ESG continues to be a high ranking risk factor to directors and officers. What are the different risk rankings across regions and what elements of the “E”, the “S” or the “G” overlap amongst companies?

The primary focus in recent years has been on ‘E’ (environmental) risks, particularly climate-related risks, but ESG is far more wide-reaching, and encompasses a range of issues under the ‘S’ (social) umbrella – for example, workplace culture, diversity, equity and inclusion (DEI) and community impact – and the ‘G’ (governance) umbrella, which ensures the board of directors is identifying, analysing, putting into action and reporting on the ‘E’ and ‘S’ issues (see Role of Insurance in ESG).

Given that the level of attention has only increased in the past twelve months (and, indeed, political uncertainty and polarisation of views in some jurisdictions to varying degrees), we have maintained this structure for this year’s survey.

In response to the increasing attention paid to ESG factors, the questions in WTW’s Global Directors’ and Officers’ Survey Report 2024 were reorganised to fit within an ESG framework.

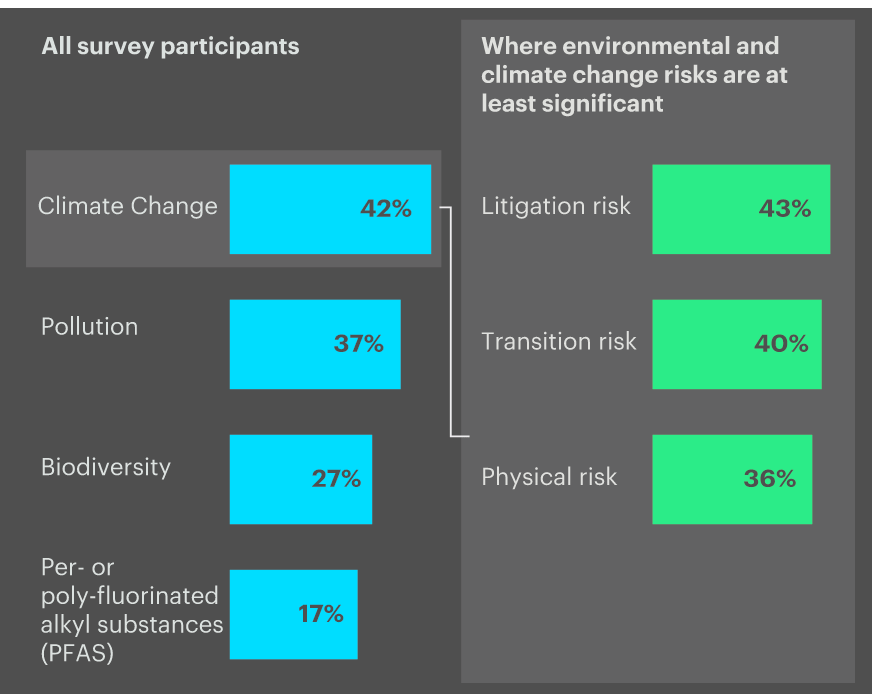

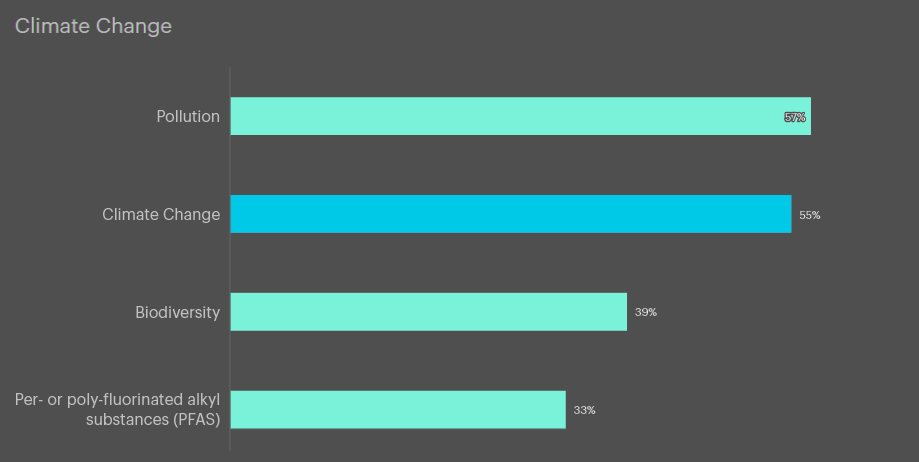

How significant are the following environmental risks for the directors and officers of your organisation?

