Data is critical to the insurance industry. It can be the difference between identifying risk and not; pricing policies correctly and not; retaining customers and not. Traditionally, legacy systems and siloed ways of working have prevented insurance organisations from making the most of the data they collect and store – but, to transform the industry meaningfully, insurtechs and incumbent insurers must get to grips with their data, according to Cognizant.

Few industries are as well positioned for the future as insurance. As Economist Impact research commissioned by Cognizant demonstrates, the industry, which was investing heavily in digital even before the pandemic, is full of companies that are recognizing strategic business value from their digital investments.

Data can help insurers to reduce their exposure to risk and create more satisfactory experiences for customers – but only if they make the most of it

Yet challenges remain. Insurers find themselves beset by niche insurtech startups competitors that are unencumbered by technical debt; a sometimes-challenging regulatory environment to innovate within; and ever more demanding consumers who insist on shopping, buying, and servicing experiences for complex products at a level akin to a purchase of a new set of earbuds.

Collecting and storing this vast amount of data is pointless and expensive unless you can derive insights from it to understand both the risk and the customer better.

One gap in the current approach is insurers failing to enable customers to engage with them when life and asset circumstances change.

By bringing the customer into the loop – in a secure and trusted manner – insurers ensure a better customer experience.

Are there holes in insurers’ data collection practices?

When it comes to making better use of data, the first thing insurers can do is reassess what data they already collect. Is every datapoint you collect necessary, and are there things you’re not collecting that you really ought to know? Data creates an all-encompassing picture about the customer and the nature of the risk you’re insuring, so collecting the right data is a critical first step in the lifecycle of a policy.

Data is vital to helping insurance companies understand their customers and assessing risk. Today, there are many data sources that simply weren’t available a decade ago.

Chris Royles, EMEA Field CTO at Cloudera

From ‘intelligent’ vehicles reporting accidents in the moment and IoT devices monitoring buildings through to the use of real-time weather data to model risk more accurately in shipping insurance (see Internet of Things in Insurance).

So what information could insurers collect, but don’t always, that would improve insurance decisioning or reduce risk for the underwriter?

Historically, insurers have relied on their vast quantities of historical data to advise pricing and customer engagement. However, we’re now seeing these incumbents increasingly using unstructured data and new sources of external data such as IoT devices, which offer many more potential opportunities to collect data to inform decision making and risk performance.

Insurers will be competing with new entrants to the sector such as hyperscalers, with the winner being the ones able to utilise their insights to price better and provide better service.

David Sexton, VP & Head of Insurance Practice UK&I for Cognizant

Fitness trackers are a good example of the way that insurers have changed their approach to data, with health insurers now using the data shared through such devices to improve decisioning and encourage less risky behaviours from the customer. This helps to create lower premiums and reduces the risk for the business – both parties win.

Are insurers making the most of the data they collect?

Once you guarantee that you’re collecting the right data, the second important step in any data strategy is to make the best use of it internally.

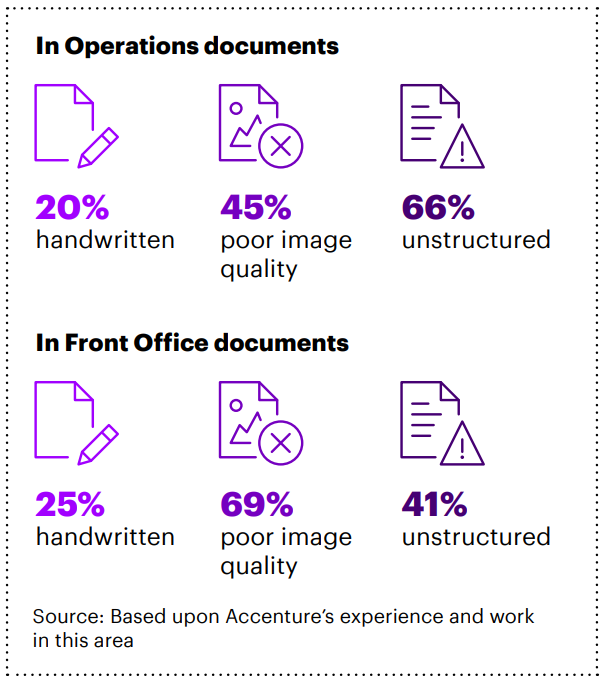

Insurers are not making the most of data they already have access to. In fact, recent Accenture research shows that up to 75% of data in-house is not being accessed and used by insurers.

