QBE Ventures has invested in California-based geospatial data aggregator Geosite, saying the platform does the “heavy lifting” to extract insurance-relevant information.

Geosite automates geocoding for insurers, taking advantage of multiple tools to provide carriers with the most accurate location data possible. QBE says combined with other data such as imagery from spaceborne radar, insurers can develop a comprehensive risk picture of a particular site, building, or area.

Geosite’s platform puts carriers in a position to service the various functions essential for effective, modern insurance operations. It’s even possible to become aware of a customer loss prior to the customer themselves. This is done through the intersection of portfolio data on building location and data from satellite views.

QBE Ventures Global Head of Emerging Technology Alex Taylor

Having access to multiple data sources is as good as useless if we can’t create a unified picture, and the ability to consume new geospatial insights depends on the ability to match it to data points already held.

The future is bright for geospatial data, and its use in the financial services sector. Once the significant challenge of combining and cross-referencing information, and connecting it to systems, is solved – the progression of this capability within financial services is expected to be rapid. New geospatial capabilities come online every day, and the ability to consume these data sources depends on the ability to match these to data points already held.

With the launch of platforms like Geosite supporting this capability, the insurance industry’s ability to respond to major events, and underwrite in preparation for them, is going to be transformed.

As the prevalence of natural catastrophes increases, the effective integration of these tools will be a key differentiator between industry participants, and the ability to remain resilient in light of these challenges as these tools are key to managing costs and controlling premiums. Being on the forefront of this emerging technology and embracing platforms like Geosite, therefore, becomes an essential component to the success of several industries – and our collective ability to respond to our customers in their time of greatest need.

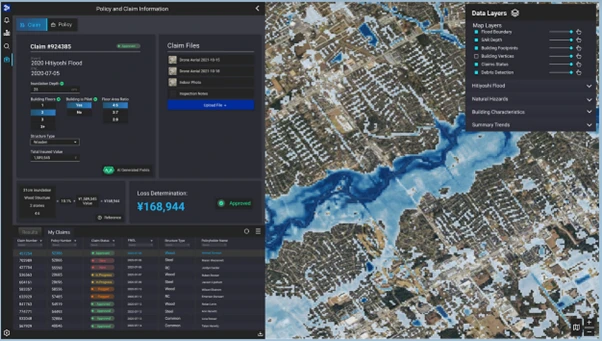

Using Geosite, the location and identity of a structure can be verified immediately upon receiving a first notification of loss. Predictive loss information can be generated based on the nature of the event – for example flood depth and construction material – in combination with computer vision analytics platforms.

Data is now available from satellites – visual, infrared and Synthetic Aperture Radar – aircraft and drones, yet implementation across insurers “remains lightweight,” and “single data points generally fill in a limited portion of what needs to be known by insurers”.

Until recently, the visibility of customers’ property assets was severely limited and a majority of properties are either not geocoded or incorrectly geocoded.

The insurance industry’s ability to respond to major events, and underwrite in preparation for them, is “going to be transformed” by Geosite technology.

As the prevalence of natural catastrophes increases, the effective integration of these tools will be a key differentiator between industry participants. A precise understanding of where properties are located supports a range of activities across the insurance lifecycle including better underwriting, reserving, and claims resolution. These tools are key to managing costs and controlling premiums.

Until recently, the visibility of customers’ property assets was limited to what they told their insurer, or what they discovered for themselves.

Expensive site surveys limited the scale of what insurers could underwrite (or accuracy was sacrificed for speed), and when a major event took place – be it a hurricane, tornado, or major storm – insurers were largely in the dark until claims started to roll in or people were deployed on the ground to ascertain the damage.

From a claims perspective, legacy practices create a number of challenges for insurers, but the biggest challenge is time. Namely, the time between when a catastrophic event occurs and when insurers can confirm components necessary for the insurance value chain and customer response. Key among these is the reserving process. After a major event, the safest assumption is that every property you underwrite in an impacted area is a total loss and response is required, though this is hardly a realistic scenario. Supply chain activation and prioritisation – getting customers help where and when it’s needed most – is also often delayed by current business practices.

When it comes to residential and commercial property, the insurance and financial services sectors are operating in a landscape of unprecedented uncertainty. The last several years have seen a dramatic rise in natural disasters that have driven insurance losses higher and lending risk for the banking sector is equally exposed. From floods in Europe, Asia, Australia, and the United States – to catastrophic wildfires in the U.S., Australia, and even Europe – there is a growing need to understand emerging and evolving risks and engage with customers to openly discuss them.

