Fairfax Financial Holdings announced that a preliminary estimate of the impact of its adoption of a new accounting rule showed it may result in a $2.2 bn increase in shareholder equity.

- IFRS 17, the new accounting rule, was required to be adopted on Jan. 1 for insurance contracts, on common shareholders equity as at Dec. 31

- Finalized information will be presented in FFH 1Q results, scheduled May 11

- The $2.2 billion increase amounts to an increase in book value per share of about $94

- Shares are up 4.2% Tuesday, the most since Feb. 17

The new accounting standard, IFRS 17, was required to be adopted on January 1, 2023 for insurance contracts, on common shareholders’ equity as at December 31 last year.

Although IFRS 17 brings considerable changes to the measurement, presentation and disclosure of the company’s insurance and reinsurance operations, it will not affect the company’s underwriting strategy, its prudent reserving, management’s use of the traditional performance metrics of gross premiums written, net premiums written and combined ratios, or the amount of the company’s cash flows.

As these are preliminary, not finalised, unaudited estimates, Fairfax noted the finalised information will be presented in the company’s 2023 first quarter unaudited financial results.

According to the announcement, the estimated figure reflects the introduction of discounting net claims reserves – approximately $4.7 bn, partially offset by a risk adjustment of approximately $1.7 bn for uncertainty related to the timing and amount of cash flows arising from non-financial risks, partially offset by the tax effect of the measurement changes and other of approximately $800 mn.

Fairfax Financial Holdings announces fiscal year 2022 net earnings of $1,147.2 mn ($43.49 net earnings per diluted share after payment of preferred share dividends) compared to fiscal year 2021 net earnings of $3,401.1 mn.

Book value per basic share at December 31, 2022 was $657.68 compared to $630.60 at December 31, 2021.

We ended 2022 in a strong financial position with $1.3 bn in cash and investments in the holding company, our debt to capital ratio at 26.2%, and no significant holding company debt maturities until 2024

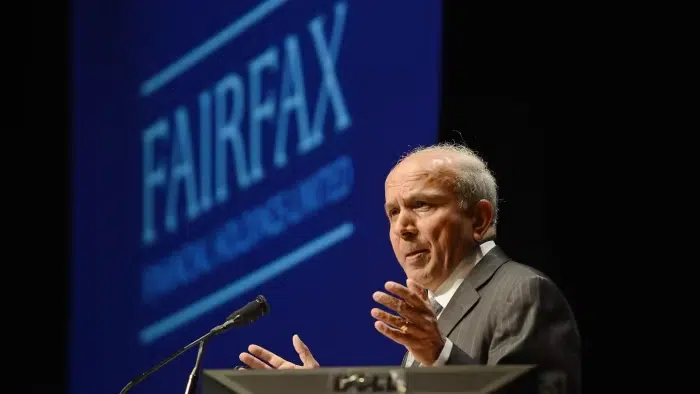

Prem Watsa, Chairman and Chief Executive Officer

Core underwriting performance continued to be very strong, with record underwriting profit of $1.1 bn and a combined ratio of 94.7% in 2022, reflecting growth in gross premiums written of 15.8% or $3.8 bn to $27.6 bn – essentially all organic.

Net losses on investments of $1.7 bn were principally comprised of mark-to-market losses on bonds of $1 bn due to the rising interest rate environment, the majority of which are expected to reverse over the short term, unrealized foreign exchange losses of $304.3 mn and losses on equity exposures of $243.8 mn.

Fact checked by