Inclined Technologies, a digital platform that simplifies access to the living benefits of whole life insurance, has closed an $8mn Series B round.

HSCM Ventures led the investment, joined by Northwestern Mutual Future Ventures and other new and existing backers.

The raise follows a $16.5mn Series A in September 2022 and comes at an increased valuation, reflecting the company’s growth in the $5tn whole life insurance market.

Northwestern Mutual Future Ventures vice president Craig Schedler said the firm’s mission is to help Americans maximize the value of their policies, and Inclined’s tools give policyowners the streamlined digital experience they now expect.

Inclined has built an innovative technology platform that connects policyowners with financial institutions in a unique marketplace that maximizes efficiency and delivers competitive rates.

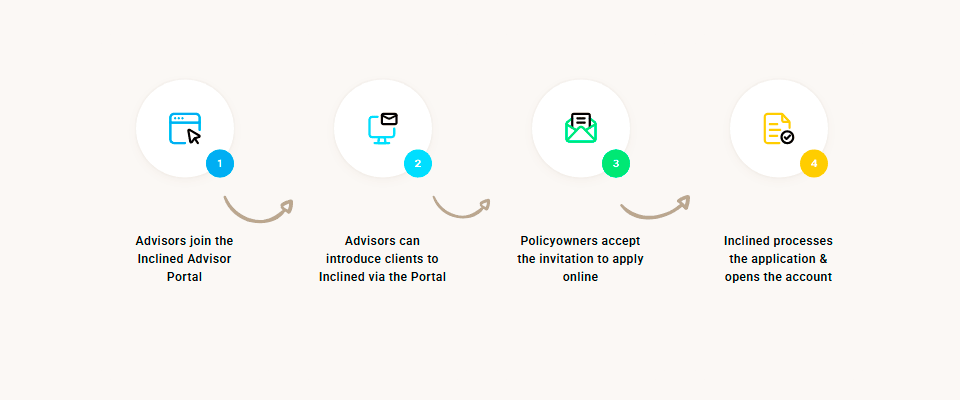

Financial Advisors can introduce the Inclined Line of Credit (iLOC) to clients as a fast and flexible way of accessing the liquidity they need.

Accessing cash value in whole life policies has traditionally been slow and complicated. Inclined’s technology offers a digital, automated process completed in under 15 minutes.

Through partnerships with advisors, the platform enables policyowners to open an Inclined Line of Credit (“iLOC”)—a secured revolving credit line backed by their policy’s cash value.

Borrowers can access funds at competitive rates without platform fees and repay on flexible schedules.

CEO and co-founder Joshua Wyss said thousands of advisors now use the platform, with adoption accelerating. The fresh capital will support new features, deeper partnerships with carriers like Northwestern Mutual, and broader reach across the $1.1tn in U.S. whole life policy assets.

We have thousands of whole life advisors actively leveraging Inclined’s platform to better serve their clients, and that number is growing daily

Joshua Wyss, CEO and co-founder of Inclined

“This funding will accelerate new product features and help us expand partnerships with Northwestern Mutual and other top carriers to unlock the $1.1 trillion invested in whole life policies,” said Joshua Wyss.

“We’ve built an innovative technology platform that connects policyowners with financial institutions in a unique marketplace that maximizes efficiency, lowers barriers to access, improves customer experience, and fosters competitive rates”.

Our mission at Inclined is to help people get more value out of their whole life investment, while bringing change to an industry ready to benefit from modern technology

The iLOC requires the lowest minimum cash value of any similar product on the market, opening access to previously unserved policyowners.

“In addition, our modern online platform replaces the traditionally long and cumbersome process of borrowing against cash value while providing a superior customer experience,” said Joshua Wyss.

Inclined plans to grow its team, advance its tech stack, and expand carrier integrations nationwide.