For life insurance carriers, building the infrastructure to support a successful teaming model often requires a major shift in many of the mechanics of distribution. Insurance carriers must be prepared to redesign their organizational structure, governance, and talent strategy to align with the imperatives of teaming. Firms with the appetite and capability to make these changes can unlock best-in-class productivity and create incremental value for all stakeholders—producer, home office, and customer alike.

The life insurance industry has been talking about the benefits of teaming for a long time. A departure from the traditional solo-adviser approach, teaming refers to a team-based distribution model in which insurance agents work together—with varying degrees of specialization and sharing of resources and revenue (Why You Should Get Life Insurance?).

Compared with other financial advisers, life insurers have been slow to adopt this practice. A limited understanding of how to build successful advisory teams only adds to the skepticism and lack of appetite to reimagine business models to the extent required to reap the benefits that teaming can provide.

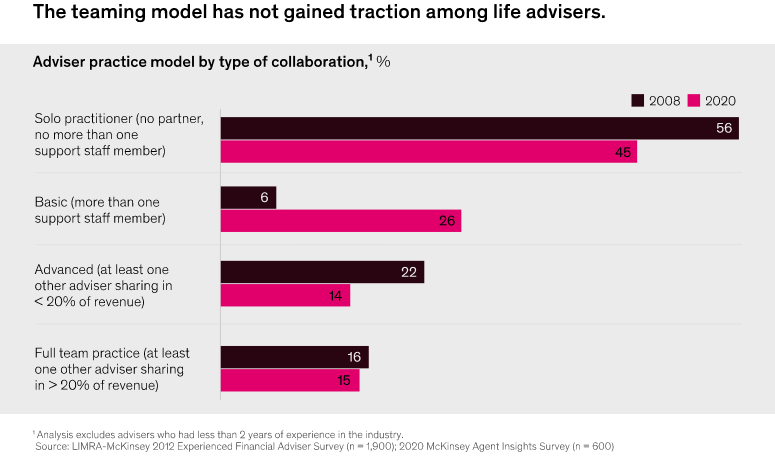

While informal collaboration has increased in recent years, only 15 percent of life advisers in North America reported sharing a substantial portion of their revenue with at least one other agent—effectively the same proportion of life advisers sharing revenue in 2008.

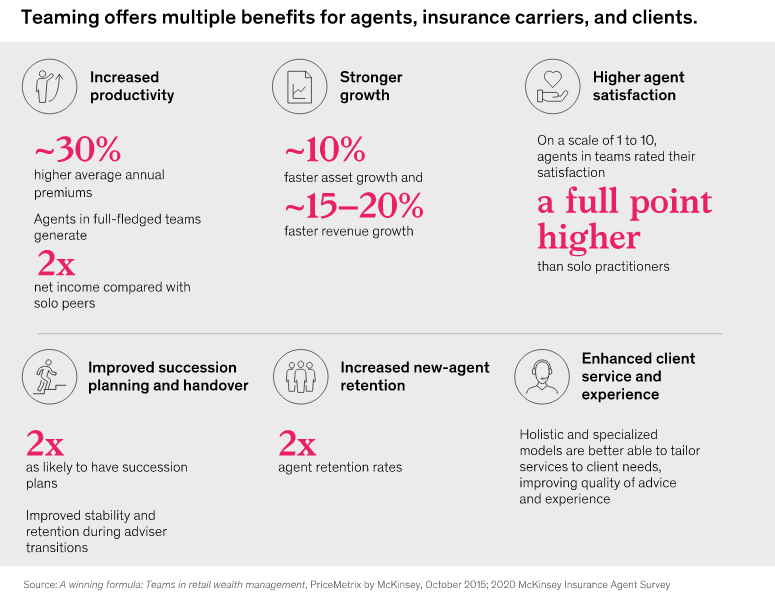

According to McKinsey’s Agent Insights Survey, teaming has significant advantages for life insurers—including increased productivity, stronger growth, and higher agent satisfaction. Teaming offers an elegant solution to many of the industry’s challenges, such as changing consumer preferences, an intensifying competitive landscape, and an aging agent workforce (see about Life Insurance Company Transformation).

