UK-based insurtech Marshmallow has raised £68 mn through a mix of debt and equity financing, bringing its valuation to £1.5 bn.

Portage Capital Solutions participated in the round, along with funds managed by BlackRock and CLP.

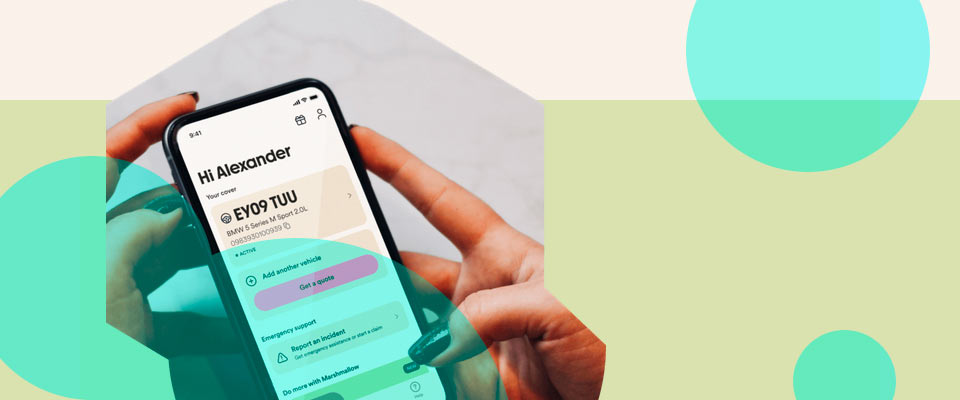

Marshmallow initially launched to serve migrants moving to the UK, offering car insurance to individuals often excluded by traditional insurers.

The company has since expanded its scope, now aiming to build a financial services platform to meet the broader needs of migrant populations worldwide.

The funding follows a period of rapid growth. The company now insures over one mn drivers and increased its annual revenue by 75% to £184 mn. The new capital will support product development and international expansion.

Co-founder and co-CEO Oliver Kent-Braham stated that the company plans to simplify access to financial services for people relocating across borders.

He noted that many still face financial barriers that limit their ability to settle and participate in daily life. According to him, the funding will enable the company to address these issues more effectively.

Our ambition is to become a one-stop-financial-shop for newcomers so they feel as though it’s easy to move to, and live in, a different country

Oliver Kent-Braham, co-founder and co-CEO of Marshmallow

“There are still major financial services barriers that make it harder for newcomers to settle and take part in everyday life. This funding gives us the capital to solve these problems and deliver against our mission,” said Oliver Kent-Braham.

We started Marshmallow when we found out how unfair insurance prices are for people who move to the UK. Purely because the industry hasn’t given this huge cohort of people a second thought, and isn’t set up to price them properly.

“We now help 100,000s of UK newcomers get a fairer deal on their car insurance every year. We do this by building our own technology, developing pricing and fraud models that let us cater to their unique experiences, and investing time in getting to know them on a deeper level,” said Oliver.

“So far we’ve sold over half a million policies with our app being used every year by hundreds of thousands people. And according to the Financial times, we were the second fastest growing company in Europe”.

Portage Capital Solutions general partner Devon Kirk expressed continued confidence in Marshmallow’s strategy. She described the company as a market leader focused on solving financial challenges that impact consumers. She also expressed confidence in its ability to deliver solutions that improve access to financial services.

Marshmallow is a clear leader in innovating to solve important financial challenges for consumers. We are confident in the business’ ability to continue developing solutions for a fairer financial ecosystem.

Devon Kirk, general partner at Portage Capital Solutions

This funding round follows the company’s £63 mn Series B raise in 2021, which marked its entry into unicorn status.

With this latest investment, Marshmallow plans to increase its presence beyond the UK and continue building services for globally mobile individuals.