AI insurtech CLARA Analytics, the provider of AI technology for insurance claims optimization, launched of CLARA Intelligence-as-a-Service (IaaS), a groundbreaking solution that leverages data from CLARA’s existing products to empower claims executives with powerful information.

With the largest claims AI dataset of bodily injury cases across workers’ compensation, auto liability, and general liability, insurance carriers and self-insured organizations can leverage CLARA IaaS for strategic decision-making.

It draws on millions of records, spanning over a decade, to yield granular and accurate insights that can transform claims operations and profitability.

The new solution debuts as claims executives continue to grapple with loss and expense accuracy, social inflation, reserving adequacy, and the need for greater control over complex claims.

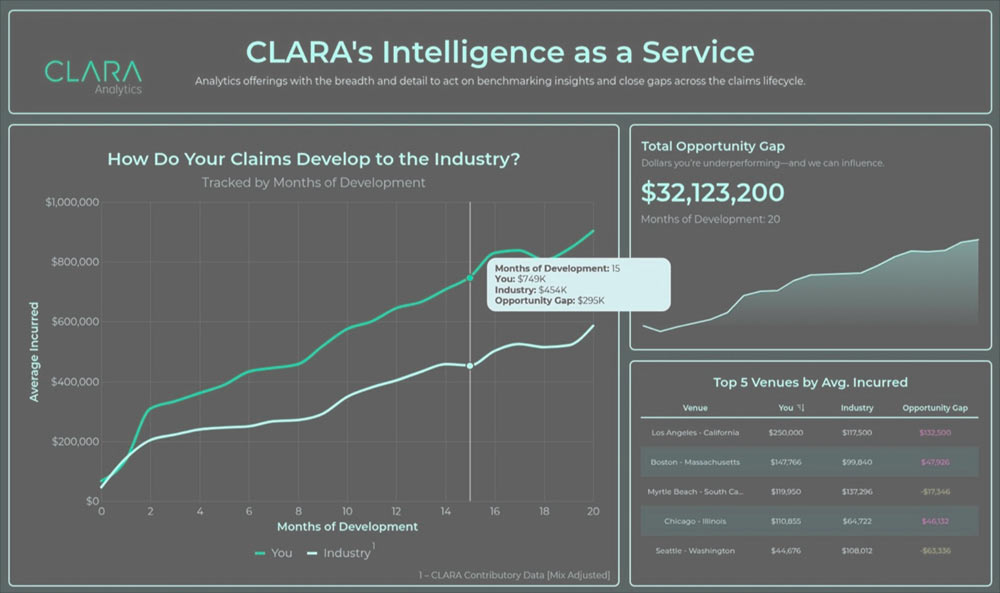

By leveraging CLARA’s robust and detailed industry data, insurance carriers and self-insured organizations will be able to strategically query their own practices, drill down into aberrations, and identify opportunities to optimize reserving and settlement outcomes. No other provider can extend this capability.

CLARA Analytics has unveiled CLARA IaaS, a benchmarking and analytics platform designed to give insurers and self-insured organizations a sharper view of their business performance.

The system layers CLARA’s AI with expert-curated reports and a contributory database, offering tailored comparisons that account for state rules, litigation patterns, hazards, damage attributes, and geography.

The platform’s selling point: an apples-to-apples view of where carriers stand against peers and where improvements can be made. Heather H. Wilson, CLARA’s CEO, said the depth of CLARA’s dataset makes it a “source of truth” for insurers looking to see their true market position and anticipate challenges.

The breadth and depth of our dataset is unmatched. When carriers want to know what’s truly happening in their business and where they stand in the market, there’s no better source of truth

Heather H. Wilson, CEO of CLARA Analytics

“CLARA IaaS gives insurers insights they’ve never had before — the ability to clearly see where they stand, anticipate challenges, and make decisions with confidence,” Heather H. Wilson said.

Key features include customized industry benchmarks, standardized KPI tracking across claims and litigation, expert-driven trend reports, and a fully configurable interface. Built on CLARA’s existing products, IaaS aims to deliver immediate value from launch.

Testing showed one clear benefit: spotting over- or under-reserving in real time using loss triangles. That has direct balance sheet implications—over-reserving inflates loss ratios and hides actual underwriting results.

By aligning normalized company data with industry benchmarks and historical performance, CLARA says carriers gain a clearer picture of both risk and opportunity.

Wilson positioned the product as more than a claims tool. “With CLARA IaaS, insurers finally have the clarity and control they need to drive better outcomes,” she said, calling it a shift toward proactive leadership.

The platform is live for workers’ compensation, auto liability, and general liability lines.