AI rental insurtech Honeycomb Insurance sequred $36 mn in Series B led by Zeev Ventures. Honeycomb plans to use its new funding to double its workforce from 90 to 180 employees within 18 months, introduce new products, and expand into new markets.

When Honeycomb prepared to raise its Series B earlier this year, Ben-Zaken contacted solo venture capitalist Oren Zeev, a major shareholder in Navan, Houzz, Next Insurance, and Tipalti.

According to Crunchbase, venture capitalist Oren Zeev wrote a $30 mn check to insurtech Honeycomb, making him the company’s largest shareholder. Other participants in the $36 mn Series B include new investors Arkin Holdings and Launchbay Capital and returning backers Ibex Investors, Phoenix Insurance, and IT-Farm.

Insurtech raised a $15 mn Series A in early 2022 and is currently on track to sell $130 mn of insurance premiums in 2024, a threefold increase from last year.

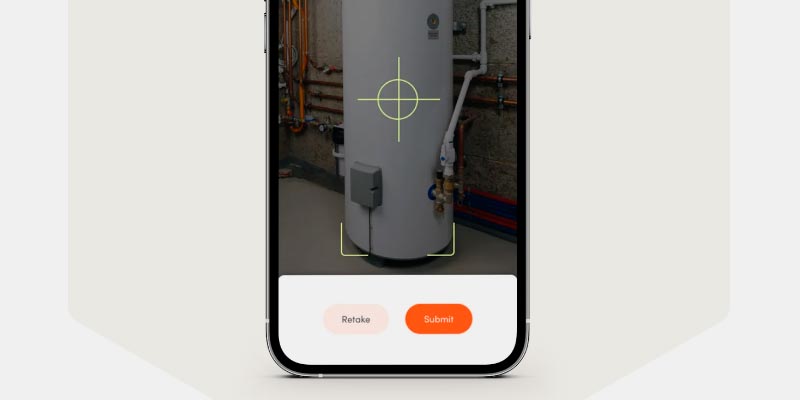

Honeycomb’s AI relies on aerial photographs of building roofs, often eliminating the need for costly physical inspections.

Ben-Zaken, CEO and founder at Honeycomb

Ben-Zaken launched Honeycomb Insurance in 2019, and after spending two years building the company’s computer vision and AI-driven property technology, the company sold its first policy in 2021.

After his first startup failed in 2018, Itai Ben-Zaken, a former BCG consultant and Wharton MBA, spent months reflecting on his five-year experience running the company.

He realized that while Comprendi, a digital ad recommendation business, had potential, it struggled to compete in a market dominated by Google and Facebook.

Before starting Comprendi, Ben-Zaken spent four years managing Insurance:com at QuinStreet, a financial services marketplace operator.

Determined to avoid past mistakes, Ben-Zaken targeted a market with varied competitors for his next venture. He chose to create a company providing property and casualty rental insurance for landlords and condo associations.

Investors were drawn to Honeycomb not only for its rapid growth but also because landlord insurance, though ripe for innovation, remains too small for major insurance companies to dominate.

Ben-Zaken notes that the landlord and condo association insurance market is still highly fragmented.

According to Crunchbase, two startups in this space are Steadily, which raised $28.5 mn in Series B funding last July, and Obie, which secured $25.5 mn in Series B funding from Battery Ventures a year ago.