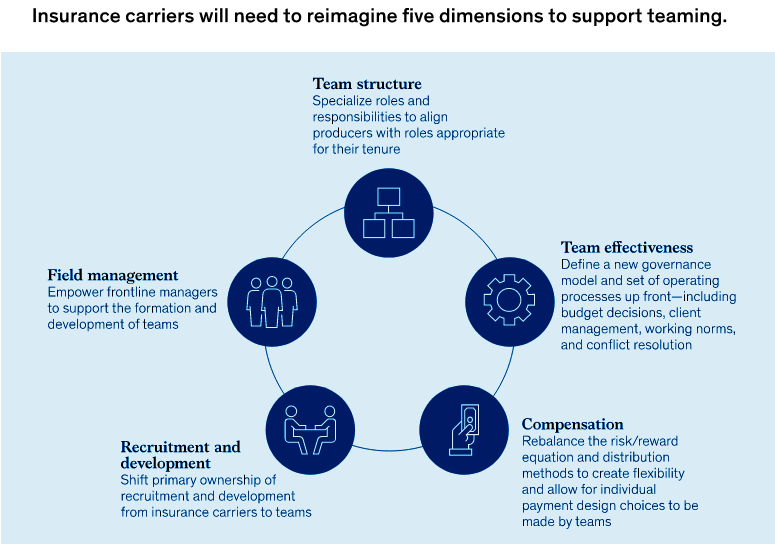

Insurance carriers will need to rethink their distribution models across five dimensions: roles and responsibilities of producers, governance models and operating processes, compensation design, recruitment and talent development, and field management. In our experience, the success of teaming depends on a wide variety of factors, from the overall organizational structure to the accountability of frontline managers.

The current state of teaming in life insurance

Teaming can drive major improvements for advisers, insurance carriers, and clients alike. According to Life Insurance Digitalization and Core Modernization Survey, advisers who regularly work in teams generate about 30 percent higher average annual premiums than those who don’t.

Productivity gap is even larger for more sophisticated teaming models: agents in full-fledged specialized teams often generate double the net income of their solo peers.

Teams report about 10 percent faster asset growth and 15 to 20 percent faster revenue growth when compared with solo advisers.

It can be difficult to determine whether these benefits are driven solely by the team structure or are due in part to selection bias—that is, the tendency of high-producing advisers to form teams with other already strong performers.

Nonetheless, in our experience, insurance carriers that have made targeted pushes to increase teaming among agents have experienced discrete lifts in productivity.

Beyond the financial upsides to the team structure, our research suggests that teaming also facilitates significant improvements in recruitment and retention, agent satisfaction, and succession planning.

Despite the robust benefits of teaming, the proportion of life advisers who have adopted a full-team practice has remained virtually the same for nearly 15 years.

This is because the existing incentive structure and organizational culture of life insurance companies typically promote individual production over teaming. Many insurance carriers and agents also have an imperfect understanding of how to design a successful team (see Largest Life Insurance Companies in United States).

Furthermore, the shift to a teaming model requires insurance carriers, which are typically risk averse, to fundamentally transform their operational models and infrastructure.

Finally, some insurance carriers point to failed experiments in teaming that did not yield the promised results.

For example, many insurance carriers worry that self-proclaimed “teams” will simply be groups of producers seeking to “grid stack,” or combine their individual productions to reach a higher, leveraged part of the commission grid. As a result, many insurance carriers are hesitant to fully endorse teaming and provide the necessary infrastructure to support the teaming model.

The challenger: Wealth advisory firms

Current market trends are forcing insurance carriers to reevaluate their stances on teaming. In the competition to serve as a customer’s primary financial adviser, life insurers are at a disadvantage against wealth management teams that specialize by expertise and provide holistic advice.

Wealth advisers are twice as likely as life insurance agents to function in a teaming model in which they share a substantial portion of their revenue with at least one other agent.

At wealth management firms that have made consistent efforts to promote teaming within their field force over the past ten years, more than 70 percent of wealth advisers operate in formalized, specialized teams.

Within insurance, the share of advisers in equivalently sophisticated teams is about 30 percent.

The primary reason for this discrepancy is the difference in compensation models: life insurance agents often do not attain a steady income until later in their careers, when they have built a substantial stream of policy-renewal revenue.

However, life insurance agents are already accustomed to working in a solo model and have fewer incentives to embrace long-term business model changes. Alternatively, the assets under management (AUM)–based compensation structure in wealth management enables wealth advisers to achieve a steady flow of income much earlier in their careers than life insurance agents, thus allowing for long-term investments such as teaming.