This is because a lot of data is still being stored in old legacy systems, which can make it hard to unlock and access.

Valuable data is often unstructured, such as underwriting and claims notes. As a result, insurers often don’t know the power of the data they actually have available to them.

On top of this, not all insurers know exactly which business use cases can be optimised by which data. All of these issues make it very difficult for insurers to make the most out of the data they already have in their organisation.

The Dark Data challenge

According to Accenture, in insurance, automation clearly provides great efficiency gains when it is used to realize STP. Yet many insurers (and vendors) shy from targeting no-touch automations. One of the primary roadblocks is the issue of “Dark Data.” Up to 75% of a corporation’s data may be Dark Data.

Dark Data is data that an organization has but cannot make use of. This includes both data that is not currently accessible to human or automated operators, as well as data that is accessible, is used by humans, but cannot be directly interrogated by systems and automation technologies. All forms of Dark Data can present roadblocks to STP.

Consider the example of a photograph that shows the scene of a car accident, as well as capturing the license plate, color, and severity of damage to the vehicle. There may be a street sign in the image indicating the location of the accident, and the image may show whether it is day or night, and whether the road is wet or dry.

This information on its own could be enough for an insurance company to open a claim and produce an initial estimate of damages, determine whether to dispute the claim, and assess the probability of fraud.

However, because that data is locked inside a photograph and is not presented in a structured format, it is not captured by the business; the image is indexed for future reference and the data is left on the shelf forever.

Insurers have a head start on the future — but the road ahead is uncertain

Here are insights on ways in which the insurance industry is future-ready—and where there is work to be done.

Sustaining the first-mover advantage

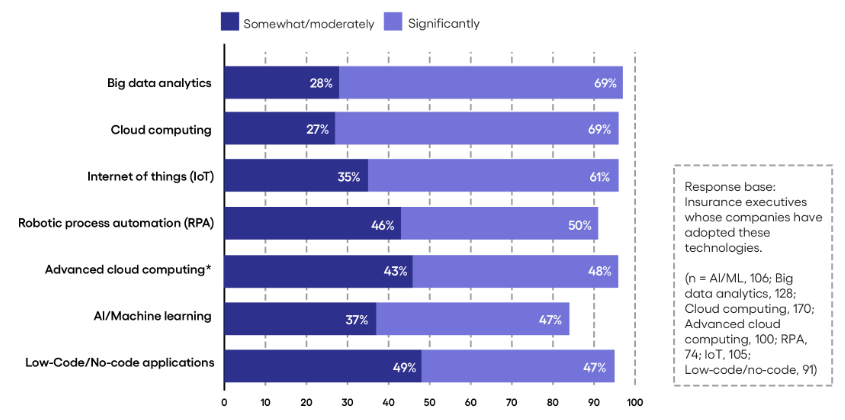

- Mastery of data. Insurance is all about data: how it informs the design of products and services, and how it manages customer experience. Insurers are ambitious users of technology and are skillful at linking it to business goals and extracting strategic value from it—this is fundamental to the business. Big data analytics and cloud technology are increasingly being used to handle the massive volumes of data passing through systems and risk engines, searching for insights that lead to differentiation. Almost seven in ten insurance companies that have adopted these two technologies are seeing them deliver significant value. Tech is moving beyond the foundational to the frontier, opening the doors to emerging risks and protection with the promise of predictive analytics and artificial intelligence (AI) contributing to healthier bottom lines and superior customer experience.

