Meanwhile Insurance Bitcoin (Bermuda), the life insurer fully denominated in Bitcoin (BTC), announced the completion and public release of its 2024 audited financial statements as required by statute.

This marks the first time globally that a company has released audited financial statements entirely denominated in BTC.

Licensed by the Bermuda Monetary Authority (BMA), Meanwhile operates exclusively in Bitcoin, combining insurance and cryptocurrency.

The audited financials, prepared under Bermuda’s Insurance Act 1978 and reviewed by Harris & Trotter LLP and its digital asset division ht.digital, report 220.4 BTC in total assets and a net income of 25.29 BTC for the year ending December 31, 2024 — a 300% increase year-on-year.

These results reflect the Company’s disciplined approach to building a sustainable, Bitcoin-based business, with all operations and reporting denominated in BTC.

Meanwhile completed of a $40 mn Series A funding round. The investment was co-led by crypto-native venture capital firm Framework Ventures and Bitcoin-focused Fulgur Ventures, with participation from renowned investor and Xapo founder Wences Casares.

The Series A raise follows Meanwhile’s prior $20.5 mn total in seed funding — with a first tranche co-led by Sam Altman, CEO of OpenAI, and Lachy Groom, an early employee at payments giant Stripe, and a second tranche led by Mouro Capital.

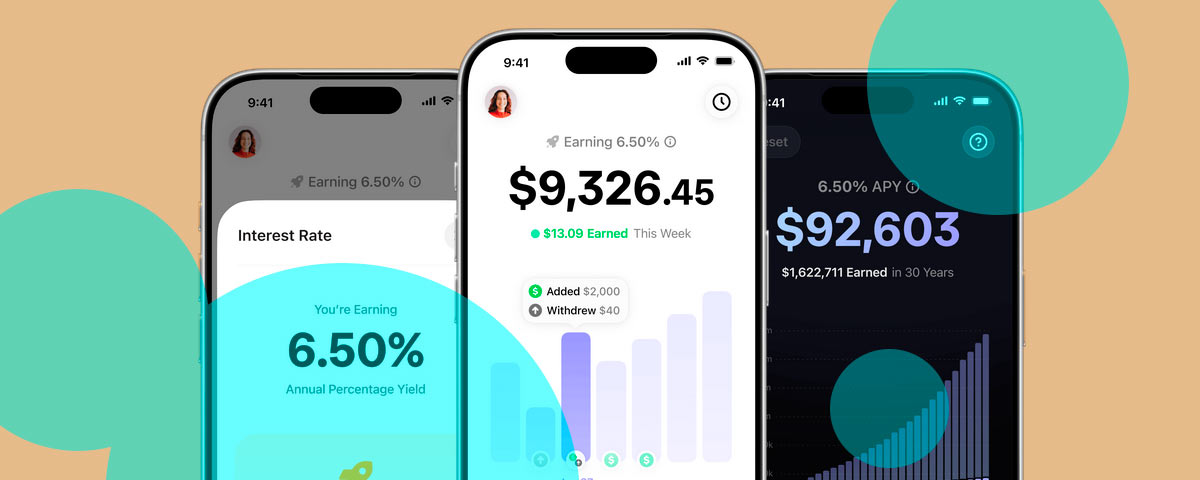

Meanwhile’s innovative “BTC Whole Life Insurance” product combines the security and predictable benefits of traditional life insurance with Bitcoin – a scarce, inflation-resistant asset built to preserve long term value.

Founded in 2022 by Zac Townsend and Max Gasner, Meanwhile is based in Bermuda and offers life insurance and annuity products denominated in Bitcoin.

Meanwhile’s approach to life insurance provides policyholders worldwide with a powerful tool for long-term financial planning, inflation hedging, and secure, tax-advantaged wealth transfer across generations.

We made history as the first company to have Bitcoin-denominated financial statements externally audited. This represents a foundational step in building a financial system based on a single, global, decentralized standard outside the control of any government.

Zac Townsend, CEO of Meanwhile

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long term, supporting the Company’s insurance liabilities over decades. This makes it significantly more stable and less exposed to market pressures than BTC held by companies for treasury purposes,” said Zac Townsend.

Unlike companies holding BTC for treasury management, Meanwhile is prohibited by regulation from selling its assets regardless of market conditions.

Most BTC is held on behalf of policyholders as part of their life insurance policies and is subject to strict regulatory rules.

BTC can only be sold when policyholders redeem it through claims or surrenders, which can take decades.

Meanwhile offers policyholders a way to preserve and grow their Bitcoin holdings over the long term, as the Company must keep BTC in its treasury permanently.

Our announcement shows how Meanwhile leads the next phase of the connection between Bitcoin and institutional financial markets.

Tia Beckmann, CFO of Meanwhile

“By generating net income in BTC, we have proven the sustainability of our insurance business model, which delivers essential financial services to our policyholders,” Tia Beckmann stated.

Meanwhile’s Bitcoin Whole Life product protects policyholders’ families, builds savings in Bitcoin, enables loans against policy cash value, and supports legacy planning — all denominated in BTC.

As a Class IILT insurer, Meanwhile graduated from Bermuda’s innovation sandbox in July 2024, becoming the first fully licensed Bitcoin-denominated life insurer.

Meanwhile’s BTC Whole Life Insurance benefits to customers:

- Insurance policies entirely denominated in Bitcoin, safeguarding long-term value against inflation and currency depreciation

- Seamlessly integrates Bitcoin’s appreciation potential with traditional life insurance stability

- Secure and tax-advantaged savings and intergenerational wealth transfer through innovative, regulated financial products

- Guaranteed insurance payouts and conservative Bitcoin-denominated institutional investments

Confident that BTC is on pace to become a global store of value and functional currency, the company’s licensed and regulated Bermuda subsidiary is entirely denominated in BTC, accepting all premiums and paying out all claims in BTC.

The Company plans to expand its product offerings in 2025, continuing to serve long-term savers and investors globally.

Operating exclusively within the crypto ecosystem allows Meanwhile to avoid traditional currency volatility while aligning with the growing institutional adoption of cryptocurrency.

Meanwhile is the world’s first life insurance company to operate entirely in Bitcoin, offering products such as Bitcoin Whole Life to policyholders worldwide.

Licensed by the Bermuda Monetary Authority, Meanwhile combines traditional insurance with cryptocurrency to deliver long-term financial solutions for Bitcoin savers.