In addition to compensation, the traditionally hands-off approach that life insurance carriers have taken toward their agents’ models stands in stark contrast to how wealth managers encourage and facilitate teaming. This resulting divergence will continue to put life insurance agents at a disadvantage, leaving wealth management teams better positioned to edge out life insurers and take on the primary advisory relationship with consumers.

The competition for talent

According to McKinsey’s 2020 Agent Insights Survey, the average life adviser in North America is 50 years old, and only a quarter of advisers are under 40 years old. This lopsided curve has created an urgent need for insurance carriers to ramp up recruiting, retention, and succession planning; teaming models can address all three.

In the typical solo model, 80 percent of agents quit in their first four years. This is because, in addition to a compensation model that rewards tenure (and thus is lean in early years), new agents are required to perform multiple skills at a high level—contacting clients, conducting meetings, building relationships, and closing sales.

They must also possess a deep knowledge of an increasingly complex and diverse array of products and regulations, as well as the skills to run a small business and an appetite for entrepreneurial risk-taking.

It is no surprise, then, that insurance carriers often face severe challenges in attracting and retaining the talent they need.

Under the teaming model, new-agent retention more than doubles. In our experience, teaming enhances the employee value proposition, especially for younger generations that place a higher emphasis on professional-development opportunities. In teams, responsibilities can be divided across tenures, allowing new agents to own a more manageable set of tasks while they ramp up their skills and apprentice with more tenured agents. Agents in teams are also twice as likely to have a succession plan—and because clients build trust with a team of advisers rather than with an individual, client retention becomes more natural as senior agents near retirement.

Designing successful teams

There are two common types of teams that work in practice but that have meaningfully different operating models and impacts on productivity (see sidebar, “Teaming archetypes”).

Generalist teams are groups of agents who largely continue to manage their individual books of business but coordinate to share servicing responsibilities—for example, sharing office space, support staff, and vacation coverage. While this model can improve accountability and facilitate best-practice sharing, individual productivity is essentially unchanged.

Specialist teams are teams in which the roles of producers and the way every aspect of work gets done, from client service to process flows and individual responsibilities, significantly change to grow the economic pie. When agents specialize by task (such as prospecting, servicing, and managing portfolios) or by expertise (such as life insurance, estate planning, and wealth management), the entire value chain can be optimized, resulting in higher overall productivity.

Because most teams in life insurance today are generalist teams, the real value-creation potential of teaming is rarely realized.

Across team types, research on teaming in wealth management suggests that certain team design choices play an outsize role in performance:

- Age of team members. Teams tend to grow faster when their members are within a decade of one another in age. In fact, teams whose members are within ten years of one another typically grow at least one percentage point faster than teams with wider age gaps. While the mentor–mentee relationship inherent in teams can—and in fact should—increase the odds of long-term, multigenerational success, having members of similar age can drive improved growth.

- Gender diversity. Mixed-gender teams are likely to grow and perform better than their single-sex counterparts. One study found that the average all-male and all-female wealth management teams lag by at least one percentage point in annual revenue growth compared with their mixed-gender counterparts. Because nearly 75 percent of life insurance agents today are male, it will be challenging for insurance carriers and agents alike to create sufficiently diverse teams.

- Team size. We also observe a significant lift in productivity as team sizes increase. A McKinsey survey across both life insurance and wealth management segments found that teams with three or more advisers reported 30 percent higher productivity per adviser on average than solo advisers. A solo adviser who adds a single support staffer or partner can still expect an average uptick in productivity of 6 percent and 9 percent, respectively. But the significant unlock occurs only when advisers go beyond the “two-person partnership” and embrace larger teams.

Five dimensions to reimagine

To create the infrastructure necessary to support teaming, insurance carriers will need to reimagine their distribution models across five dimensions.

