California Democrat Sen. Adam Schiff introduced legislation to establish a federal catastrophic reinsurance program intended to stabilize state property insurance markets and reduce premiums.

The Incorporating National Support for Unprecedented Risks and Emergencies Act would create the program within the Department of the Treasury.

Insurers participating in the program would be required to cover all natural disaster risks, including wildfires, severe storms, wind, hurricanes, and currently excluded flood and earthquake risks, according to Schiff’s statement.

The bill would also expand market monitoring activities at the Office of Financial Research and the Federal Insurance Office.

Participating insurers would be required to make “significant” investments in loss prevention and risk reduction measures. These investments must aim to lower losses; premium discounts would not count as such investments.

Coverage requirements would be phased in over several years. Wind and hurricane coverage would become mandatory when the program begins, four years after enactment.

Coverage for severe convective storms and wildfires would follow in year five. Flood coverage would be added in year six, and earthquake coverage in year eight, according to the bill.

Payments from the program would be limited to 40% of the probable maximum loss of each participating insurer.

The program would be funded through premiums set by the Treasury secretary. These premiums would reflect each carrier’s expected average annual losses, adjusted for trends in loss growth and administrative costs, according to the legislation.

Too many families and small businesses are struggling to keep up with the rising costs of insurance, and steep year-after-year price increases are simply unsustainable. All across America, in fire zones, flood plains, and beyond, the most valuable property a family owns is becoming uninsurable.

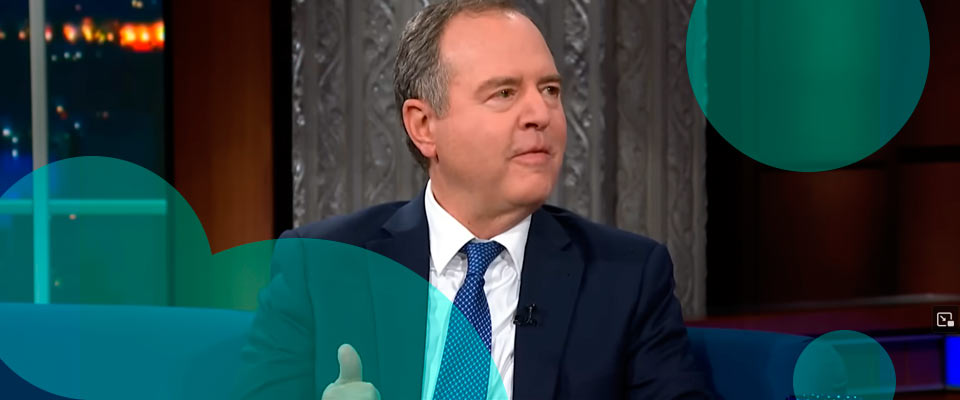

Sen. Adam Schiff

The bill comes amid what United Policyholders describes as an “unprecedented national insurance crisis,” where insurers are reducing coverage and policyholders are unable to find alternatives.

The group noted that state insurers of last resort are not equipped to address these challenges.

Amy Bach, co-founder and executive director of United Policyholders, stated, “As extreme weather events grow more frequent and severe, insurance companies are cutting back on where and what they will cover, leaving millions of Americans vulnerable to disasters and financially strapped. This bill offers the innovation needed to keep families and communities prepared for disasters.”