Overview

Canadian individual life insurance new annualized premium grew 5% year-over-year to C$532 mn in the second quarter 2025, according to LIMRA’s Canadian Individual Life Insurance Sales Survey. The number of policies sold increased 1% from the results in the second quarter of 2024. Beinsure analyzed report and highlighted key points.

The Canadian retail life insurance market posted broad premium growth across product lines in both Q2 2025 and the first half of the year.

In H1 2025, total new annualized premium rose 9% to C$1.04 bn, and policy count improved 2%.

Whole life drives 68% of Canada’s life insurance market in 2025, with universal and term also posting steady premium and policy growth.

Key Takeaways

- Whole life still dominates: Two-thirds of new premium dollars flow into WL, though policy count shrinkage may signal a reliance on larger-ticket sales rather than volume expansion.

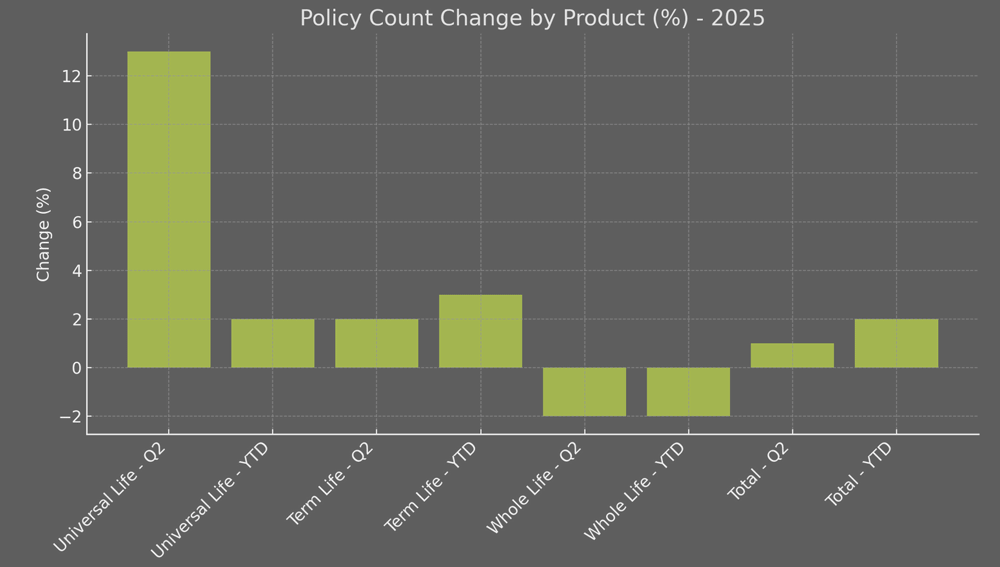

- Universal life shows fresh energy: The Q2 surge in policy counts (+13%) stands out and could mark a trend of renewed consumer interest in flexible products.

- Term life stays predictable: Slow, steady growth and unchanged market share reinforce its role as the stable, mass-market choice.

- Aggregate strength: A 9% YTD premium increase across the industry suggests demand for protection products remains resilient despite broader economic headwinds.

Overall Q2 annualized premiums advanced 5% with policy counts up 1%. YTD premiums in H1 2025 expanded 9% and policy counts grew 2%, confirming the sector’s broad upward trajectory. Total new annualized premium in Q3 2024 increased 4% to $478 mn, according to LIMRA’s Retail Canadian Life Insurance Sales Survey. Despite the rise in premium, the policy count dropped 17%, primarily due to a decline in term life sales.

