AM Best has cut its outlook on the U.S. health insurance sector from stable to negative, citing higher medical spending, deteriorating risk pools, and rising pharmacy costs.

Jennifer Asamoah, senior financial analyst at AM Best, said the industry saw a broad rise in medical and pharmacy claims through late 2024, with underwriting earnings sliding as utilization climbed.

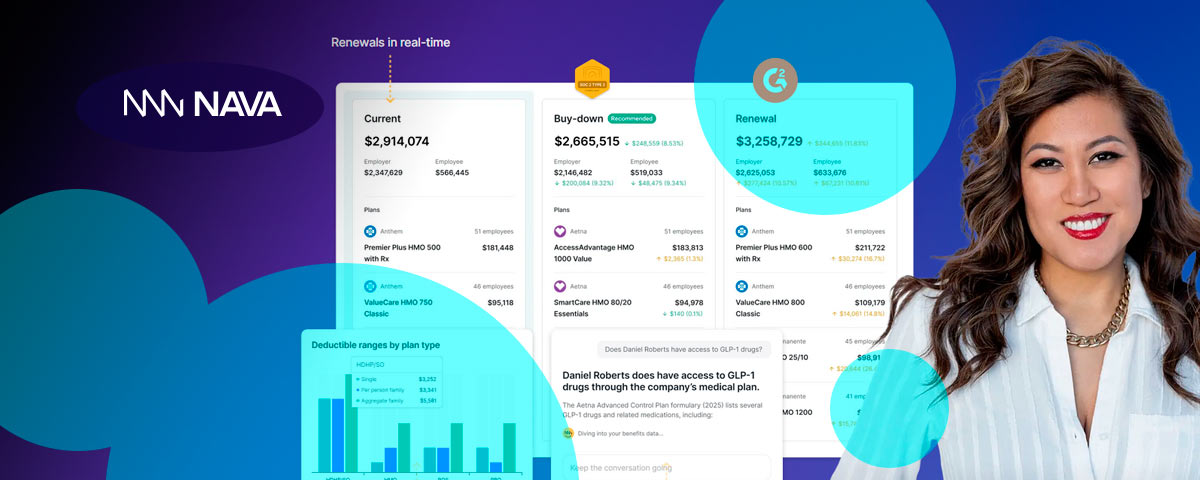

The U.S. industry’s experience in the broader base increased in medical and pharmacy expenses. Although it varies by line of business, the majority of the segment are reporting elevation and trends driven by higher utilization of specialty drugs.

Jennifer Asamoah, senior financial analyst at AM Best

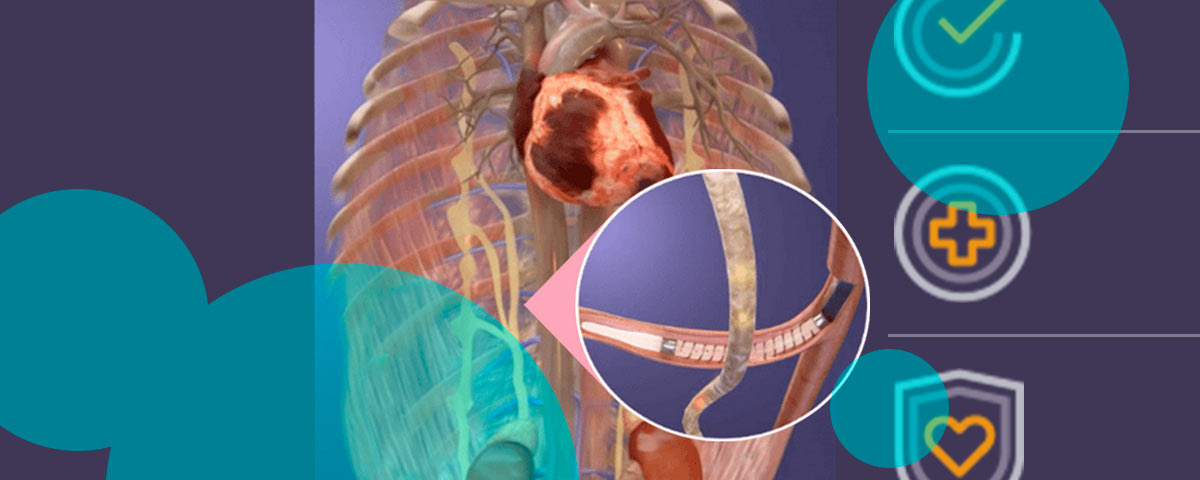

Specialty drugs remain a driver, with GLP-1 prescriptions surging. Physician visits, ER trips, and inpatient admissions all moved higher, while behavioral health claims and Medicaid coding intensity also rose. In early 2025, respiratory claims from flu, COVID, and pneumonia pushed costs up further.

GLP-1 usage is reshaping benefit design. Asamoah said both insurers and employer groups have tightened coverage for 2025, restricting reimbursement for weight-loss use and focusing on other medical indications.

Bridget Maehr, AM Best director, pointed to Medicaid and Affordable Care Act exchanges as pressure points.

Medicaid enrollment swelled during the COVID public health emergency, when states were barred from disenrolling members. Once eligibility checks resumed, millions left the rolls—often healthier, low-utilization individuals.

During the public health emergency, which was enacted due to the COVID pandemic, states were not allowed to disenroll Medicaid members. During this time the Medicaid enrollment increased as people lost employer coverage or became eligible for Medicaid based on lower wages. The completion of the eligibility redeterminations saw Medicaid enrollment drop significantly.

Bridget Maehr, AM Best director

That left a smaller but sicker pool. Many who lost Medicaid shifted to ACA plans with subsidies, worsening claims experience there. Rates, Maehr said, will lag until they catch up with the new risk profile.

AM Best expects strains to persist into 2027. Maehr said plans will lean on pricing discipline, tighter benefit design, and stronger care-management tools to cope with higher morbidity.

Value-based care and selective provider deals will be central. Some carriers may exit Medicare Advantage or ACA markets entirely.

Medicaid faces added funding pressure too, with new work requirements and more frequent eligibility checks under recent federal legislation. Insurers will need to expand administrative systems to manage those rules.

The bottom line: health insurers are heading into a tougher stretch, with elevated medical costs colliding with structural shifts in government programs.