ESG continues to be a hot topic

The phrase is an umbrella term for a variety of what have historically been viewed as non-financial factors (albeit it is increasingly the case that some are seen as having tangible financial impacts) relating to the structure, operation and performance of corporate entities and other enterprises and organisations and the relationship of the business with various interested stakeholders and the environment more generally (see ESG Rating Regulation proposal for Insurance).

While the broad thrust of ESG is generally understood, crucially there is no agreed definition as to the constituent elements of the “E”, the “S” or the “G”, their overlap or interaction.

Further, ESG factors will differ amongst companies dependent on issue such as industry, jurisdiction, size and listing (to name but a few variables).

Climate Change, which has had so much public attention, is seen as the highest of the Environmental risks. In GB, Climate Change has also been the subject of considerable new legislative and regulatory obligations, according to Survey about ESG Strategy & Climate Risk Modelling.

Environmental risks in ESG

Climate change ranked as the highest risk of ESG

Social risks on the rise

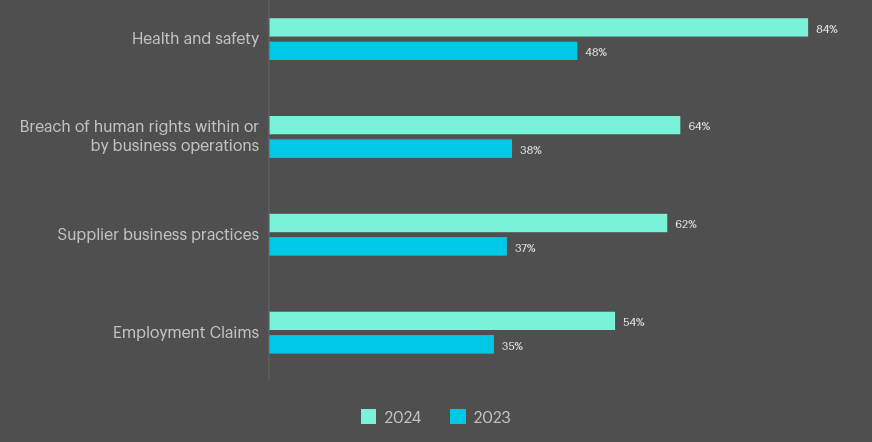

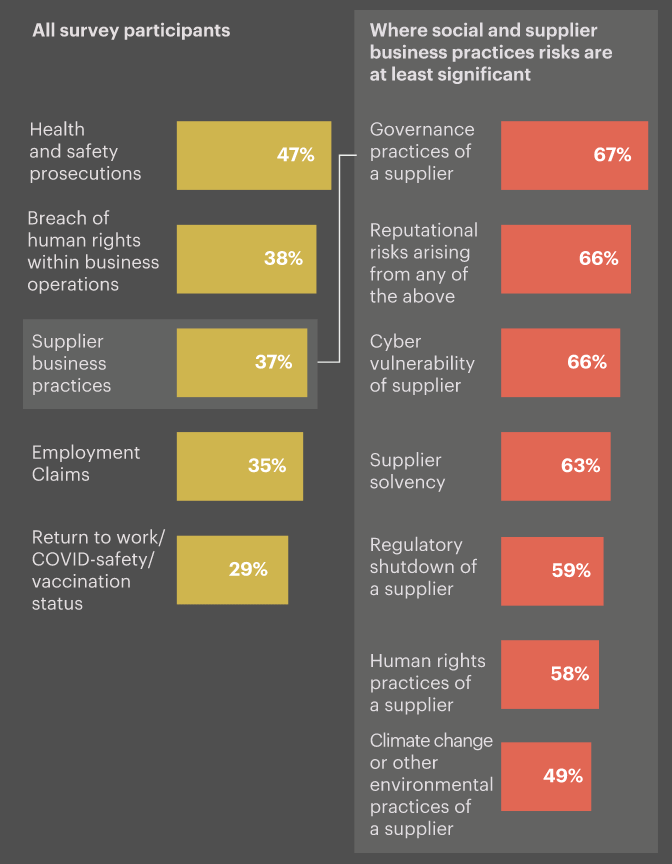

While there are variations between results when looked through a jurisdiction or industry lens, this year’s survey shows that, overall, all ESG-related risks are of more concern to D&Os than they have been in the past but social risks, health and safety (H&S), human rights, supplier business practices and employment claims – have particularly grown in importance, with each risk perceived as much higher than in previous years (see 4 Key Benchmarks for Insurers to Implement ESG Investment Strategy).

H&S risks are now considered the number one concern, perhaps linked to a rise in employment litigation (the survey shows concern about such claims has also risen).

There are many reasons why ‘S’ issues have become increasingly important in recent years, including:

- changing consumer attitudes, with consumers expressing more interest and concern about how companies’ operations impact society;

- more attention on social issues as a result of highly publicised cases involving inequality and human rights;

- regulatory pressure to improve corporate behaviour and increase board accountability for their impact on their workforce and the broader community; and (iv) increasing demand from investors, who want to know how social factors are incorporated into investment decisions.