This uncertainty, however, can be mitigated through the use of geospatial data to improve nearly all elements of the insurance value chain.

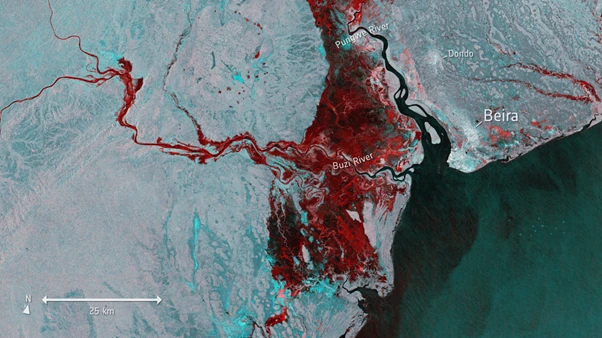

In addition to ground-based data and data captured from aircraft and drones, we now have data available from satellite-based sources (visual, infrared, Synthetic Aperture Radar [SAR]). In a positive development, the rise of platforms like Google Earth Engine have inspired organisations to adopt these technologies in their existing processes. That said, across the insurance industry, implementation has remained lightweight – largely to verifying the specifics of properties, with single data points generally filling in a limited portion of what needs to be known by insurers.

So why have spatial data sources like those listed above struggled to establish a stronger foothold in insurance, banking, and other sectors? The insights we can gather from these platforms are clearly valuable, and the cost to acquire it is declining year on year. The issue, it seems, is consumers of these data sources don’t have the technical expertise to combine information from multiple data sources effectively at scale – a remarkably complex problem to solve.

In simplistic terms, when merging data sets, the combined accuracy of the data is about the same as the least accurate data source. This holds true for working with geospatial data sets.

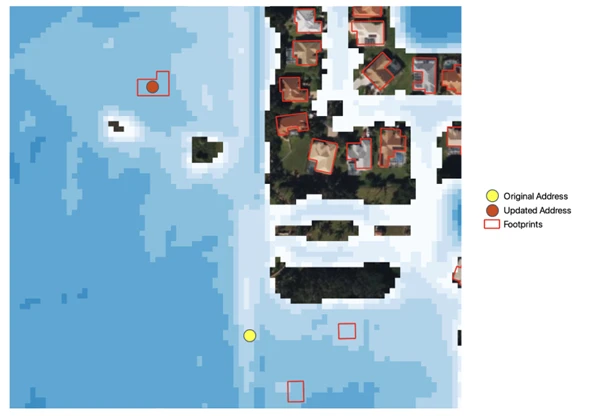

One of the most fundamental geospatial problems insurers need to solve is geocoding properties within their portfolios.

Geocoding is the process of going from a text-based address to a mapped location. Most people rely on geocoding every day.

For example, opening Uber to call a ride requires geocoding. You type in your location, the app uses a geocoder to drop a pin at a latitude/longitude approximation on the map, then you manually pull the pin to match with your actual location.

Despite the ubiquitous nature of geocoding in today’s technological landscape, most insurance providers currently work with extremely crude, manual geocoding tools. For carriers with millions of properties, manually determining the exact location of every insured property is economically infeasible. As a result, a majority of properties are either not geocoded or are incorrectly geocoded.

Geosite enables insurers to overcome this fundamental challenge by automating the geocoding process and tapping into the capabilities of competing geocoders. Rather than relying on the accuracy of one geocoder, Geosite takes advantage of multiple geocoding tools to provide carriers with the most accurate location data possible for their building footprints. With an understanding of where properties are actually located, combined with other spatial data sources such as ultra-high-resolution imagery from spaceborne RADAR, insurers can start to develop a comprehensive risk picture of a particular site, building, or area.

In addition to informing more accurate risk profiles, correctly geolocating properties is critical to using other forms of spatial data for near real-time damage assessments during catastrophic events such as flooding. Thus, a precise understanding of where properties are located supports a range of activities across the insurance lifecycle including better underwriting, reserving, and claims resolution. Improved reserving practices especially important for insurance companies facing major natural catastrophes looking to predict claims payouts so they can better support internal decision-makers as well as their customers in a time of crisis.