- Specialize responsibilities and expertise Two non-mutually exclusive types of specialization are relevant to the life insurance sector: specialization by responsibility and specialization by expertise. Specialization by responsibility refers to the disaggregation of the sales cycle by tenure, which increases efficiency across the value chain. For example, a new life insurance adviser may spend the first year primarily supporting senior producers by gathering data, preparing cases, and observing as senior advisers counsel clients and close sales. In the second year, the new adviser might still mostly focus on data gathering and case analysis but also begin to engage with clients more independently. Meanwhile, veteran producers can concentrate on higher-impact client work, alongside recruiting and mentoring new producers. Over time, the formerly new producer would shift focus from support to sales, with coaching from the senior producers along this transition, while additional new advisers would join the team to take over the support responsibilities. The example above represents a marked shift from the traditional model, in which all advisers are expected to play every role throughout their careers. Disaggregating the responsibilities and defining clear roles allows each member to focus on the activities that generate the highest returns for the entire team. Beyond specializing by responsibility, teams can also specialize by expertise to create a holistic financial offering for clients. While many life insurers are actively working to diversify the expertise within their adviser base, very few have achieved the breadth of skills and knowledge required to form distinct advisory specialties within teams and compete with comparable wealth management practices. In the long run, however, life insurers that can specialize by expertise will gain a competitive advantage.

- Define processes up front Once the team has decided how to specialize across roles, agents must work together to define a new governance model and set of operating processes to support the structure. These processes range from making critical budget decisions to transforming the client management and interaction model and setting clear working norms, such as conflict resolution processes and the frequency and agenda of team meetings. However, agents cannot define new models and processes on their own. In our experience, insurance carriers can support teaming by providing blueprints on recommended processes and operating models and by sharing best practices with new and existing teams. Furthermore, field managers should facilitate sessions for new teams to help guide the governance design process, providing expertise and learnings from other teams.

- Rebalance the risk/reward equation for compensation Teaming requires insurance carriers to reevaluate their compensation design and distribution. Under the current solo-adviser model, the least-experienced producers take on the highest risk and receive the lowest compensation. This misalignment between risk and reward puts new producers in precarious situations and contributes to persistent recruiting and retention challenges. The teaming model can help rebalance the equation. A cash compensation “pot,” based on collective team performance, can sustain stable compensation for new producers while offering higher potential upside for the most senior producers, akin to a law firm or any other professional partnership. Moreover, this model creates tangible incentives for senior producers to mentor and develop junior advisers, which has historically been deprioritized relative to new production. To help encourage the formation of teams in the early development stages, insurance carriers can also share part of the risk—for example, by taking on the partial or full cost of adding new, largely nonproducing advisers to teams. When implementing changes to the compensation model, insurance carriers should prioritize flexibility and allow teams to own individual payment design choices. We have seen multiple structures work successfully—including insurance carriers providing financial support for initial team setup, incentives tied to the performance growth of individual team members, and other mechanisms that make pooling resources more seamless for teams.

- Embed teaming into recruitment and development In a future state in which teams invest financially in new team members, it follows that the team should own its recruitment and professional development. In the initial transition toward teaming, the insurance carrier’s home office may continue to hire advisers who match a new, team-oriented profile. Once teams mature, however, the role of the home office should focus on communication, developing recruiting materials, and sourcing and filtering candidates. Ultimately, the primary decision-making power should reside with teams. Next-generation teaming requires recruiting a radically different producer profile—a strong team player, rather than a solo practitioner, with both leadership and selling skills. Insurance carriers will need to develop new tools to identify these profiles and to recruit from a broader and more diverse pool of candidates. Finally, training and development for new advisers will also transform under the teaming model. Today, most new advisers are asked to sell from day one. This “sink or swim” model results in high early-tenure attrition, which in turn inflates recruiting and training costs. In a teaming model, new advisers can begin by learning the fundamentals of the business and apprenticing with tenured producers, increasing their likelihood of success and reducing the costs associated with high turnover.

- Empower field managers To enable successful teaming, insurance carriers need to elevate and empower frontline managers to manage the strategic and tactical aspects of delivering impact through teams. Field managers would be responsible for consulting advisers about the formation and development of teams, providing ongoing counseling to improve performance, and identifying and disseminating best practices across teams. This includes coaching team leaders to be effective mentors and ensuring that junior members are given adequate development opportunities. Frontline managers would also hold teams accountable for meeting their collective performance targets and evaluate teams against metrics that extend beyond sales—such as recruitment, retention, and customer satisfaction. As the responsibilities of field managers shift and expand during the transition to a teaming model, some insurance carriers may need to reassess their current talent and training strategies for field managers.

………………………………..

AUTHORS: Arielle Pensler – associate partner in McKinsey’s New York office, Shannon Varney – partner in McKinsey’s Boston office