The nationwide homeowners insurance giants in the U.S. have some of the highest level of catastrophe exposure to hurricane Ian, which is currently forecast to reach west-central Florida as a major Category 3 storm. To provide some insight into the potential exposure for primary insurers operating in Florida as hurricane Ian approaches, analysts at KBW have released data on the cat-exposed market share for carriers, which shows that some of the nationwide homeowners giants are among the most exposed to the event.

- Allstate Corporation tops the list with a 6.7% market share

- followed by a 6.4% market share for The Progressive Corporation

- 2.8% market share for The Travelers Companies

- followed by Chubb with a 2.6% cat-exposed market share

- Universal Insurance Holdings with a 2.4% share

- AIG with a 1.7% share

- Assurant at 1.5%

- United Insurance Holdings also at 1.5%

- Loews Corporation at 1.1%

- Heritage Insurance with a 1% market share

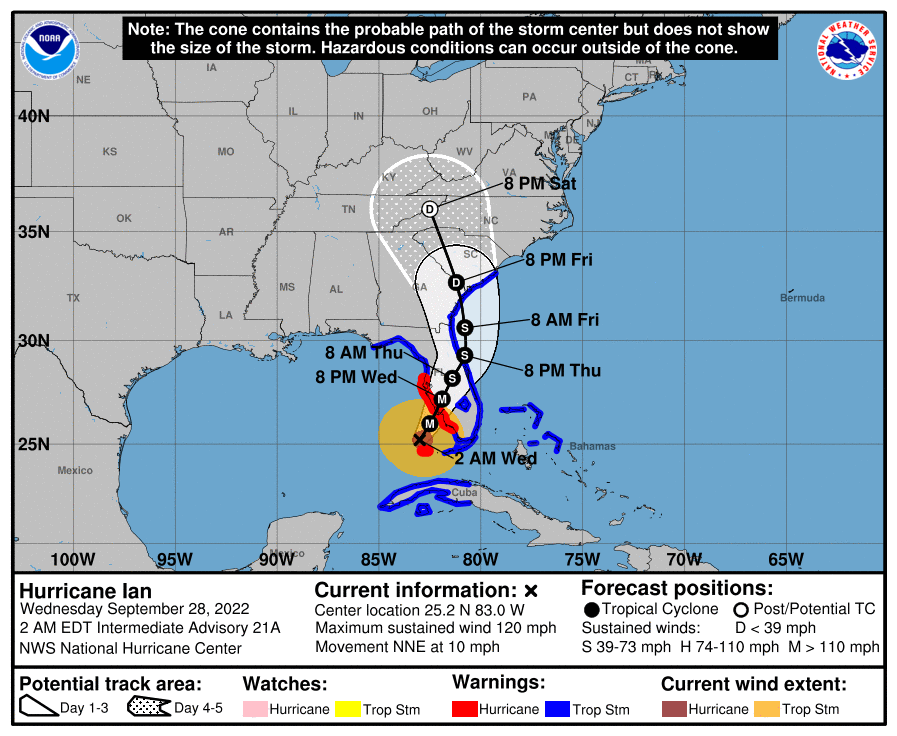

After making landfall in Cuba’s Pinar del Río province as a Category 3 storm with winds of 125 mph, models suggest hurricane Ian will strengthen further, and reach the Tampa Bay area of Florida’s coastline as a major Cat 3 hurricane (see The Largest Natural Catastrophes).

While the exact landfall location, as well as the size and strength of hurricane Ian as it moves over Gulf of Mexico waters is uncertain, the threat of significant storm surge has emerged as a real concern for insurance and reinsurance market participants.

