Founded in 2022, insurtech Liberate, a San Francisco-based AI startup automating insurance operations, has raised $50m in Series B funding led by Battery Ventures.

The all-equity round also drew participation from Canapi Ventures and returning investors Redpoint Ventures, Eclipse, and Commerce Ventures. The raise values the company at $300 mn post-money.

The company, now three years into its journey, wants to expand agentic AI deployments across insurers and agencies worldwide.

Its goal is to push adoption forward in an industry where past AI pilots often stalled or collapsed under fragmented data and rigid workflows.

Insurers meanwhile are straining under higher operating costs, brittle legacy systems, and customers who expect faster, more intelligent service.

The non-life insurance faces added pressure – global premium growth is forecast to slow through 2026 as competition intensifies, rate momentum weakens, and new costs like tariffs eat into margins.

Founded by Amrish Singh, Ryan Eldridge, Jason St. Pierre and a team of enterprise software and insurance veterans, Liberate partners with leading carriers and agencies to deliver transformative ROI in weeks.

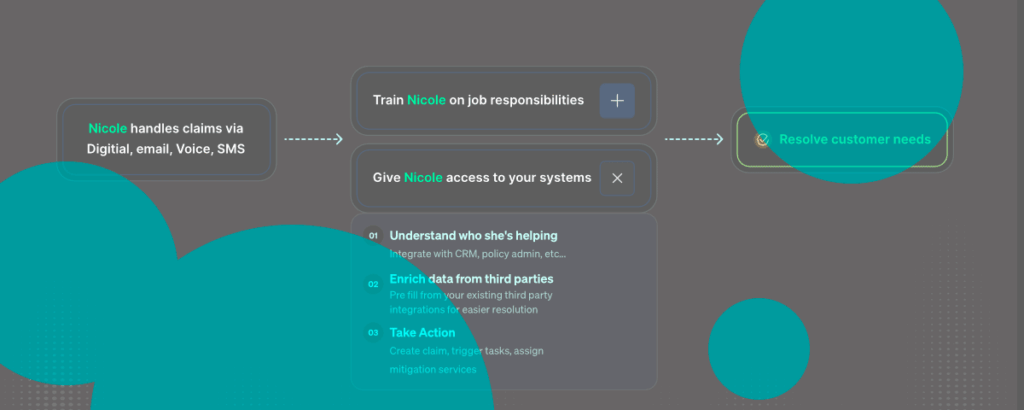

Liberate builds AI systems for property and casualty insurers focused on sales, service, and claims. Its conversational AI assistant, Nicole, manages inbound and outbound calls to sell policies or answer requests.

Supporting Nicole are reasoning-based AI agents that connect into insurers’ existing systems, retrieve context, and generate complete responses without human intervention.

These agents execute full end-to-end tasks, from quoting and endorsements to claims processing, and extend across SMS and email to cover multiple customer channels.

Insurance companies want to grow, but they’re not able to do so. It’s the status quo where the opportunity is.

Co-founder and CEO Amrish Singh, formerly with Metromile (acquired by Lemonade), said the company grew from a clear frustration: insurers want growth but can’t achieve it with existing workflows. He teamed up with former Metromile colleague Ryan Eldridge, now VP of engineering, and CPO Jason St. Pierre, who previously held roles at Twitter, Google, and Verily.

Our singular focus on the P&C insurance industry, pre-packaged integrations into most major carrier core systems & agency management systems, and emphasis on end-to-end resolution of calls and emails has enabled us to demonstrate real ROI with every carrier and agency we work with

Amrish Singh, Liberate co-founder and CEO

“The Series B funding will allow us to further accelerate the deep AI reasoning capabilities we have in our autonomous task resolution agents and help our customers deliver the best customer experience at the industry’s lowest cost,” said Singh.

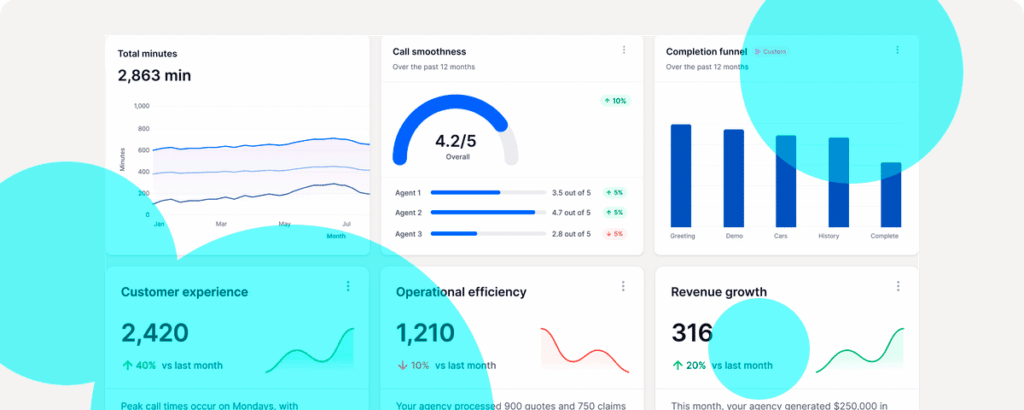

Liberate reports its AI has increased client sales by an average of 15% while cutting costs 23%. It already serves more than 60 insurers and agencies, with an emphasis on the top 100 carriers that control the bulk of the U.S. property and casualty market.

Results include:

- Operational ROI: A documented 263% return on investment for a large insurer, increasing sales by 15% and reducing cost of operations by 23%.

- Customer Experience: Drastic improvements in call resolution, including reducing hurricane claim response from 30 hours to 30 seconds.

- Enterprise Adoption: Large enterprises are deploying Liberate agents to cut costs and expand coverage without expanding headcount.

Reinforcement learning drives its long-form, regulated conversations, with all interactions fully auditable and monitored by an internal tool called Supervisor.

If anomalies occur, Supervisor escalates to a human operator to maintain compliance and accuracy.

The scale-up over the past year has been striking. From 10,000 monthly automations, Liberate now handles 1.3m resolutions, blending front-line customer conversations with back-office workflows.

Singh claims the technology can collapse hurricane claim response times from 30 hours to just 30 seconds. Beyond claims, the agents support 24/7 sales, allowing customers to purchase insurance at any time of day or night.

Prior to this Series B, Liberate raised $15 mn in Series A funding last year, attracting investors with its ability to automate full processes instead of only surface-level communication.

Marcus Ryu, general partner at Battery Ventures and new board member at Liberate, said the company’s edge lies in mapping entire insurance workflows, designing system connections rigorously, and ensuring that the AI completes the task itself.

Mapping the process, modelling it, and making sure that all the systems connections are in place, well tested, and appropriately designed so that you can complete the task, not just communicate, is what Liberate is doing

Marcus Ryu, general partner at Battery Ventures

With $50 mn in fresh capital, Liberate now looks positioned to push its tightly focused AI strategy across more insurers, scaling where legacy systems and partial AI pilots have repeatedly fallen short.