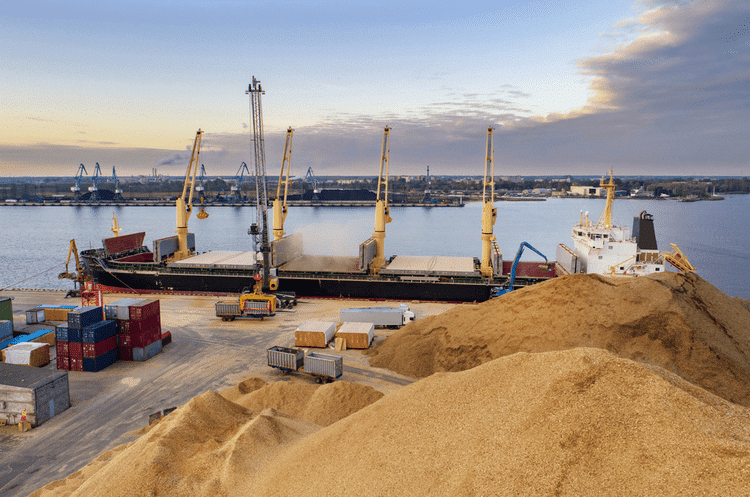

Specialty re/insurance group Ascot and broker Marsh have launched a marine cargo and war facility, which will provide coverage for vital grain and food products transitioning through safe corridors established by the newly signed Black Sea Treaty between Russia and Ukraine.

A cargo insurance facility providing cover for shipments via Ukraine’s grain export corridor will continue 2023 year with no reinsurance rate increases, an underwriter with Lloyd’s of London insurer Ascot said.

The ‘AsOne’ Black Sea facility will continue unabated with no planned increases to rating. This is against a supply-driven, rate-hardening environment in the marine war market

Placed by Marsh, and led by Ascot, the Lloyd’s facility will provide up to $50 million of cover in marine cargo and war insurance.

The facility will allow ships transporting grain, and other designated food products from Ukrainian ports, to have reliable and readily available coverage in place for their export voyages.

Under the terms of the treaty, ships can transit designated Ukrainian ports through safe access corridors. Ascot and the London market to be doing its part to catalyse this humanitarian venture.

The recovery of these grain supplies is vital to addressing global food insecurity and market uncertainty at this difficult time. The facility announced by our market today is of paramount importance. It will add essential protections to the deal brokered by the UN last week and represents the latest support from Lloyd’s and the insurance industry to help the international community respond to the conflict.

Patrick Tiernan, Chief of Markets at Lloyd’s

This facility is a major development in assisting Marsh cargo clients manage the risks associated with operating in the Black Sea during this terrible time of war. Not only will it help unlock supply chains, it will alleviate mounting pressures on global food security, which will benefit nations and communities around the world.

The Lloyd’s is gearing up to provide coverage for shipments of grain coming out of war-torn Ukraine.

Lloyd’s Chairman Bruce Carnegie-Brown told that preparations were underway among Lloyd’s insurers and brokers after Russia and Ukraine agreed to allow the safe transport of grain and fertiliser through the Black Sea corridor.

And now, it’s emerged that the Lloyd’s market will help to further facilitate the arrangement by providing coverage for ships transporting these goods, with Carnegie-Brown assuring that the necessary insurance products will be confirmed imminently.

Insurers will only be willing to cover ships sailing through a proposed corridor to get Ukrainian grain out if there are arrangements for international navy escorts and a clear strategy to deal with sea mines.

Banks usually require ships entering the three Ukrainian ports that have been part of the UN-backed agreement, to have various insurance policies in place.

These include hull and cargo war cover, which need to be renewed every 7 days.

Because of the conflict, natural catastrophes and high inflation, war and other insurance rates are generally expected to rise sharply across the board next year.

by

by