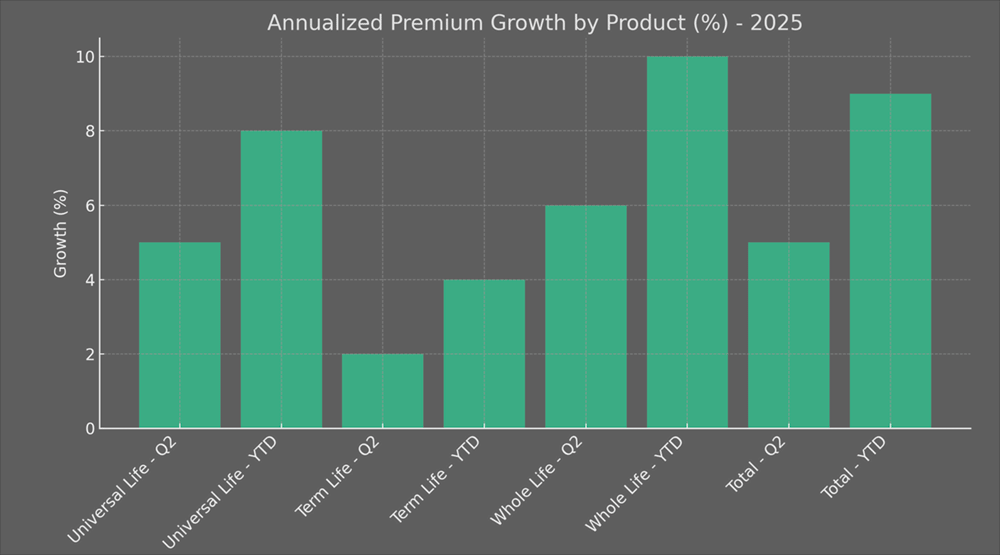

Canadian Retail Life Insurance Growth Rates by Product

| Product | Annualized Premium Change | Policy Count Change | Market Share by Premium |

| Universal Life – Q2 | 5% | +13% | 13% |

| Universal Life – YTD | 8% | 2% | 13% |

| Term Life – Q2 | 2% | 2% | 19% |

| Term Life – YTD | 4% | 3% | 19% |

| Whole Life – Q2 | 6% | -2% | 68% |

| Whole Life – YTD | 10% | -2% | 68% |

| Total – Q2 | 5% | 1% | 100% |

| Total – YTD | 9% | 2% | 100% |

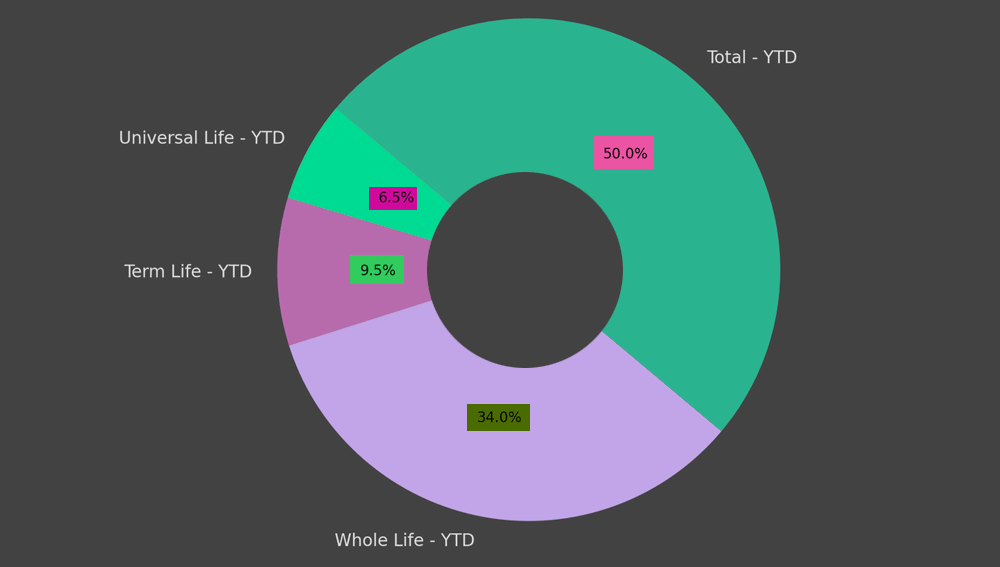

Market Share by Premium

Annualized Premium Growth by Product

Whole life remained the dominant driver, while universal and term contributed smaller but consistent gains (see Canada’s Climate Risk Strategy: Insurance, ESG & Fragmentation). Policy count trends diverged by product, signaling a shift in demand dynamics.

