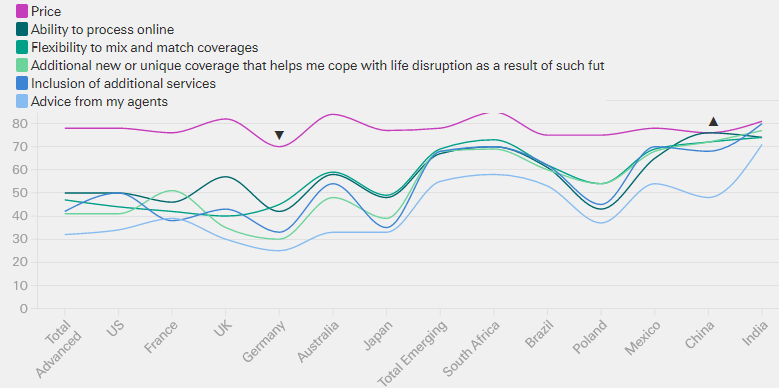

Global Transforming Healthcare and digital touchpoints for health and insurance management have gained traction, particularly among younger cohorts. In the advanced markets, respondents looking to purchase insurance pay close attention to affordability and the convenience of online processing, while in the emerging markets, priority is on price, online processing and the flexibility to mix and match coverage plans.

Consumers continue to prioritise their wellbeing two years into the pandemic. The re/insurance industry has an opportunity to help strengthen this resilience in the post-pandemic world

Paul Murray, CEO Reinsurance Asia at Swiss Re

The good news is that more and more consumers are putting their faith in the industry and to make the most of this, we must collectively respond to their changing preferences by meeting their expectations of us – multiple digital touchpoints, new products for the new normal, and more efficient underwriting.

Changing consumer attitudes towards healthcare

This year’s report shows that while the pandemic has shifted consumer behaviour in emerging markets to preventative care and disease prevention, COVID-19 has become a catalyst for more regular health checks across the globe.

Findings reveal that 46% of respondents in emerging markets plan to attend health check-ups more frequently, versus 16% in advanced markets. This is particularly true for India and China, whereas the US saw the highest impact on check-ups (21%), while Japan the least (7%).

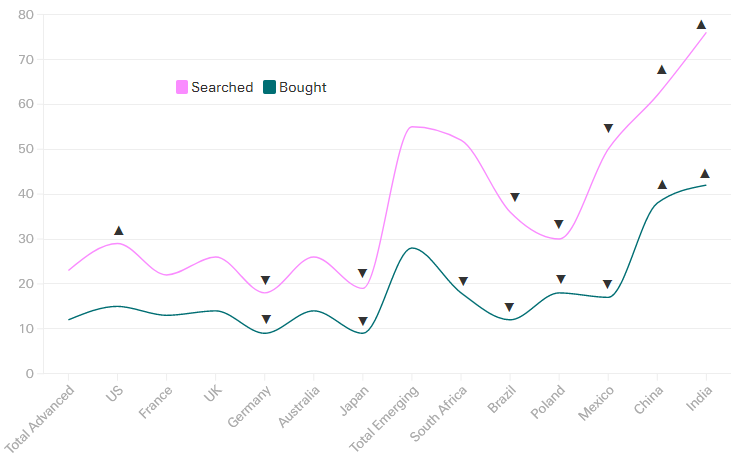

Respondents also expressed rising concerns over the adequacy of their existing level of insurance coverage. Of those surveyed and under 40, 54% declared having researched new or additional policies in the six months preceding the survey.

Among the advanced markets, respondents in Japan (55%) and the UK (49%) expressed the greatest level of insecurity. Insurance searches and purchases were notably the highest in China and India, with an average, 40% of respondents purchasing new coverage. In the past six months, the under-40s in emerging markets were the most active in exploring new or additional coverage and constitute the fastest growing target group for insurers.

Mental health also remains a priority, with the results showing that one third of the population surveyed in advanced markets reported a deterioration in their mental health status over the past 12 months. This was most prominent in the UK (28%) and Australia (26%), while in Germany (26%), sentiment around overall health declined the most.