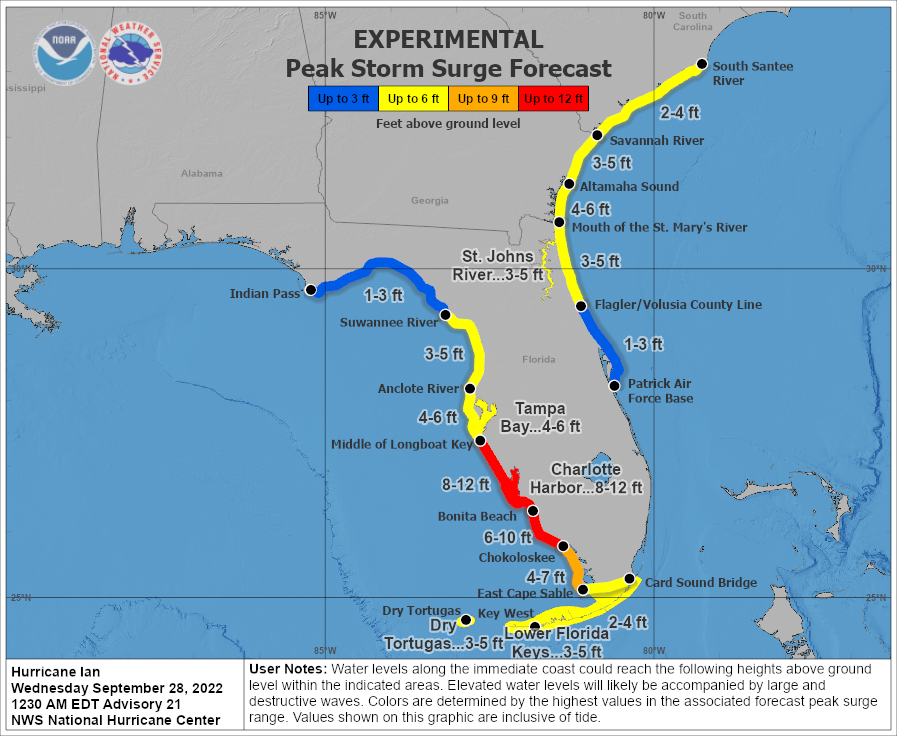

The NHC has warned that significant storm surge poses the highest risk across Fort Myers to Tampa. The Tampa Bay area is extremely vulnerable to storm surge given low-lying properties and a coastline that accentuates surges.

Further, the region is home to some very high-value properties, and while homeowners’ policies in the state generally exclude flood, personal auto and commercial property policies do cover the flood peril.

Ratings agency AM Best has also provided a list of market share for homeowners insurers in Florida based on 2021 direct premiums written (DPW). This has Universal Insurance at the top of the list with a 10.48% market share with DPW in the state of more than $1.3 billion.

Interestingly, Citizens Property Insurance Corporation, Florida’s residual market insurer, is second on the list with a 10.16% market share with DPW of $1.26 billion. The data shows that Citizens is holding a lot of exposure and this has been growing fast in recent times on the back of a rising policy count driven by issues in the Florida property market and insolvencies (see Parametric Catastrophe Bonds and Alternate Risk Transfer Mechanisms).

It’s also worth noting that Citizens has less reinsurance in place after it struggled to fill its towers for the 2022 wind season in challenging market conditions for buyers of protection, notably in Florida.

After Citizens, AM Best’s data reveals that State Farm has the next largest market share at 6.67%, followed by Tower Hill at 5.18%, Progressive at 4.36%, USAA at 4.1%, First Protective at 3.89%, HCI at 3.89%, Florida Peninsula Group at 3.76%, and Heritage at 3.26%.

Notwithstanding uncertainty over Hurricane Ian’s size and impact, large catastrophe losses should provide more property-catastrophe reinsurance pricing momentum, following significant optimism at Monte Carlo.

Some two million Floridians have been told to evacuate the state as hurricane Ian heads towards the south coast as a strong and dangerous storm (see How Florida’s Insurance Market Could to Respond to a Repeat of a Category 5 Hurricane Andrew?).

According to reports, storm surge flooding is already occurring in the Lower Florida Keys, and with the storm surge set to raise higher as the storm gets closer, it’s going to be a dangerous 24 hours+ for the state’s coastline.

It’s also still expected that major hurricane Ian will slow as it nears the Florida Peninsula’s coastline, with further growth in size of the storm also anticipated. Given the low-lying properties along Florida’s west coast, a slow and larger hurricane Ian has the potential to exacerbate the storm surge flooding.

Of course, there’s still a lot of uncertainty as hurricane Ian nears its second landfall, and this is reflected in the industry loss ranges, which suggest anything from $10 billion to $40 billion.

According to catastrophe risk modeller Karen Clark & Company (KCC), a landfall near Longboat Key would result in a $30 billion loss for the industry from wind, with a further $2.5 billion from flooding as Ian tracked inland.

A second loss scenario reported by KCC suggests a landfall more to the south, near the Venice area, would drive industry losses of $17 billion from wind damage and an additional $2 billion from flood.

It’s worth noting that the latest forecast path is now south of both of these KCC scenarios, but it’s possible that this could actually result in higher loss estimates if the Fort Myers region suffers a more direct hit from hurricane Ian’s strongest winds.

CoreLogic has released data analysis showing that more than one million single-family and multifamily homes along the Florida gulf coast with a reconstruction cost value (RCV) of approximately $258.3bn are at potential risk of storm surge damage from Hurricane Ian.

Add to this the fact that Tampa Bay and the surrounding area is a very high-value part of the coast, and it’s clear that there’s some significant property values at-risk from hurricane Ian’s winds and surge.

Many homes along Florida’s western coast are at risk of storm surge inundation regardless of where the storm makes landfall, and even more homeowners will contend with heavy rainfall and hurricane-force winds throughout mid-week.

The RCV figures assume 100% destruction of all at-risk homes and are not a representation of expected damages.

………………………..

by

by