Insurtech Coverflow, which provides a platform that automates policy analysis, data entry, and workflow management for insurance brokers, has announced $4.8mn in seed funding led by AIX Ventures, with participation from Founder Collective and Afore Capital.

Backed by AIX Ventures, Coverflow is targeting the $130 bn+ in industry waste caused by manual workflows.

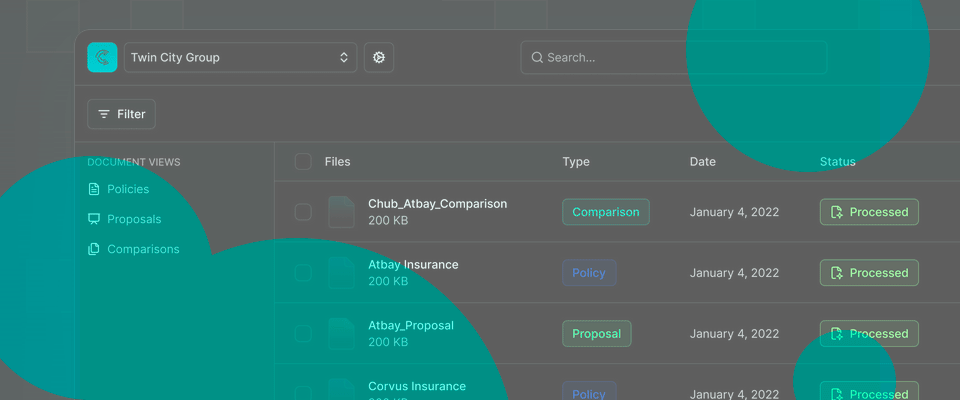

Founded in 2023, the San Francisco-based startup uses proprietary AI models to ingest, analyze, and extract data from policy documents.

Last year, Coverflow co-founders Matthew Fastow and Akash Samant spotted what they call “a once-in-a-generation opportunity” in a surprisingly overlooked corner of enterprise software: insurance brokering.

While the industry pulls in $400 bn in annual revenue, brokers still spend a third of that on “manual, low-value work. Reviewing dense policy docs, entering data, juggling spreadsheets, those repetitive tasks are exactly what AI excels at automating.

Matthew Fastow, Coverflow co-founders

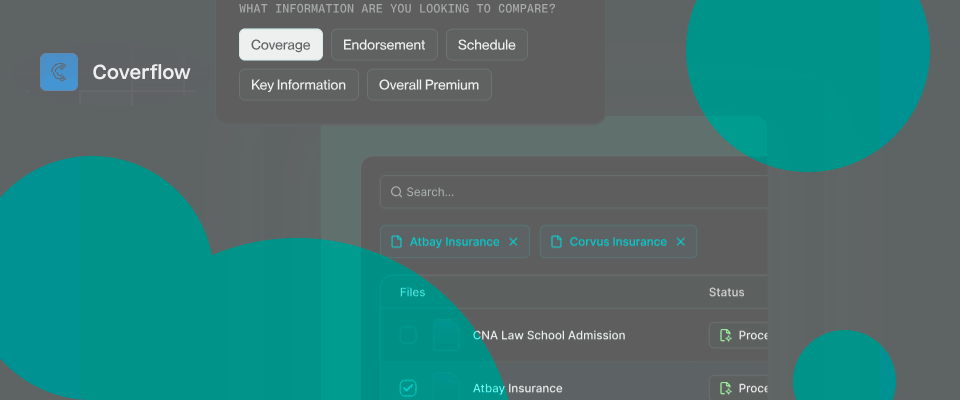

Brokers can use the platform to generate executive summaries and identify coverage gaps, among other tasks.

From pilot to production, Coverflow’s customers report dramatic efficiency gains: policies processed in minutes instead of hours, saving up to 75% of time per day. The result? 3x month-over-month growth and near 100% retention.

“After brokers see the ROI in reclaimed time, deal sizes organically grow as more agents onboard to Coverflow,” Fastow says.

With $4.8 mn in seed funding led by AIX Ventures, Founder Collective, and Afore Capital, Coverflow will invest heavily in R&D and go-to-market.

By year’s end, the team aims to:

- Launch deep connectors for leading Agency Management Systems and CRMs

- Introduce carrier portal and rating-tool integrations

- Roll out chat-based interfaces and customizable proposal templates

- Secure partnerships with several national broker networks

Insurance professionals move cautiously, but Coverflow’s “rapid ‘aha’ moment” during a live pilot flips skepticism to advocacy. “We can be live within days, with zero IT lift,” says Fastow. That speed, coupled with robust security, wins operational champions and drives broader rollouts.

Here’s what the company’s lead investor Jason McBride from AIX Ventures says: “Coverflow addresses some of the insurance industry’s largest bottlenecks caused by manual and paper workflows.

By saving brokers 6+ hours each day, Coverflow is poised to become the operational backbone for every broker by helping them focus on growing their business and serving their customers.

The company plans to use the funding to expand its team and develop additional features.

“Coverflow was created because brokers should not spend their days buried in paperwork. By applying AI to automate every step—from policy ingestion and analysis to system updates and proposal generation—we give teams back hours each day to focus on client relationships and business growth,” said Matthew Fastow, co-founder and CEO of Coverflow.

Coverflow addresses major bottlenecks in the insurance industry caused by manual and paper workflows.

“By saving brokers over 6 hours per day, Coverflow can become the operational backbone for brokers, allowing them to focus on growing their business and serving their customers,” said Jason McBride, Partner at AIX Ventures.

After speaking with dozens of Bay Area brokerages, the team realized that inefficient document handling alone wasted over $130 bn each year.

That insight drove Coverflow’s focus on a sector too complex for off the shelf AI tools but ripe for a purpose-built automation platform.

We spent hundreds of hours working with brokers to map their workflows. The result is a platform that saves 6+ hours of manual work per broker per day, freeing them to focus on clients and growth instead of busy-work.

Matthew Fastow, Coverflow co-founders

Unlike template-based solutions, Coverflow’s proprietary AI “ingests any policy document, no tagging or prompting needed, and in seconds extracts critical data, flags discrepancies, and generates proposals,” says Fastow.

Because it’s offered as a fully managed, web-based service, brokers require zero IT integration. The platform stitches directly into existing systems without code changes, delivering true “set-and-forget” automation from ingestion to proposal generation.