Insurance Europe has published a set of key messages on the European Commission’s proposal for an Insurance Recovery and Resolution Directive (IRRD).

Insurance Europe does not consider there to be a need to develop an extensive recovery and resolution framework for insurers. Should such a framework nevertheless be adopted, it should be properly tailored to the insurance sector and take into consideration the specific characteristics of the EU’s different national markets.

The Commission’s proposal for an IRRD needs a number of significant changes to make it fit for purpose and to avoid subjecting European insurers and their policyholders to a greater and more costly unnecessary regulatory burden.

The key messages outline how the Commission’s IRRD proposal could be streamlined to deliver a pragmatic yet effective approach to resolution for Europe’s insurance industry.

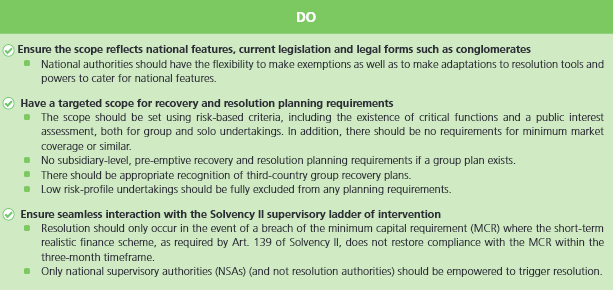

The IRRD should:

- Ensure the scope reflects national features, current legislation and legal forms, such as conglomerates.

- Have a targeted scope for recovery and resolution planning requirements, set using risk-based criteria.

- Ensure seamless interaction with the Solvency II supervisory ladder of intervention.

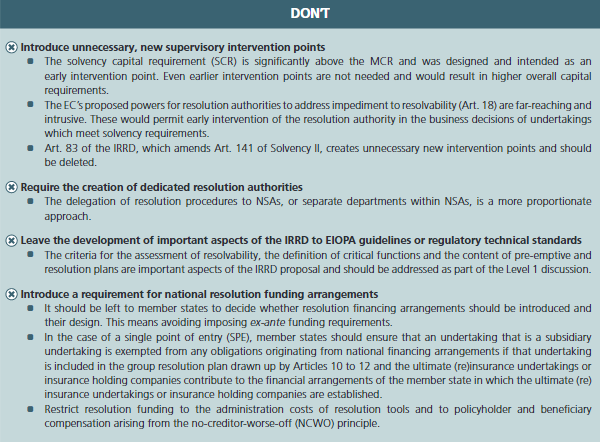

The IRRD should not:

- Introduce unnecessary, new supervisory intervention points.

- Require the creation of dedicated resolution authorities.

- Leave the development of important aspects of the IRRD to EIOPA guidelines or regulatory technical standards.

- Introduce a requirement for national resolution funding arrangements.

In September 2021, the European Commission published its proposal for an Insurance Recovery and Resolution Directive. This proposal followed its earlier work on a Banking Recovery and Resolution Directive (BRRD) and the Central Counterparty Recovery and Resolution Directive (CCPRRD).

The EC’s IRRD proposal took many stakeholders by surprise due to the extensive and unnecessary requirements for minimum standards of recovery and resolution for insurance companies across Europe.