A new AI product from UK-based agency Sputnik Digital may reshape how insurers handle home contents insurance coverage.

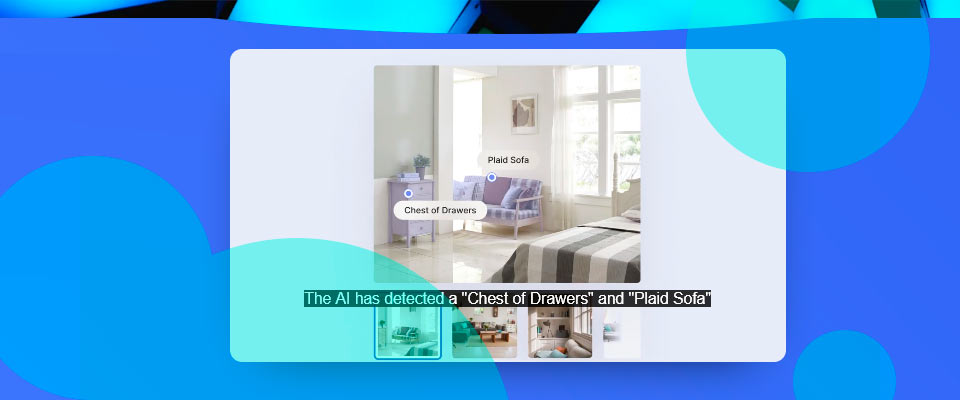

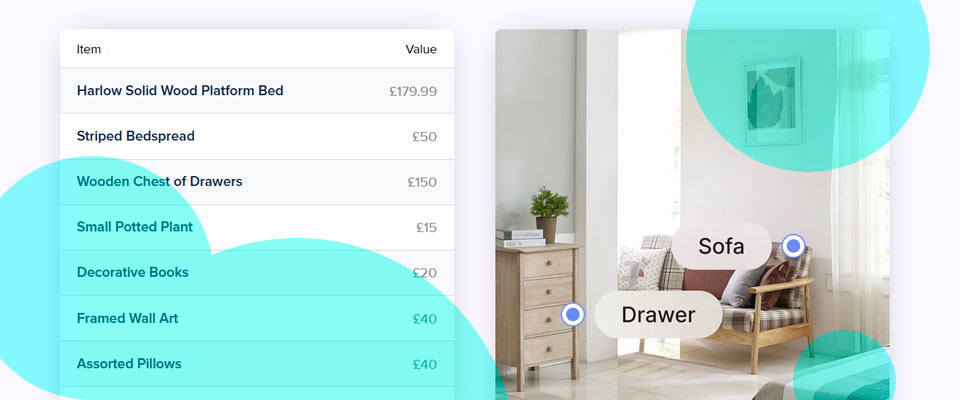

The tool, Invntry, automatically compiles and estimates the value of items from images, streamlining a traditionally time-consuming process for both insurers and policyholders.

Invntry was developed to address those pain points. The system allows insurers to offer policyholders an intuitive way to track possessions using photos, reducing the complexity of traditional inventory calculators.

It also gives providers a direct channel to stay relevant year-round, offering a value-added feature within home contents policies.

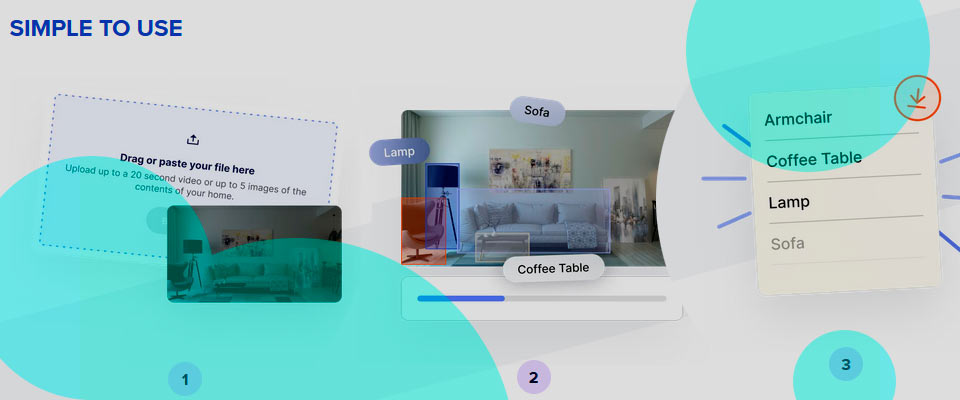

Invntry addresses this by using our new AI-powered platform, which streamlines the process. It allows users to generate insurer-ready content reports in minutes by uploading images of their home.

- For insurers, inaccurate contents data makes it harder to charge the correct premium, assess risk, process claims, and settle disputes fairly.

- Traditional home inventory tools rely on manual input and subjective estimation, resulting in inconsistent data and poor customer experiences.

Launching in April 2025, Invntry is simple to use, easy to integrate, and engineered for accuracy and scalability. The result is faster onboarding for customers, improved coverage accuracy, and reduced risk for insurers.

Andy Nicol, Managing Director of Sputnik Digital, says the product reflects more than ten years of working with insurers and brokers on digital platforms and user flows.

We’ve seen firsthand the friction in quote-and-buy experiences, widespread underinsurance, and the lack of meaningful engagement between insurers and customers outside of annual renewals,.

Andy Nicol, Managing Director of Sputnik Digital

Work on Invntry began in Q4 2024. It has now reached MVP stage, with a functional product ready for demos to insurance partners. Despite ongoing feature development, Nicol says the team focused on delivering a working solution quickly.

“As often happens, the scope grew during development, but we now have a live product and a roadmap of additional features we want to implement,” he says.

Although designed with consumers in mind, Invntry will be introduced through B2B channels. Insurers can deploy it to enhance customer trust and reduce coverage gaps by giving policyholders more control over their inventories.

The tool pulls product data from multiple sources and improves through continued use. However, Nicol makes clear that Invntry’s estimates serve as a starting point — not a guarantee.

Differentiating between models of flatscreen TVs remains difficult, and some items may fall outside the image frame. Invntry handles the bulk of the workload, but users still need to verify and complete their inventory manually.

Andy Nicol, Managing Director of Sputnik Digital

To improve accuracy, the system detects room types and recommends likely missing items. Users can adjust any valuation and add new items as needed.

“We’ve built Invntry to be flexible — it helps users keep a detailed list, but it’s up to them to decide what level of cover they want,” says Nicol.

Sputnik Digital is also working on other AI-based products, including Hollr, a personalized AI video tool currently in private beta.

“We architect & deliver web and mobile projects for clients with big ambitions, having delivered digital projects for GoCompare, Fluent Money, Hastings Financial Services and Swinton Insurance. With a strong creative and technical team, we design and build innovative, enterprise-level digital products that are fast, secure and scalable for our clients”.