Insurers are deriving significant strategic value from tech investments

Respondents were asked to what extent the following technologies and methodologies already adopted by their business are delivering strategic value to their operations. (Percentage of respondents who advised each technology is, or is not, providing significant value to their business)

- Insurance products are changing rapidly as digitization accelerates. From personal auto coverage in which driver behaviors are monitored from mobile phones to renewable energy technology that can be monitored online, the very nature of developing products for the market is evolving rapidly.

- Permissible use of data. Insurers are pondering the digital dimension for applying techniques to improve the use of data, particularly in areas such as risk and rating. Regulation demands increased focus and is driving more and more tech investment (AI/machine learning, big data, etc.) to ensure customer privacy and data protection.

- Future regulatory considerations for data. The emerging regulatory scenario will place significant pressure on compliance requirements facing insurers related to data security; consumer protection; and climate-change and environmental impacts.

- Employee satisfaction. Insurers have largely embraced flexibility in areas such as hybrid work and are seeking to make themselves more attractive for tech-savvy and statistically trained talent in a highly competitive job market. Young talent today seeks not just financial rewards, but also purpose at work. Insurers exist precisely to give people security; given their exposure to environment-related risk, they also have a powerful incentive to embrace sustainability.

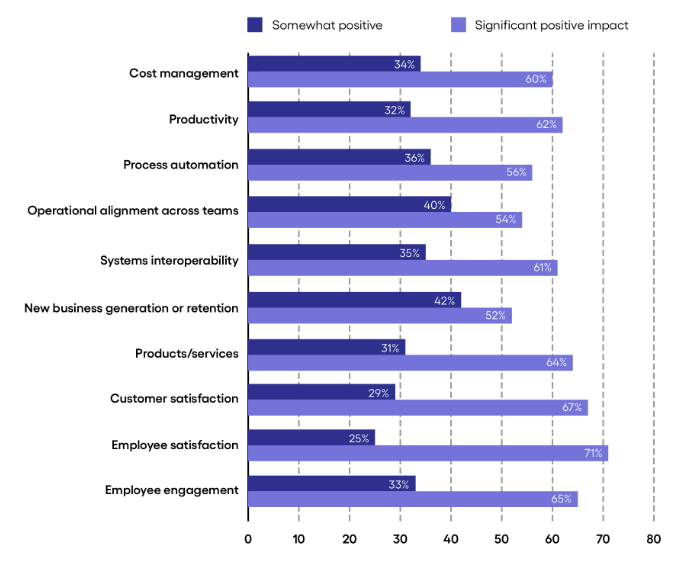

Tech adoption is benefiting multiple business areas

Respondents were asked what impact their company’s technology improvement efforts had on the following business areas over the past year.

- New business generation and retention. Just slightly above half of insurers believe tech adoption is significantly benefitting new business generation or retention. This falls well short of data’s potential. Since sales often run through the app or website of a digital retailer, a critical step to maximize this is for insurers to build out an API layer that smoothly integrates their systems with those of these retailers.

- Being embedded in tech ecosystems is critical to driving future value. Insurers need to be well embedded in dynamic ecosystems through economical API solutions—for example, in partnership with innovative distribution startups.

- Commercial adjacencies and market opportunities emerge through ecosystems. Post-sale relationships with clients can now become ongoing conversations that benefit all sides. For example, subject to customers’ consent, health insurers can use digital channels to nudge them to exercise more and eat healthier food—and then offer lower premiums to those with healthier habits.

- Customer experience. Advances in technology, best practice adoption across industries, and an emphasis on journey-based engineering have been driving significant experience improvements in insurance. The movement to first understand the human-centric reality of business processes has opened transformational uses of conversational AI, natural language processing, and systems that interact with clients based on underlying emotions. For industry leaders, cognitive systems guide chatbots to respond to customers and escalate work to upskilled agents when tense situations need specialized, human-driven handling. The result is higher customer retention rates, lower agent turnover and the generation of insights to continuously improve customer experience.

