Glow Insurance Services, the digital insurance agency for small businesses, announced that it has closed a $22.5 million round of series A financing led by Cota Capital.

AV8 Ventures, Markd, Startup Venture Capital, Maiden Re, and others also participated in the round. The financing will fund innovation in Glow’s digital insurance platform, which automates the insurance process for small businesses.

Glow uses data to ensure that a business is maintaining the correct coverage for all their insurance needs at a lower cost, not just when they purchase, but every year.

Glow will also use the investment to expand into more states across the nation, serving small businesses across more vertical industries.

“Glow is changing the landscape for small business insurance,” said Ben Malka, partner at Cota Capital.

Small business insurance is a $100 billion market, and it’s underserved and underinsured. Glow’s approach has all the elements the industry needs to bring small businesses into the new era of digital insurance.

It offers the platform small businesses are moving toward. It’s consolidated and convenient, and it helps the small business bottom line.

Glow technology matches companies with carriers that best meet their needs, then offers policies that are a better fit at the exact time they need it, at lower costs, with less paperwork.

“Our goal is to take care of all small business insurance needs, because insurance provides the peace of mind to pursue your dreams,” said Samad Wahedi, CEO and founder of Glow.

If you’re a small bakery, you want to know that your employees and your assets are safe but your focus is baking. At the same time, insurance comes out of your margins. Overpaying can mean a lot of cupcakes. We use data and cutting-edge technology to make sure you’re always protected with the right coverage so you can focus on building your business.

Traditional insurance has moved up-market, leaving small businesses behind. These agents often have a blunt-instrument approach to insurance, quoting policies that may not be the best fit for the company based on very few details about the business and its employees. This “one size fits all” approach can lead to overpaying. Glow uses technology to look more deeply at data like job codes that can more accurately reflect the risk of a business.

This allows Glow to offer a policy that results in a more cost-effective option than local agents typically provide. In addition, traditional agents often “sell-and-forget,” locking customers into renewals and walking away without reexamining whether their business, number of employees, or employee roles have changed.

The Glow platform ensures that a company’s coverage is always up to date, at the lowest possible cost now and a year from now.

Glow partners with a number of well-known insurance providers to offer all the commercial insurance lines a small business needs, starting with workers’ compensation and then offering extended coverage to existing customers with an automated and streamlined insurance experience.

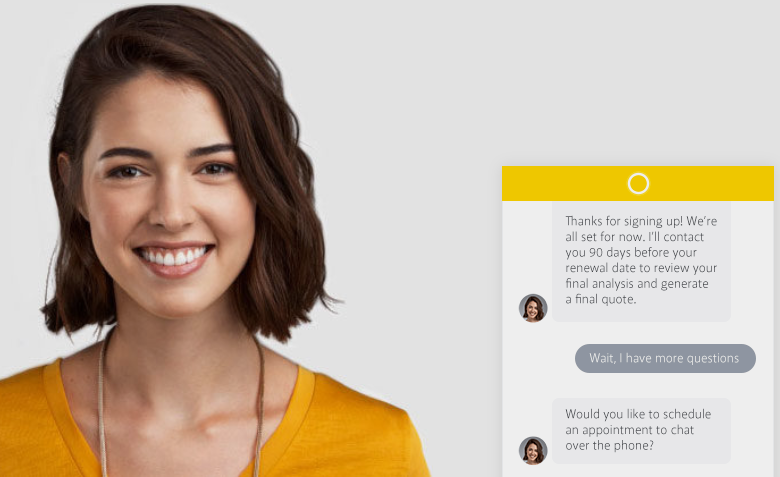

In addition to cost advantages, Glow offers small businesses the convenience of a dedicated account manager who is a licensed insurance advisor that understands the company’s business. This concierge-like service is available by phone or online. Glow’s service process is fast and transparent. Glow also syncs directly with a company’s payroll, so businesses know exactly how much they owe every month.

“Insurance can be scary for a small business owner like me. I’m not an insurance expert,” said Lanay LaFerriere, owner of Whitecaps Pizza in Lake Tahoe.

With Glow I have an expert I can call anytime that I trust to break things down, and they always get me the best rate even if we have to switch carriers. Glow is a no-brainer for us.

Amir Kabir, partner at AV8 Ventures, added, “Glow is building the next-generation digital insurance agency for SMBs in a large, growing market that is both fragmented and profitable. Their sophisticated approach to customer acquisition, data aggregation, underwriting, and servicing is transforming traditional offerings while creating unique value and customer centricity for SMBs.”

Glow began by offering workers comp to small businesses in California. Today, thousands of small businesses use Glow to get the best fit insurance coverage. Small and medium sized businesses can sign up with Glow today.

by Peter Sonner