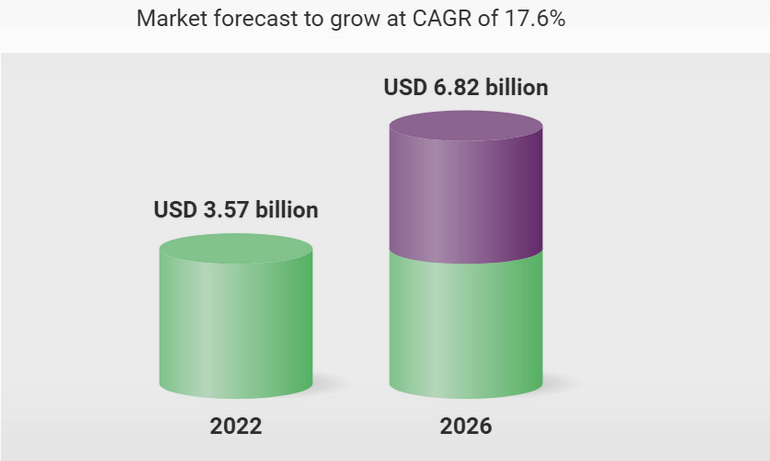

The global digital twin financial and insurance market services is expected to grow from $2.95 billion in 2021 to $3.57 billion in 2022 at a compound annual growth rate (CAGR) of 20.9%.

According to Research & Markets, the digital twin financial & insurance services and insurance market will grow to $6.82 billion in 2026 at a CAGR of 17.6%.

North America was the largest region in the digital twin financial services. The regions covered in the digital twin financial services and insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Major players in the digital twin financial services and insurance market are IBM Corporation, Atos SE, Swim Inc., General Electric, Microsoft Corporation, SAP SE, ABB Group, Kellton Tech, AVEVA Group plc., PTC, ANSYS Inc., DXC Technology Company, Bosch.IO GmbH, Siemens AG, and Oracle Corporation.

The rising urbanization around the world is expected to propel the growth of the digital twin financial services and insurance market going forward. Urbanization refers to the increasing population densities in urban areas compared to rural areas.

Global digital twin financial & insurance services

Due to urbanization and increased net income, people can afford to pay for digital services instead of physically visiting the banks. For instance, according to the United Nations Department of Economic and Social Affairs, a US-based government agency, 68% of the global population is expected to live in urban areas by 2050.

Therefore, the rising urbanization and increasing disposable income is driving the digital twin financial services and insurance market.

The digital twin financial services and insurance market consists of sales of digital twin financial services and insurance by entities (organizations, sole traders, and partnerships) that are used for assisting customers with loan management, mitigating risks, policy buying and management, and more.

Digital twins are digital replicas of physical products. The data is stored and visualized on a digital platform for better optimization of businesses.

The digital twin framework in the insurance and financial services sectors is providing customers with more optimized solutions.

The main types of digital twin in financial services and insurance are system digital twin, process digital twin, and product digital twin. The system digital twin is used for digitalizing systems in the financial services and insurance sectors. System twins are the digitalization of whole business systems to study how they work in the financial services and insurance sectors.

The different technologies include IoT and IIoT, artificial intelligence and machine learning, 5G, big data analytics, blockchain, augmented reality, virtual reality, and mixed reality that are deployed in the cloud and on-premises.

It is used in several applications, such as bank account fund checking, digital fund transfer checks, policy generation, and others.

The increasing adoption of cloud technologies is expected to propel the growth of the digital twin financial services and insurance market going forward. Cloud technologies are hosted in the cloud and are accessed via a web browser using the internet.

The use of cloud technologies in digital insurance and financial services is expected to promote the adoption of digital twin financial services and insurance as it offers greater security, and quicker processing times with reduced prices.

For instance, according to the 2019 State of the Cloud Survey by Flexera, a US-based software company, out of 786 technical professionals surveyed, 94% use cloud solutions, and 69% of them are using hybrid cloud solutions.

The increasing adoption of cloud technologies is propelling the digital twin financial services and insurance market.

Siemens Smart Infrastructure, a Switzerland-based provider of smart solutions acquired EcoDomus’s digital twin software platform for an undisclosed amount. The acquisition would help Siemens smart infrastructure to expand its digital building offerings with cloud-based building operations twin software. EcoDomus is a US-based digital twin software solutions company.

by Peter Sonner