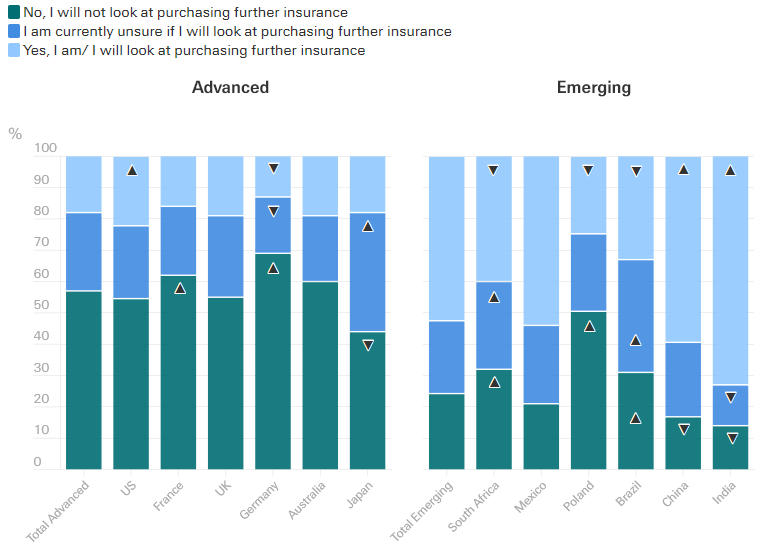

How much is enough? People worried about insufficient insurance may seek additional cover

Younger, emerging markets consumers often sought insurance as the pandemic created insecurity over coverage

During a pandemic that disrupted just about everything, it’s no wonder many fear their coverage may not be sufficient. This heightened risk awareness, which insurers often observe after catastrophes, is seen driving demand for life insurance.

Still, there’s a divide between geographies, our survey shows, as some 53% of respondents in emerging markets indicated they will buy insurance, compared with just 18% in advanced markets.

Insurance buying intentions are also higher among younger populations, with one in three people aged 18-29 and 30-39 saying they would do so. For insurers, this represents an opportunity in countries with low insurance penetration and younger populations.

Rising health awareness, digital acceptance

The report reveals increasing popularity towards using digital channels for health management. The uptick in telehealth and virtual healthcare continues to grow in use across advanced markets.

One in three respondents globally also stated their interest in using health and wellness apps, particularly within the 18 to 39-years category, to help build their mental strength. Respondents continue to prioritise their mental health, sleep management and nutritional habits.

This year’s results again demonstrate that the ongoing global pandemic is an opportunity for insurers to narrow the protection gap in life and health insurance. With a better understanding of consumer perceptions on overall health and financial security, attitudes towards digital applications, and factors that influence insurance purchasing decisions, re/insurers can work with governments and consumers to strengthen physical and mental wellbeing.

The bottom line remains consumers’ top priority

Cost of insurance and consumers’ perceptions of getting good value-for-money remains the most important driver in purchasing decisions across all markets. This is no surprise, given the financial insecurity caused by the pandemic in many sectors of the economy. People are minding their wallets, especially now that global inflation has accelerated.

Asia-Pacific markets

For Asia-Pacific (APAC) markets that we have surveyed for three years, we can analyse and track changes in consumers’ sentiment and insurance choices. We find that most APAC consumers have remained vigilant about their health status throughout the pandemic. The pandemic has also led to an increase in APAC consumers’ openness to health management and insurance purchasing through digital channels. Compared to 2021, more respondents are now open to buying insurance from non-traditional digital channels such as e-wallets or online shopping platforms.

The evolution of insurance models depends on insurers’ ability to tap into new sources of data to improve decision-making, strengthen underwriting and offer novel products to customers.

Overall, the pandemic is a call for action to insurers. Insurers can work with governments and consumers to strengthen physical and mental wellbeing to build resilience in a “new normal”. Developing affordable insurance products with comprehensive coverage, enhancing insurers’ digital capabilities and building consumer trust in digital solutions is key to success.

Conclusion

The World Health Organization (WHO) documented the pandemic-driven rise in anxiety and depression, calling this a “wake-up call” for nations to focus on mental health. Similarly, Swiss Re’s survey highlights a growing role for insurers in helping improve customers’ mental resilience.

One-third of respondents reported deteriorating mental health, and respondents in most markets cite a rising awareness of mental wellbeing, with the pandemic a catalyst for many to recognise this as central to quality of life. In emerging markets, 64% of people said they sought mental health support since the pandemic began.