Insurance Europe and Pensions Europe welcome the measures included in the European Commission’s ESG Rating Regulation proposal, as it will lead to a significant enhancement in the transparency of ESG ratings.

Importantly, insurers and pension providers support the initiative’s aim of improved ESG rating providers’ independence and a reduction in potential conflicts of interest.

However, while acknowledging the positive aspects of these measures and their role in ensuring and promoting a competitive market, further improvements are necessary to advance transparency, comparability and integrity within the ESG landscape (see Re/Insurers’ Survey about ESG Strategy & Climate Risk Modelling).

Most importantly, the Regulation should extend to ESG data itself. In the context of fulfilling sustainable finance obligations, the need for consistent and robust ESG data cannot be overstated.

The absence of a comprehensive public database poses serious challenges for both the insurance and investment industries.

Thus, the European insurance and pensions industries call on the co-legislators to include ESG data products in the scope of the Regulation to address the broader ESG data challenges and ensure the integrity of the ESG landscape (see Cyber Risks, Climate Change & ESG – Main Challenges for Insurance Industry).

There is an urgent need for the availability and transparency of ESG data to be improved, not only to fulfil regulatory requirements but, more importantly, to reallocate capital to sustainable assets.

While the introduction of regulation, such as the Corporate Sustainability Reporting Directive (CSRD) and the European Single Access Point (ESAP) in the EU, represents a positive step, it will be a number of years before these pieces of regulation are fully implemented and operational.

The current situation necessitates continued reliance on purchased ESG data services, so attaining comprehensive coverage of reporting entities and common definitions and data points will be a gradual process.

Introducing a review clause proposing to consider expanding the scope to ESG data providers will, therefore, not be sufficient to address current and foreseeable data-gap problems.

A solution is, therefore, needed now to support the financial green transition.

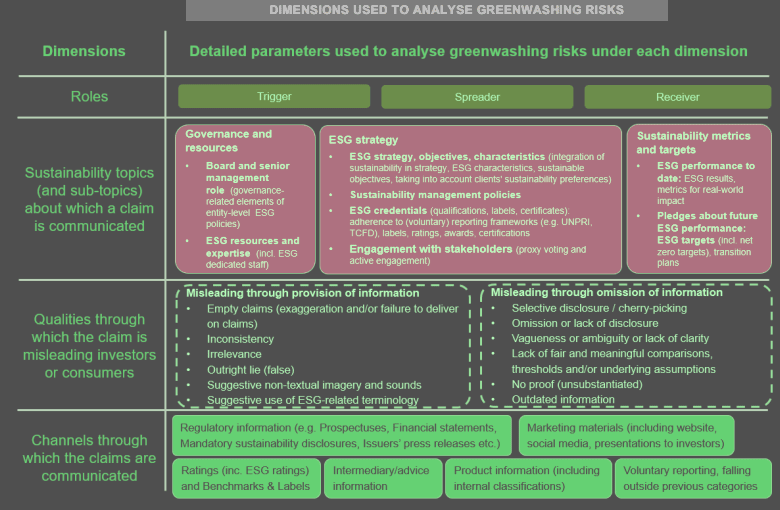

The current ESG data gap cannot be ignored. This issue was highlighted in ESMA’s progress report on greenwashing: “the lack of clearly outlined data limitations and disclaimers in the documentation on underlying methodologies poses a high risk to investor protection and hinders comparisons across products and financial market participants”.

The current market suffers from a deficiency in data integrity and reliability, which is of significant concern given that the quality of ESG ratings predominantly hinges on the data used for their computation.

Therefore, it is of the utmost importance that raw data, even in the absence of an assessment (eg, opinion, model), falls within the scope of the legislative proposal.

Covering ESG data within the ESG Rating Regulation is consistent with IOSCO and ESMA recommendations.

In November 2021, the International Organization of Securities Commissions (IOSCO) underscored the importance of ESG data to the financial market and called for oversight of both ESG ratings and data-product providers.

Given that the draft Regulation already refers to the IOSCO definition for ESG ratings, it is imperative that the definition of ESG data products, which includes ESG raw data as a type of ESG data product, is similarly incorporated into the legislative proposal.

by

by