All of the product lines experienced year-over-year sales growth in the second quarter with permanent products posting the highest gains

Nancy Moussa, associate research director, LIMRA Insurance Product Research

“Historically, consumers often turn to permanent life insurance products for steady, guaranteed returns and principal protection. LIMRA expects this trend to continue through 2025,” said Nancy Moussa.

Policy Count Change by Product

Whole life insurance

Whole life insurance kept its streak alive. New premium hit C$363.5 mn in Q2, up 6% from the same quarter last year. That marks four straight quarters of growth. The number of policies sold slipped 2% (see Best Insurance companies in the US & Canada by Assets & Revenue).

Year to date, Whole life premium totaled C$710.2 mn, climbing 10% compared with the first half of 2024.

Participating Whole life insurance products carried most of the weight, posting 11% growth over the year.

Insurance policy counts overall dipped 2% during the six months, but participating policy counts edged 3% higher. Whole life insurance commanded 68% of Canada’s life insurance market in H1 2025.

Whole Life (WL)

- Q2 premiums grew 6%, the fourth consecutive quarterly increase, but policy count fell 2%.

- YTD premiums rose 10% to capture 68% of market share, maintaining WL’s commanding position.

- Policy count slipped 2% YTD, but participating WL products still showed growth, suggesting concentration in higher-value contracts.

Universal life insurance

Universal life insurance also moved higher. Q2 new annualized premium grew 5% to C$69.4 mn. Most of that came from non-level cost-of-insurance products, which made up 78% of the UL total. Policy sales stayed flat with last year’s second quarter.

Through the first half of 2025, Universal life insurance new premium advanced 8% year over year, while policy count rose 2%.

Universal life captured 13% of Canada’s new annualized premium in the period.

Universal Life (UL)

- Premiums climbed 5% in Q2, with non-level cost-of-insurance products representing most of the volume.

- Year-to-date, UL rose 8% in premiums and 2% in policy count, stabilizing its 13% market share.

- The strong +13% policy count jump in Q2 hints at new adoption momentum, though the base remains smaller than WL or term.

Term life insurance

Term life insurance showed steadier momentum. Q2 new premium rose 2% year over year to $99.3 mn, with policy count also up 2%.

By mid-2025, term life new premium reached $193.4 mn, up 4% against the prior year, with policy count increasing 3%.

Term policies represented 19% of Canadian new annualized premium in H1.

Term Life

- Growth was steady but modest: Q2 premiums up 2% with equal gains in policy count.

- First half showed 4% premium growth and 3% increase in policies.

- Market share held at 19%, reflecting consistent demand for straightforward protection products.

LIMRA’s Canadian Individual Life Insurance Sales Survey, running since 1993, covers 93% of the national market.

FAQ

Total new annualized premium grew 5% year over year to C$532 mn. The number of policies sold in the quarter edged 1% higher compared with Q2 2024.

H1 2025 new annualized premium rose 9% to C$1.04 bn. Policy counts increased 2%, confirming a broad upward trajectory across product lines.

Whole life maintains the lead, representing 68% of all new annualized premium. Despite a 2% drop in policy count, premiums climbed 10% year-to-date, highlighting reliance on larger, higher-value contracts.

UL posted a 5% premium gain in Q2 and 8% year-to-date. Policy counts rose 2% over six months, with a sharp +13% increase in Q2 alone. Market share remained steady at 13%, suggesting renewed interest in flexible structures.

Term life grew 2% in premiums and policy count in Q2, and YTD premiums rose 4% with a 3% policy count increase. Market share held at 19%, showing steady demand for simple, cost-focused protection.

Premiums expanded across every product line, with permanent products showing the sharpest gains. The 9% YTD growth and positive policy count trends reinforce resilience despite broader economic uncertainty.

………………….

AUTHOR: Nancy Moussa – associate research director, LIMRA Insurance Product Research

Edited by Nataly Kramer