Brazilian insurtech 180° Insurance (or 180 Seguros) has raised $9.2 mn in a pre-Series B round, split between $6.4 mn in equity and $2.8 mn in debt.

The financing was led by existing investors 8VC, Monashees, and Canary, with participation from FJ Labs. It brings the company’s total funding to $46mn since its launch in 2020.

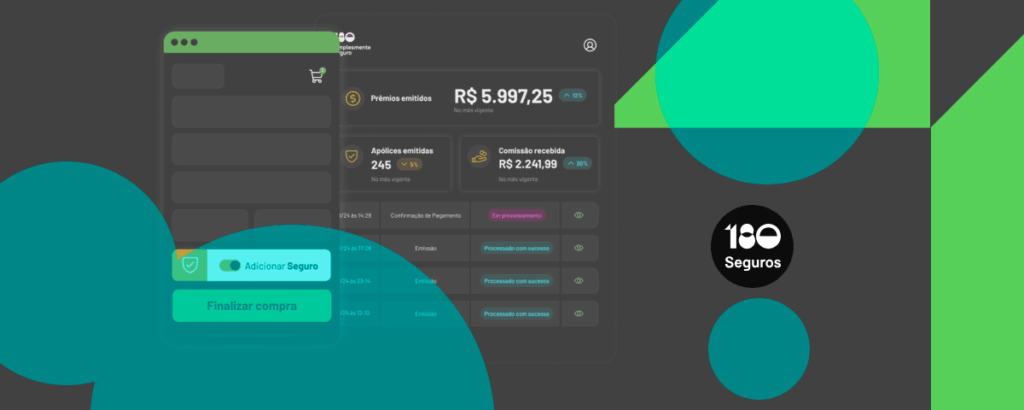

Insurtech founded in 2020 by Franco Lamping and Mauro Levi D’Ancona that provides a B2B2C embedded insurance platform enabling companies to offer customized insurance products digitally.

With just five years in operation, 180 Seguros consolidates its position as a leader in insurance innovation and paves the way for technology-driven, AI-centered insurance to scale efficiently.

The company also aims to accelerate insurance adoption in Brazil, where fewer than 20% of people have life or home insurance far below developed countries, where coverage exceeds 90%.

CEO and co-founder Mauro Levi D’Ancona said the raise builds on the company’s strong cash position and positive cash flow, giving it flexibility to accelerate expansion.

He noted that proprietary AI models already regulate more than 80% of claims, and the next frontier is deploying AI agents throughout the customer insurance lifecycle via distribution partners.

Even with positive cash flow and a strong cash position, we decided to capitalize on the interest from our current investors and accelerate our growth. AI has already transformed our operations. Today, more than 80% of claims are regulated by our proprietary models.

Mauro Levi D’Ancona, co-founder and CEO of 180° Insurance

“Now we see a new frontier where our distribution partners will be able to use AI agents across the entire customer entire insurance lifecycle. This raise, combined with the subordinated capital, gives us the flexibility and momentum to lead this transformation,” – Mauro Levi D’Ancona says.

The new capital complements subordinated debt, positioning the company to lead Brazil’s push into AI-native insurance operations.

Founded in 2020, the startup operates through a B2B2C model, providing a solution for companies to sell insurance digitally. One example is partnering with parking app Zul+ to offer an on-demand insurance product that covers personal items left in cars parked on the street.

180° Insurance previously closed a $31.4mn Series A round in 2022, led by 8VC with support from Dragoneer, Monashees, Atlantico, Quartz, and Norte.

Since then, the company has introduced 9 products across eight distribution channels.

D’Ancona said the company’s mission is to transform how Brazilians access insurance by combining technology with customer-centric design.

Investors echo that view, with 8VC’s Jake Medwell describing him as a standout entrepreneur from his earlier days at Nubank, and highlighting insurtech as a critical growth sector in Latin America.

Co-founder and CIO Alex Körner added that the pandemic accelerated digital adoption in Brazilian insurance, creating both urgency and opportunity for platforms like 180° to expand partnerships and diversify revenue models.

Digital transformation is a necessary process that has been redesigning the insurance industry in recent years. It has always lagged a bit behind compared to the financial industry in Brazil, but with the digitalization forced by the pandemic, this has become an urgent and strategic agenda for insurers and also for new distribution channels that need to diversify their revenues

Alex Körner, CIO and co-founder of 180° Insurance

“We are very bullish on the insurance space in LatAm and the technology 180° is building. We have known Mauro since his time at NuBank and he is an extremely impressive entrepreneur. 8VC has been increasingly active in the region and we see Mauro and a key player in the technology ecosystem.” – 8VC founding partner Jake Medwell.

180 already applies AI across much of its operations; from underwriting, pricing, and process automation to partner integration and claims management.

The next step is to expand a complete business vertical dedicated to AI, growing the dedicated AI team and launching B2B2AI – a platform that will allow partner companies to connect their autonomous agents to the insurtech’s systems for quoting, selling, and servicing insurance.

To support this, the company is developing a MCP (Model Context Protocol) server, a protocol which functions similarly as an API for AI services.

MCP incorporates authorization layers, auditing, and tools to ensure LLMs act with precision and security while maintaining compliance across the entire insurance cycle; from quoting and customer service to claims management.

180’s distribution partners using AI agents will be able to connect to MCP without the need for direct API integration.

Broadly speaking, the protocol transforms conversational consumer interactions into commands within 180’s system, allowing the entire policy lifecycle, from issuance to management, to be conducted by AI. For example, a customer sends a voice message to a partner channel, interacts with a chatbot, and immediately receives a personalized insurance offer, generated via MCP.