Overview

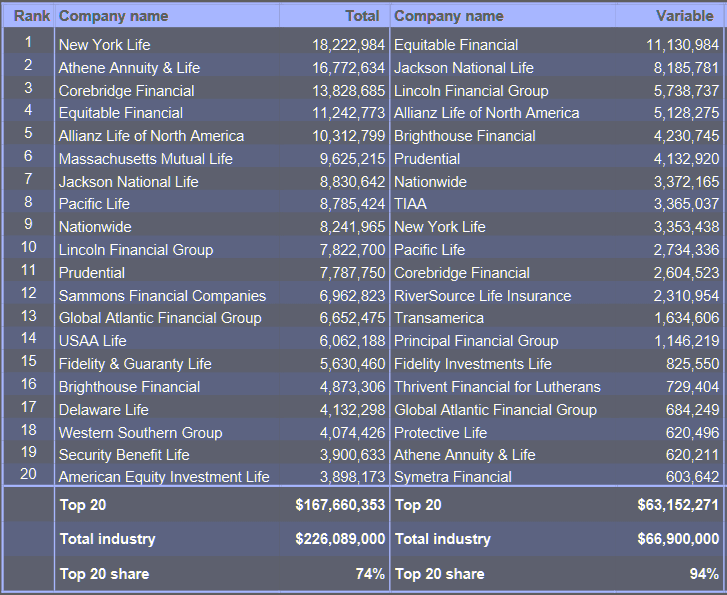

Total U.S. annuity sales were $223 bn in H1 2025, 3% above prior year results, according to preliminary results from LIMRA’s U.S. Individual Annuity Sales Survey, which represents 89% of the total U.S. life insurance and annuity market. Beinsure analyzed the report and highlighted the key points.

In the second quarter, total annuity sales increased 5% year over year to $116.6 bn. This is the highest quarterly total ever recorded.

For the third consecutive year, quarterly and year-to-date (YTD) annuity sales have set records. If you look underneath the top-level results, however, we see a slight softening in the market, which could result in a contraction in the second half of the year.

Bryan Hodgens, senior vice president and head of LIMRA research

Even accounting for the potential dip in sales in the second half of the year, annuity sales will likely surpass $400 bn in 2025.

Key highlights

- Total U.S. annuity sales hit $223 bn in the first half of 2025, up 3% year over year, surpassing the previous record set in H1 2024. Q2 alone brought in $116.6 bn, the highest quarterly total ever recorded.

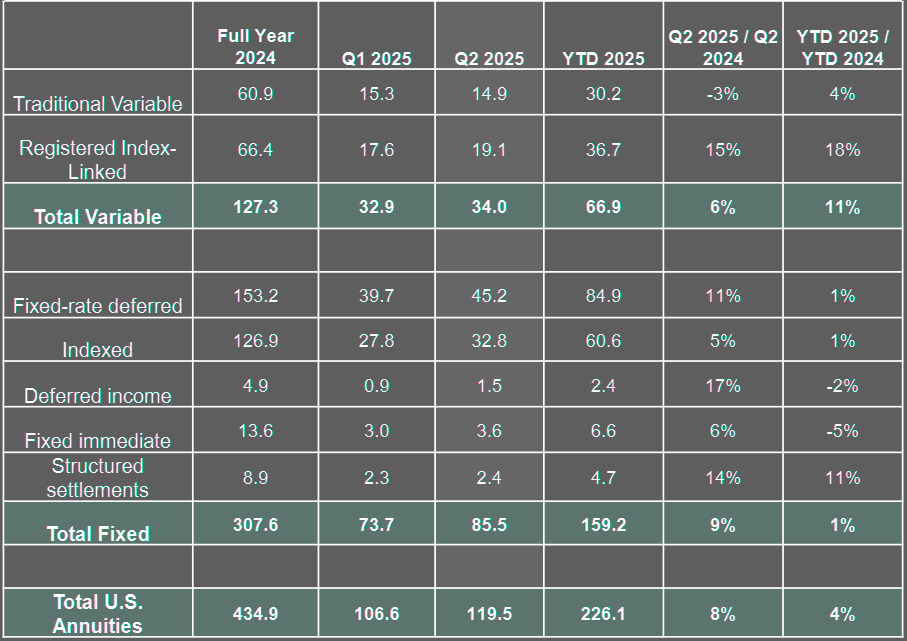

- Registered Index-Linked Annuities posted $19.6 bn in Q2 sales, up 20% from Q2 2024. Year-to-date sales reached $37.0 bn, driven by investor interest in downside protection and competitive returns.

