Insurtech Afori, a new AI platform specifically designed for insurance brokers, came out of stealth with €4 mn in pre-seed financing, led by General Catalyst with backing from Yellow, Booom, and industry names like Mustafa Suleyman of Microsoft AI, Alex Rinke from Celonis, and Mehdi Ghissassi, formerly at Google DeepMind.

The company is pitching itself as the AI layer for brokers who drown in email, PDF attachments, insurer messages through BiPro, WhatsApp notes, and even paper.

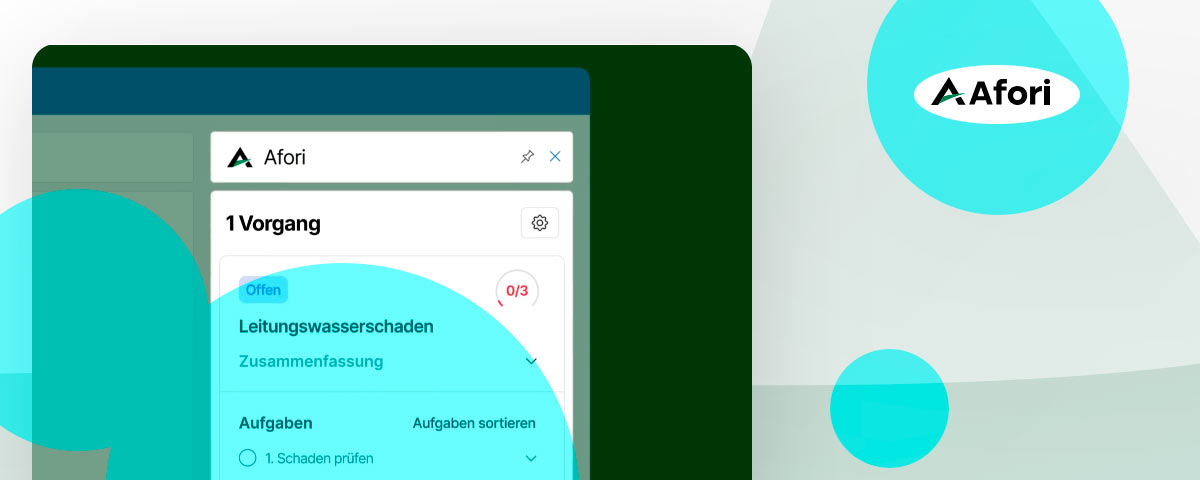

Instead of another clunky platform, Afori hooks straight into Outlook and converts all that chaos into structured cases and tasks. Insurance brokers get a sidebar assistant that recognizes claims, amendments, policy updates, and customer inquiries – then organizes them automatically.

According to Beinsure’s analysts, administrative overload eats more than half of a broker’s workweek. Sorting, duplicating, switching systems, losing track of cases – it all adds up to lost time, potential liability, and plenty of frustration.

Afori’s answer: capture every communication channel, link it to the right client record, check completeness, flag missing documents, and generate follow-up tasks on the fly.

The system doesn’t just structure data. AI agents act like colleagues in the inbox, drafting replies, analyzing coverage, reviewing docs, managing reminders, and prepping next steps.

Instead of sifting through endless email threads, staff can react instantly and focus on customer relationships, sales, and advisory.

In October, Afori launches with the mission of freeing brokers from time-consuming back-office tasks. Its first product is an intelligent inbox sidebar that automatically recognizes, structures, and initiates common workflows – directly within Outlook, without system changes or complicated training.

Brokers who deal with dozens of daily emails about claims, amendments, customer inquiries, or policy updates know the problem well: administrative work consumes much of the day, leaving little time for what matters most: advising clients.

Afori aims to change that, providing noticeable relief in brokers’ everyday work. We want to enable brokers to focus on their core business, the people

Fabian Wesemann, co-founder of Afori

“Afori is not just another software that creates new complexity, but an intelligent assistant that understands existing processes and supports routine work. Afori is, so to speak, the AI layer for all your existing applications.”

The founders of the company bring direct industry experience.

- Fabian Wesemann has been active in the insurance industry for over 10 years and was previously co-founder of wefox, where he learned a lot about the entire insurance value chain. He knows the daily challenges faced by brokers firsthand. With Afori, Fabian strategically applies his experience to relieve exactly where it matters most in everyday work with the help of AI.

- Sergi Banos was the first employee and part of the founding team at wefox, where he influenced the development of technology from the very beginning. Over the course of more than ten years, he has gained experience in building tech teams from the ground up and developing scalable products. At Afori, Sergi uses his technical expertise and passion for AI strategically to simplify processes and create genuine relief in the everyday life of brokers.

CEO Fabian Wesemann, also a co-founder of wefox, says brokers don’t need another complex system. They need clarity, speed, and a tool that mirrors their own workflow.

By combining Agentic AI with deep industry expertise, we’re creating a product that integrates seamlessly into brokers’ daily workflows and delivers real, tangible value from the very first day.

Fabian Wesemann, Afori CEO

Co-founder Sergi Banos, wefox’s first employee, brings the technical backbone, focusing on scalable AI products that strip out wasted effort.

With Afori, it no longer matters where customers or insurers communicate. Afori connects all relevant communication and data sources in real time, ensuring a seamless data flow across all systems.

The platform integrates directly into Outlook, broker management systems, and document workflows. All incoming information – whether email, file, or chat – is automatically recognized, processed, and placed into the appropriate context.