- Workflow. New workflows are being put in place so that the most predictable, rote and repetitive activities are handed off to software, while humans specialize in using judgment, creativity and language. Over time, intelligent process automation will improve and will continue to drive engagement specificity where the human touch is needed.

- The customer journey is changing fast. Traditionally, insurance buyers used brokers to select and purchase policies. Then, there was the assumption that a direct-to-consumer relationship would prevail. In today’s world of abundant data and mature e-commerce, this model is giving way to a new ecosystem that requires insurers to do things differently. With the growth of ecosystems, the linear way of thinking is giving way to a continuum on which research and pricing may be started and completed online or may involve more traditional intermediaries along the way to advise on decisions.

- Costs must be reduced. The modern insurance company begins with processes that assume zero-touch and builds exceptions with a hybrid of human and AI-powered support that can deliver a personalized policy.

Drivers of the customer experience and regular engagement

It’s important to put the customer at the heart of your data strategy, as it’s their data in the first place. This means they can act as stakeholders in their own data management, and access and maintain their own data when needed.

In today’s competitive market, insurers must be able to collect, process, store, and analyse all of their data.

Regardless of whether it is structured (age, location, asset value) or unstructured (images of burglaries or car accidents, voice recordings); whether it lives at the edge, in a data centre, public cloud, or a hybrid cloud, data can provide insight.

He continues that insurers can then use that data to apply machine learning (ML), advanced analytics and artificial intelligence (AI) and identify patterns, detect anomalies and assess risk more accurately.

Restrictive regulation is preventing insurers from embracing innovation fully when it comes to their customers’ data: 96% of insurance executives responding to Cognizant’s survey indicated that cloud computing was delivering strategic value to their business, whilst 84% shared the same belief about AI and ML.

The use of consumer data is still heavily regulated, particularly when it comes to what is permissible when measuring and identifying an individual’s risk rating.

The need to tackle and comply with these current and emerging regulations is putting significant pressure on incumbent insurers to ensure their data security, consumer protection, and sustainability solutions and initiatives meet regulatory expectations. In turn, this is reducing the speed at which insurers can transform their approach to using their data.

Advice for insurers looking to make the most of their data

So insurers are being squeezed from practically every conceivable angle: regulatory burden is preventing their freedom to innovate, yet customers want hyper-personalised experiences and senior stakeholders want reduced risk, and the technology is there to deliver both. If not exploited to its fullest, however, opportunity becomes threat.

What words of advice do our experts have for insurance organisations looking to get more out of their customers’ data?

To stay relevant and optimise growth, insurers need to focus on business transformation, and digital strength will be a clear driver for doing so. Executives need to develop comprehensive data strategies that make use of all the information available to them through investment in technology.

Investment in data and analytics is becoming critical to enable quicker, more insightful business decisions that identify return on innovation, reduce fraud, and improve risk assessment.

For example, many insurers have already begun testing technologies such as conversational AI and natural language processing to interact with clients and try to meet their demands and expectations for faster, more efficient services.

In turn, insurers are benefiting from higher customer retention rates and lower agent turnover. These advances are becoming crucial in setting insurers apart, with low prices no longer being enough to entice customers in.

In recent years, we’ve seen insurers collecting and analysing a huge variety of data sets, allowing them to customise their offerings and deliver a better service.

The next opportunity is likely to be just around the corner; we just don’t know yet what this opportunity will look like.

Only when providers recognise what data is held, and the customer is seen as the primary stakeholder, can the data be managed with the focus and care it deserves.

Insurers must also have a unified data platform that enables them to apply ML, AI, and advanced analytics to data, ensuring they can harness the power of new data sources as they become more varied and complex. This will allow them to gain better customer insights and provide more accurate policies.

………………

AUTHORS: David Sexton – VP & Head of Insurance Practice UK&I for Cognizant, Chris Royles – EMEA Field CTO at Cloudera