Hurricane Fiona has caused loss of life, extensive property damage, flight cancellations and power loss for hundreds of thousands of homes across Atlantic Canada, and, according to a DBRS Morningstar report, the storm is likely to cause record insured losses in Newfoundland and Labrador, New Brunswick, Nova Scotia, and Prince Edward Island.

While this would be significant, it will not be large enough to affect the financial strength of the large, nationally diversified insurance groups which are the top participants in the property insurance market in Atlantic Canada.

Hurricane Fiona is highly likely to be one of the largest catastrophic events in history for Atlantic Canada. Initial estimates from DBRS indicate that insured losses will be within the $300 million to $700 million range for the industry.

DBRS Morningstar states that insured losses should remain in line with other recent severe weather loss events across Canada, which were manageable for the industry.

The largest catastrophe losses for the Canadian property and casualty (P&C) industry have been outside of Atlantic Canada, reflecting the region’s lack of large population centers, lower property values, and relatively stable weather patterns.

Combined, the four provinces represent 5.9% of the Canadian property insurance market by direct written premiums ($1.8 billion in 2021).

Moreover, property insurance premiums are approximately 37% of the $4.8 billion P&C insurance premiums in Atlantic Canada, with auto and commercial insurance also affected by the storm although to a lower extent.

In DBRS Morningstar’s view, Fiona will have negative earnings implications for most Canadian insurers but only a negligible impact on solvency levels.

However, while Hurricane Fiona is clearly not enough to make the assumption that climate change is worsening Atlantic Canada’s risk exposure to major storms, insurers are likely to be more cautious in the future when modeling catastrophe risk in that region.

Ultimately, this may lead these companies to review their product pricing and reinsurance coverage.

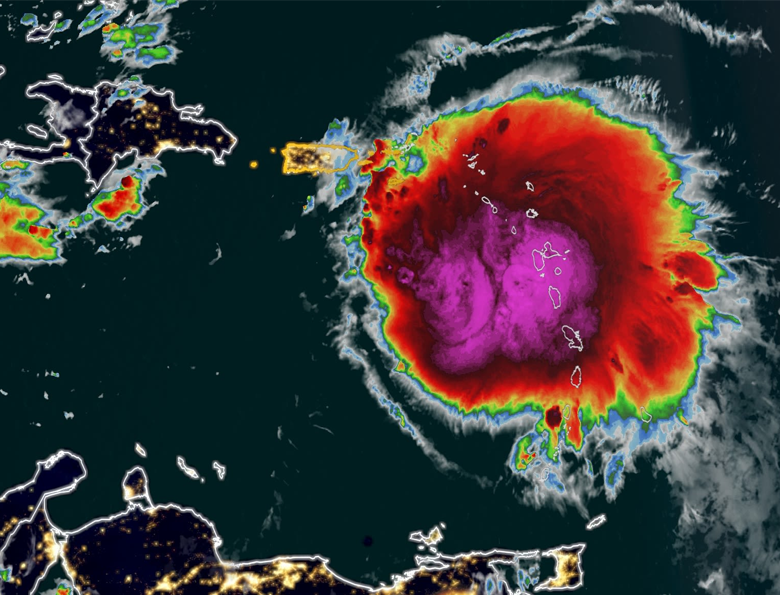

Meanwhile, Hurricane Fiona also damaged infrastructure and interrupted business operations in Puerto Rico and the Dominican Republic when the storm made landfall on September 18.

by Yana Keller