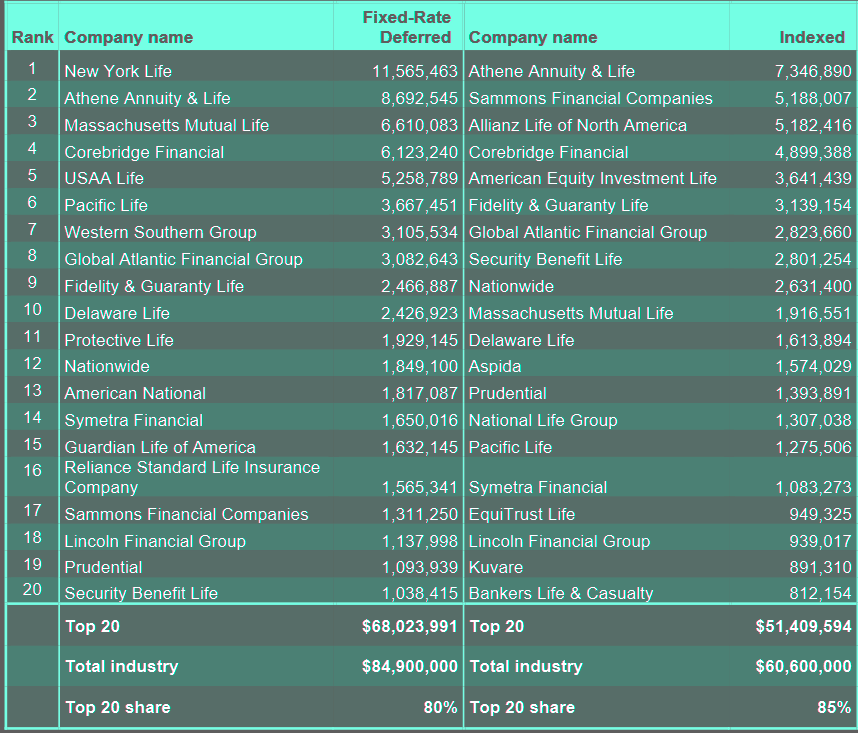

- Fixed-Rate Deferred annuities totaled $44.2 bn in Q2, up 9% year over year. However, recent monthly data indicates a potential cooling as investors react to stable interest rates and equity market growth.

- Fixed Indexed Annuities held steady at $31.4 bn in Q2, while Traditional Variable Annuities declined 4% to $14.7 bn. Shifts in product preference and market conditions influenced performance across these segments.

- Despite record sales, only 1 in 5 pre-retirees owns an annuity. Nearly 50% expect insufficient guaranteed income in retirement, underscoring the need for continued education and outreach by the industry.

Registered Index-Linked Annuities

Registered Index-Linked Annuities (RILAs) sales reached $19.6 bn in Q2 2025, marking a 20% year-over-year increase and the highest quarterly total to date. Cumulative sales for the first half of the year rose to $37.0 bn, also up 20% compared to H1 2024.

Market conditions stabilized by late Q2 following early-year volatility, contributing to investor confidence.

Demand continues to rise due to the product’s structure offering downside protection and competitive cap and participation rates.

U.S. Annuity Second Quarter 2025 Sales Estimates

LIMRA expects the trend to hold as more broker-dealers expand their offerings to include RILAs.

Elevated market volatility in the first quarter calmed in the second, and by the end of June, the markets registered positive growth.

Keith Golembiewski, assistant vice president and director of LIMRA Annuity Research

RILA’s value proposition of protected growth with attractive caps and participation rates is very appealing in this environment.

LIMRA expects the growth trajectory for RILA will continue for the foreseeable future, especially as more broker-dealers add RILAs into their product mix.

Fixed-Rate Deferred Annuities

Fixed-Rate Deferred (FRD) annuities generated $44.2 bn in Q2, up 9% from the same period last year. YTD sales totaled $83.9 bn, roughly equal to the first half of 2024.