There is also greater awareness of studies which have indicated that a company which invests in good, responsible social practices results in better financial performance.

Social

Whilst ‘S’ issues are of concern across the board, the survey shows that larger companies are more concerned with ‘E’ issues than smaller companies, likely reflecting the greater regulatory burdens these companies face.

Unsurprisingly, the energy and utilities sector ranks climate change risks the highest and is the only sector which has it within its top seven risks.

One of the more notable developments in the last year relating to ESG is the increase in ‘anti-ESG sentiment’.

For example, we have witnessed some states in the US taking ‘anti-ESG’ measures, including divestment policies and ‘anti-boycott laws’, limiting the state’s business with companies that take into account ESG factors in their operations. It has been suggested that this may lead to companies engaging in ‘green hushing’ downplaying their ESG efforts to avoid backlash.

On the flip side, a number of other states in the US have enacted legislation encouraging or requiring fiduciaries of state pension plans to take ESG factors into account when such factors may be financially material and disclose how they are doing so. Bills have also been introduced calling for the mandatory divestment of public funds from certain industries like fossil fuels, firearms and nuclear power.

How significant are the following social risks for the directors and officers of your organisation?

These bills have generally not been passed into law and have faced significant opposition, particularly as they remove the discretion of fiduciaries to assess materiality. The approach proposed or enacted by different US states is, for the most part, determined along party political lines but there are variations and nuances between them all.

In sum, there is currently a very complex patchwork of current and upcoming regulations at both the state and federal levels in the US applicable to ESG.

This makes for an incredibly difficult and ever-changing landscape for D&Os to navigate, and the political overlay adds volatility and unpredictability as to the direction and speed of travel.

This is particularly so for D&Os of multi-nationals as the situation becomes more complex still when one factors in current and upcoming regulations in other jurisdictions.

