Largest the International Groups of P&I Clubs — 2024, ranked by US$ thousands gross premiums written, according to Beinsure research by A.M. Best data.

13 P&I Clubs which comprise the International Group (the “Group”) between them provide marine liability cover (protection and indemnity) for approximately 90% of the world’s ocean-going tonnage.

Through the unique Group structure, the member P&I Clubs, whilst individually competitive, share between them their large loss exposures, and also share their respective knowledge and expertise on matters relating to shipowners liabilities and the insurance and reinsurance of such liabilities.

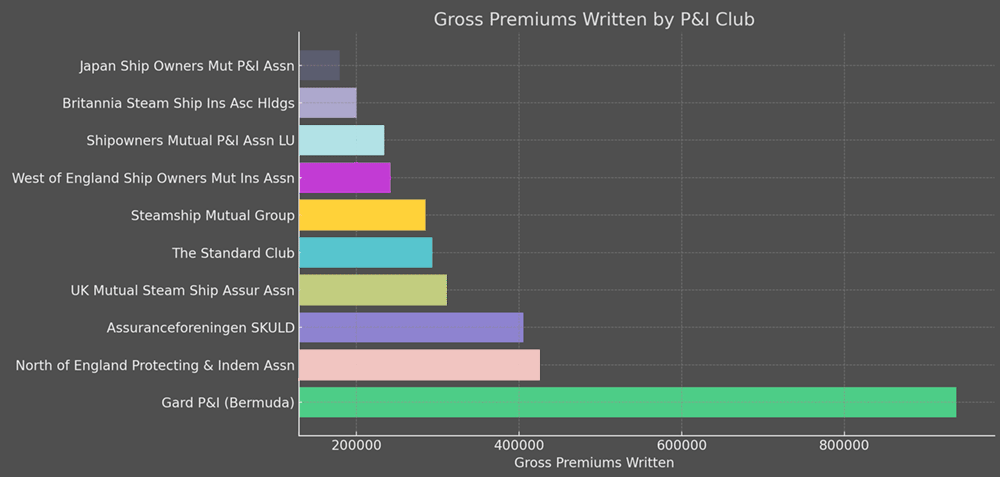

TOP 10 International Groups of P&I Clubs

| № | P&I Club | Gross Premiums Written | Capital & Surplus |

|---|---|---|---|

| 1 | Gard P&I (Bermuda) | 937,735 | 1,262,920 |

| 2 | North of England Protecting & Indem Assn | 425,385 | 450,273 |

| 3 | Assuranceforeningen SKULD | 405,379 | 385,367 |

| 4 | UK Mutual Steam Ship Assur Assn | 310,342 | 507,398 |

| 5 | The Standard Club | 292,9 | 360,3 |

| 6 | Steamship Mutual Group | 284,331 | 511,064 |

| 7 | West of England Ship Owners Mut Ins Assn | 241,956 | 291,134 |

| 8 | Shipowners Mutual P&I Assn LU | 234,1 | 379,065 |

| 9 | Britannia Steam Ship Ins Asc Hldgs | 200,086 | 449,055 |

| 10 | Japan Ship Owners Mut P&I Assn | 179,426 | 243,666 |

Source: A.M. Best Company, Inc. and/or its affiliates. ALL RIGHTS RESERVED

International Group of P&I Clubs

Each Group Club is an independent, not-for-profit mutual insurance association, providing cover for its shipowner and charterer members against third party liabilities arising out of the use and operation of ships.

The Clubs cover a wide range of liabilities, including loss of life and personal injury to crew, passengers and others on board, cargo loss and damage, pollution by oil and other hazardous substances, wreck removal, collision and damage to property.

Each Club is owned by its shipowner and charterer members, and its operations and activities are overseen by a board of directors, or committee, elected from the membership. The day-to-day operations of the Clubs are handled by professional managers, either “in-house” or external, who are appointed by and report to their Club board/committee.

Gross Premiums Written by P&I Clubs

Capital & Surplus by P&I Clubs

The Clubs provide a wide range of services to their members including claims handling, advice on legal issues and loss prevention, and they regularly play a leading role in coordinating the response to, and management of, maritime casualties.

