ClaimSorted has closed a $13.3 mn seed round led by Atomico, joined by Eurazeo, Y Combinator, firstminute capital, Start Ventures Capital, and several high-profile industry veterans.

The start-up, founded by Pavel Gertsberg and German Mikulski, says it’s time to drag claims handling out of its outdated rut.

The idea came straight from frustration. Running their previous insurance business, the founders relied on third-party administrators to manage claims.

Those TPAs slowed everything down, botched consistency, and in the end gutted profitability. So they decided to build their own replacement, a system they call “Claims TPA 2.0”.

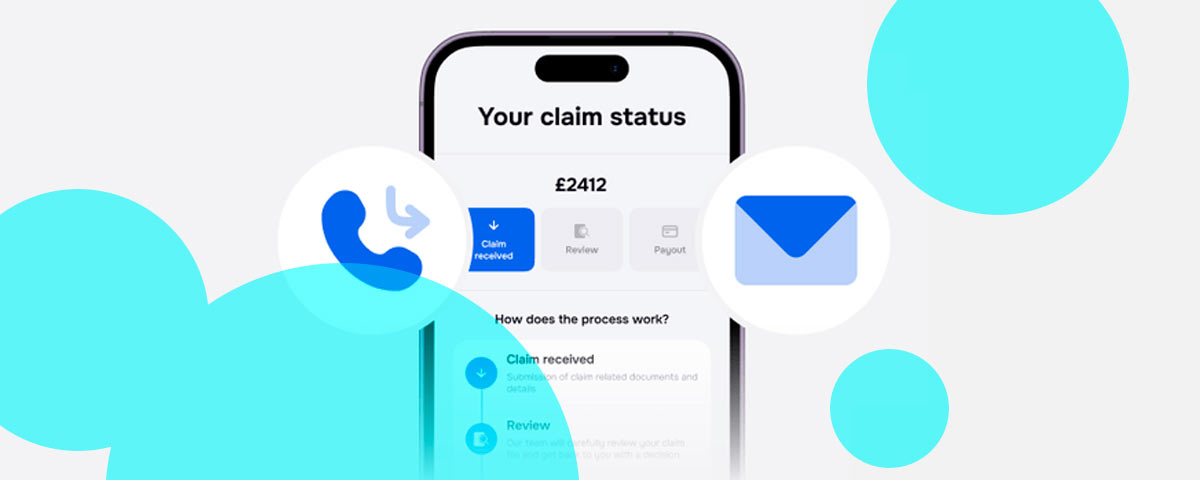

The platform marries human expertise with embedded AI agents, creating a claims workflow that’s faster, cleaner, and much less expensive.

According to our analysts, ClaimSorted’s approach looks less like yet another claims SaaS pitch and more like a next-gen service layer that directly replaces sluggish TPAs.

Funding will fuel global expansion, faster product cycles, and tighter partnerships with insurers eager to simplify claims. The team isn’t light either: they’ve recruited veterans from Hiscox, Lemonade, AXA, Hartford, Liberty Mutual, and other household names.

Over 20 insurers across the US, UK, and EU already rely on ClaimSorted, touching tens of thousands of policyholders.

CEO Gertsberg doesn’t hide his disdain for the old system. TPAs made the claims process painfully slow, often introducing errors that drained profits. In his words, “we decided to build something better.”

Ask anyone in insurance where the weakest link is, and most will point to claims TPAs. We saw the claims process being painfully slow. Mistakes made by TPAs that should’ve been caught early ended up eating our entire profit margin. So, we decided to build something better.

Pavel Gertsberg, ClaimSorted CEO

He claims ClaimSorted’s model settles claims three times faster while giving customers a five-star experience and saving insurers millions.

Atomico partner Andreas Helbig framed it bluntly: insurers don’t want another ambiguous “AI claims platform”.

They want an end-to-end service that removes the headache, serves policyholders at their most critical moment, and protects margins. According to him, the platform already delivers – cutting cost per claim and boosting Net Promoter Scores by 10 points.

Our proprietary claims platform enables our claims adjusters to focus on what truly matters, your policyholders and claims indemnity accuracy. By streamlining and automating routine tasks, we free our team to spend more time assisting your customers and handling complex cases

Gertsberg went further, saying claims shouldn’t be seen as a cost sink. They’re the “moment of truth” in the insurance journey.

With this seed round in the bank, ClaimSorted wants to flip claims into a competitive advantage, not a liability.