SehaTech, an Egyptian InsurTech building AI-driven tools for health insurance administration, closed a $1.1 mn seed round.

Ingressive Capital led the raise with Plus VC, strategic angels, and existing investors A15 and Beltone Venture Capital also in. The new cash brings SehaTech’s total funding to $2 mn.

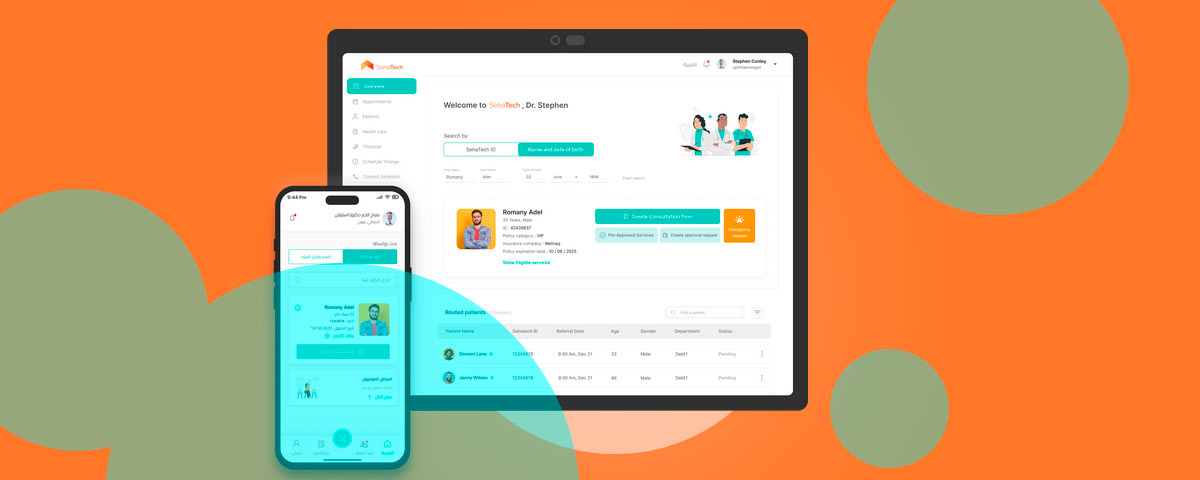

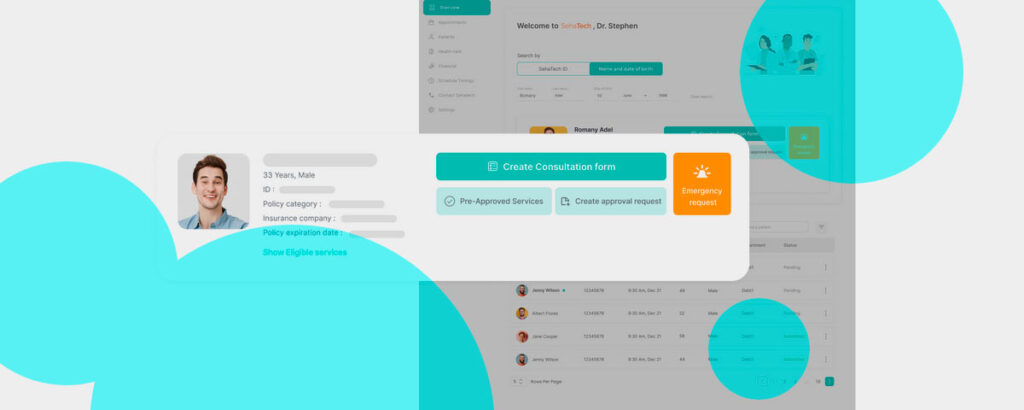

The company runs a proprietary full-stack platform that automates workflows between insurers and healthcare providers.

The aim is straightforward: cut inefficiencies, reduce disputes, and flag fraud before it bleeds cash. That operational cleanup frees insurers to focus on coverage rather than firefighting, while providers see faster processing and fewer headaches.

With this funding, SehaTech intends to grow its team, widen operations in Egypt and into regional markets, and double down on AI and automation capabilities.

The broader ambition runs deeper. Health insurance penetration in much of the region is painfully low. SehaTech says its platform can help build a system that’s more inclusive, accessible, and financially sustainable.

Founder and CEO Mohamed Elshabrawy said the mission isn’t just fixing messy processes. It’s about expanding access to quality health coverage for millions underserved today. Tools that limit friction between insurers and providers, he said, are key to unlocking that access.

Our goal is not only to fix the operational inefficiencies in medical insurance processing but also to expand access to quality health coverage.

Mohamed Elshabrawy, SehaTech founder and CEO

“This funding will help us continue building the tools needed to reduce friction between insurers and providers—and ultimately make health insurance more available to the millions who are underserved today,” Mohamed Elshabrawy said.

Backing the vision, Maya Horgan Famodu of Ingressive Capital said the firm invested because SehaTech addresses a problem that drags on healthcare delivery across regions with fragile infrastructure. For her, it’s about more than automation. It’s about enabling healthcare financial inclusion.

SehaTech’s work is critical in solving a deeply entrenched problem at the heart of healthcare delivery—especially in regions where infrastructure gaps hinder access to quality services.

Maya Horgan Famodu of Ingressive Capital

“Their platform isn’t just about automation—it’s about enabling healthcare financial inclusion, and we’re proud to support that mission,” Maya Horgan Famodu said.

Earlier funding from A15 and Beltone laid the groundwork. This latest round sets the stage for a larger push – both in product depth and market reach.