Brazilian Insurance Industry premiums continued with a double-digit growth trajectory in 2023, with an increase of 16.2% versus 12% in 2022, according to Fitch Ratings.

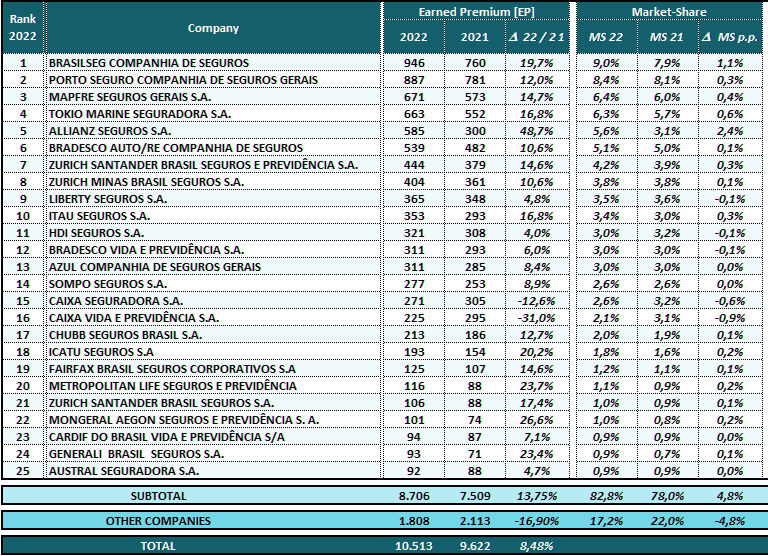

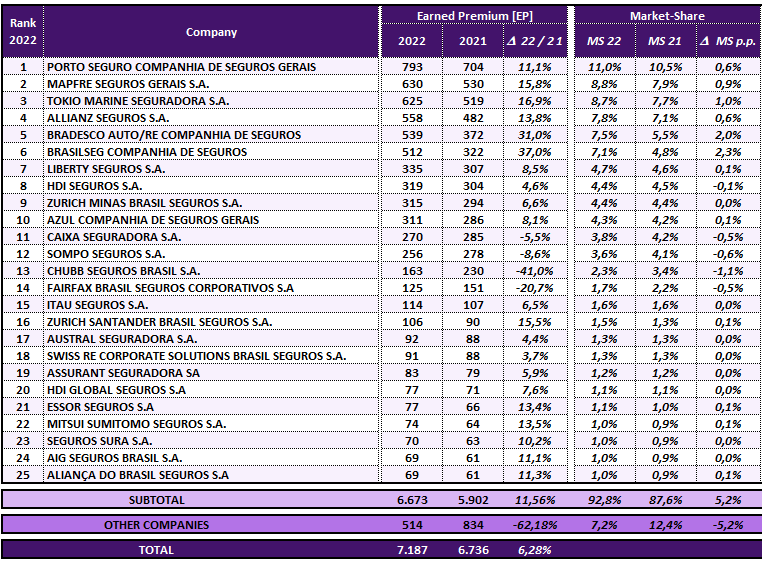

All segments increased, with emphasis on auto at 33% and property/casualty (P/C) at 21%. Together, these two segments grew by 26.5% in 2022.

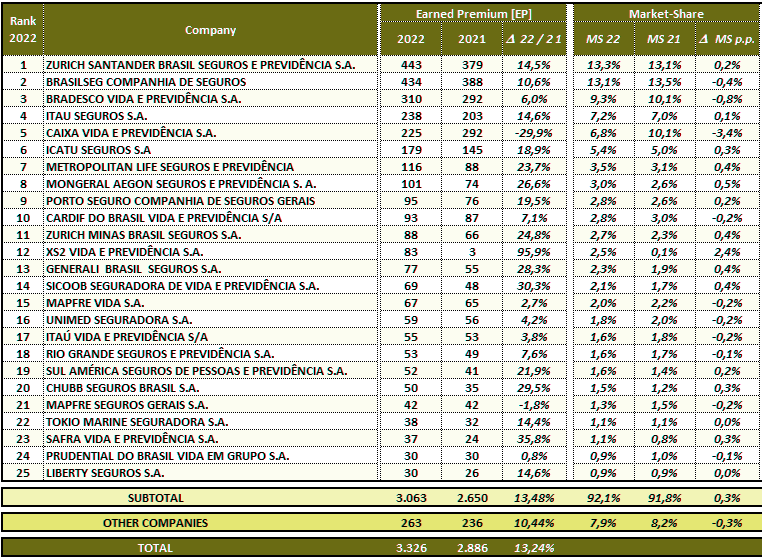

The segments related to life and pension grew by 11.2%, also above inflation in the same period.

The continued growth in premiums partly reflects price adjustments due to inflation, life insurance consumer growth and signs of more economic activity in 2023.

The Brazilian GDP rose for the fifth consecutive quarter, growing by 3.2% up to 2Q23 compared with 2022.

Inflation, measured by the broad consumer price index (IPCA), ended the year by 5.8%, down from 2022 when it was 10.1%.

Total: Insurance Life + Non-life excluding healthcare and pension plans (BRL millions)

Insurance Non-life (BRL millions)

Insurance Life (BRL millions)

Nevertheless, it was above the ceiling of the Banco Central do Brasil’s (BACEN, central bank) target of 5%. The interest rate reached 13.75% in an attempt to contain inflation and bring the indicator back to the BACEN target.

The sector’s main credit indicators remained adequate until the end of 2023. The ROAE recovered closer to the pre-pandemic period, due to the increase in premiums, improvement in the financial result and better loss ratio in relation.

The sector’s capitalization and regulatory capital coverage showed a slight deterioration, but remained adequate.

However, despite adequate capital reserve, the investment quality continues to impose negative pressure on the country’s insurers, given the concentration of investments in sovereign bonds.

by Yana Keller