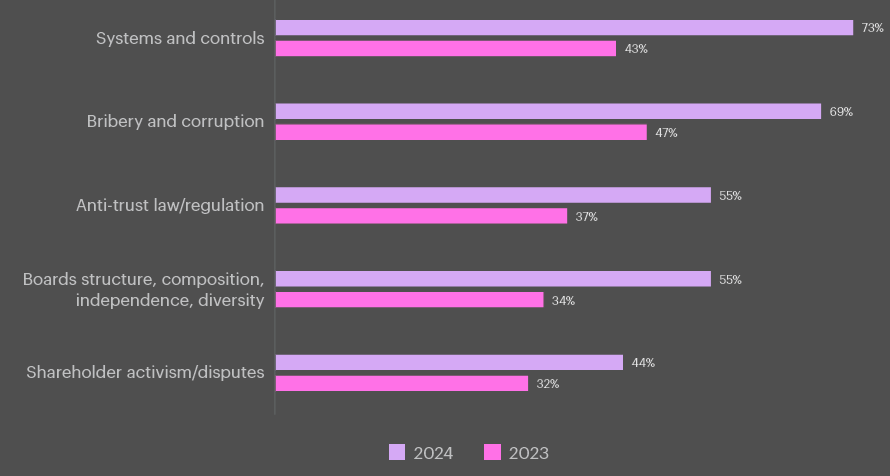

Governance and ESG regulatory space

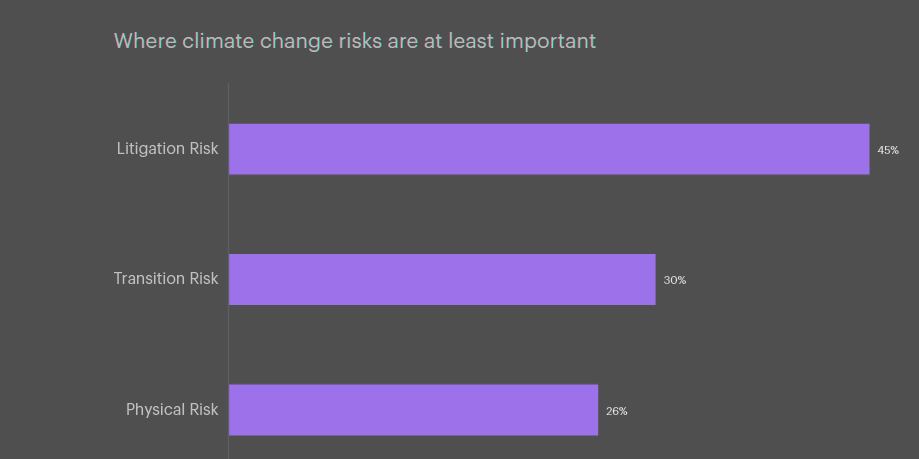

The regulatory space, in particular, is driving the risk for D&Os. There are additional reporting obligations in many jurisdictions.

For example, the UK has brought in specific climate-related disclosure rules (which are a mix of mandatory or comply or explain depending on the size of the company and whether it is listed) and is consulting on DEI issues and, in the EU, there is the Corporate Sustainability Reporting Directive (CSRD), which expands the scope of the companies which are required to make sustainability disclosures and includes more stringent and harmonised reporting obligations.

Australia has climate reporting proposals on the table and, in the US, specific disclosure guidelines were adopted by the SEC on 6 March 2024.

Of note, the adopted version is a much-diluted version of the proposals originally on the table. Nonetheless, we expect there to be some pushback on the guidelines given the current US sentiment towards climate (and broader ESG) issues.

Governance

In the UK, for example, the FCA announced a new regime (PS23/26) to increase trust in the market through sustainability disclosure and labelling. The regime has:

- a new anti-greenwashing rule, in force from 31 May 2024, which makes UK-based firms ensure that sustainability claims are accurate, clear, and fair;

- four new labels for investment products;

- rules on proper marketing and information about the sustainability of financial products and services, to protect consumers and improve investor confidence.

Similarly, in the EU, Members of the European Parliament (MEPs) recently announced that they have adopted a directive to protect consumers from deceptive marketing practices.

The directive, amongst other things, adds some harmful marketing behaviours linked to greenwashing to the EU list of prohibited commercial practices.

In Australia, regulators have recently had a particular focus on misleading conduct in relation to sustainable finance, including greenwashing, which we expect to be an ongoing trend in 2024.

Interestingly, regulators there have utilised existing legislative instruments as a means of enforcement, rather than seeking to introduce a new regime.

ESG is an enormous, fast-moving area and can be extremely challenging for D&Os to find a course through, particularly with the current political sentiment.

A recent example of the difficulties of anticipating how matters will develop can be seen in the EU where the Corporate Sustainability Due Diligence Directive has failed to be passed

…………….

AUTHORS: Laura Cooke – Partner, Clyde & Co, Angus Duncan – Executive Director, D&O Insurance Coverage Specialist, Global FINEX