While early-year performance lagged, monthly sales data indicates recent weakening. LIMRA attributes the dip to rate stabilization and early positioning by investors.

However, FRD contracts still outperform CDs, positioning them as an appealing option for short-term, risk-averse buyers despite the resurgence in equities.

Fixed Indexed Annuities

Fixed Indexed Annuities (FIAs) sales stood at $31.4 bn in Q2, flat compared to Q2 2024. First-half results reached $59.2 bn, down 1% year over year.

Golembiewski noted that FIA growth slightly contracted, partly due to a shift toward FRD products. Nonetheless, FIAs remain a preferred solution for clients seeking guaranteed income and market protection.

U.S. Individual Fixed Annuity Sales Breakout

Traditional Variable Annuities

Q2 sales of traditional Variable Annuities (VAs) declined 4% to $14.7 bn, impacted by April’s market turbulence. Despite that, YTD sales reached $30.0 bn, reflecting a 3% increase over H1 2024.

U.S. Individual Annuity Sales

Income Annuities

SPIA sales held steady at $3.4 bn in Q2 but fell 8% YTD to $6.5 bn. DIA sales dropped 7% in Q2 to $1.2 bn, with first-half sales at $2.1 bn, a 14% decline from the previous year’s record.

For the seventh straight quarter, total U.S. annuity sales exceeded $100 bn. Todd G. Hodgens stated that strong sales reflect ongoing efforts to improve public awareness around guaranteed income products. He warned, however, that adoption remains limited—only 20% of pre-retirees currently own an annuity, while nearly 50% expect inadequate guaranteed income in retirement.

This ‘new normal’ in the U.S. annuity market is partially because of industry efforts to educate consumers and advisors about the value of including a guaranteed lifetime income stream into a retirement plan. But the work needs to continue.

“Today, just 1 in 5 pre-retirees own an annuity, and nearly half say they won’t have enough guaranteed income to cover basic living expenses. With the Alliance for Lifetime Income coming under LIMRA’s umbrella, we will carry on the mission to help Americans understand the role annuities play in achieving financial security in retirement.”

LIMRA, now managing the Alliance for Lifetime Income, plans to expand outreach and education.

FAQ

Total U.S. annuity sales reached $223 bn in H1 2025, up 3% year over year, according to LIMRA’s preliminary U.S. Individual Annuity Sales Survey, which covers 89% of the market. This sets a new half-year record, surpassing the previous high in H1 2024.

Second-quarter sales hit $116.6 bn, up 5% from Q2 2024 and the highest quarterly total on record. This marks the third consecutive year of record-setting quarterly and year-to-date results.

RILA sales reached $19.6 bn in Q2, up 20% year over year. H1 sales totaled $37.0 bn, also up 20%. Stabilizing market conditions and product features offering downside protection and capped upside have driven investor demand. LIMRA expects continued momentum as more broker-dealers adopt RILAs.

FRD annuities brought in $44.2 bn in Q2, a 9% increase year over year. YTD sales were $83.9 bn, matching 2024 levels. While monthly sales softened due to stabilized rates and earlier investor activity, FRDs remain attractive for conservative buyers, often outperforming CD rates.

FIA sales in Q2 stood at $31.4 bn, flat compared to Q2 2024. H1 sales were $59.2 bn, down 1% year over year. A shift in demand toward FRD products contributed to the slight decline, though FIAs remain popular for those seeking income guarantees and limited market exposure.

Traditional VA sales dropped 4% in Q2 to $14.7 bn due to April volatility but still grew 3% YTD to $30.0 bn. SPIA sales stayed level at $3.4 bn in Q2 but fell 8% YTD. DIA sales declined 7% in Q2 to $1.2 bn and were down 14% YTD to $2.1 bn.

Despite signs of softening in H2, LIMRA forecasts total annuity sales will exceed $400 bn by year-end. Continued efforts to educate consumers on guaranteed income products remain critical, especially as only 20% of pre-retirees currently own an annuity. LIMRA plans to expand outreach through its partnership with the Alliance for Lifetime Income.

………………………

AUTHORS: Bryan Hodgens – senior vice president and head of LIMRA research, Keith Golembiewski – Assistant VP and director of LIMRA Annuity Research

Edited by Nataly Kramer