One of the main roles of the IG is co-ordinating the operation and regulation of the P&I Clubs’ claim-sharing agreement (the Pooling Agreement).

All qualifying claims in excess of US$10 million are shared between Clubs in accordance with the terms of the Pooling Agreement.

Much of the Group’s work involves defining and refining the scope of cover for pool claims, and the rules and guidelines under which claims are shared. This claim-sharing agreement is underpinned by a very extensive, annually renewed, market reinsurance programme.

The Group also provides a unique and invaluable forum for sharing information on matters of concern and an effective voice to speak collectively on important industry issues, for example on international conventions and legislation affecting shipowners’ liabilities and related insurance matters.

The International Group of P&I Clubs represents a collection of Protection and Indemnity (P&I) Clubs, which provide marine liability coverage for the majority of the world’s ocean-going tonnage.

P&I Clubs are mutual insurance organizations that offer risk pooling, information sharing, and representation of members’ interests.

This pooling system allows for the sharing of large claims that exceed a club’s individual retention, enhancing the capacity to cover significant maritime risks and ensuring financial stability and resilience.

9 key points about the International Group of P&I Clubs

- Membership: The International Group consists of several major P&I Clubs, each operating as independent, non-profit mutual insurance associations. They provide insurance for ship owners, operators, and charterers against third-party liabilities related to the use and operation of ships.

- Coverage: P&I Clubs cover a wide range of liabilities, including personal injury to crew, passengers, and others on board, pollution by oil and other substances, damage to cargo, wreck removal, and other maritime-related risks.

- Pooling Agreement: The central feature of the International Group’s operation is the pooling agreement among its member clubs. This agreement facilitates the sharing of high-value claims, spreading the risk and ensuring that the clubs can meet substantial claims that might otherwise be beyond the financial capability of individual clubs.

- Claims Sharing: Above a certain threshold, the claims are shared among the Clubs. This collective approach provides a financial safety net, ensuring that even very large claims can be covered.

- Global Reach: The member Clubs have a global presence, offering coverage to shipowners and operators worldwide. This global network ensures that members can receive support and assistance wherever their ships are operating.

- Lobbying and Advocacy: The Group represents the interests of its members in front of international regulatory bodies such as the International Maritime Organization (IMO), advocating for fair and practical maritime laws and regulations.

- Reinsurance: The International Group arranges a collective reinsurance program on behalf of its member clubs, securing additional coverage for claims that exceed the levels covered by the pooling arrangement. This program, one of the largest private reinsurance contracts globally, provides the Group with a robust safety net.

- Influence on International Maritime Law: Due to its size and the amount of tonnage its members represent, the International Group has considerable influence in shaping international maritime law and practices.

- Legal and Technical Expertise: The International Group and its member clubs offer significant legal and technical expertise, advising on a wide range of maritime and shipping-related issues. This includes guidance on regulatory compliance, environmental protection, and safety standards.

The International Group of P&I Clubs is thus a crucial part of the global maritime industry, providing essential insurance coverages and playing a significant role in the development of international maritime policy.

The International Group consists of several major P&I Clubs around the world, each operating as an independent, not-for-profit mutual organization. Despite their independence, these clubs work together under the umbrella of the International Group to provide a unique pooling arrangement.

Challenges and Opportunities for P&I Clubs

Insurance professionals within the P&I Clubs face a variety of challenges, including navigating complex and evolving international regulations, responding to environmental and sustainability pressures, and managing the risks associated with new technologies and changing global trade patterns. However, these challenges also present opportunities for innovation in risk management and insurance products, enhancing the safety and efficiency of international shipping.

Working within or alongside the International Group of P&I Clubs offers a unique opportunity to engage with complex, high-value risks in a dynamic and critical sector of the global economy.

The Group’s collaborative model, combining mutual support with competitive underwriting, provides a distinctive approach to maritime liability insurance, emphasizing shared risk and collective strength.

……………………

Edited & fact-checked by Oleg Parashchak – Editor-in-Chief Beinsure Media