The insurance sector is not materially exposed to the business interruption losses that could arise due to a cut-off in Russian gas supplies to Europe, according to a statement by Fitch.

Business interruption (BI) insurance policies typically only cover losses resulting from physical damage to business premises or production facilities. They do not cover losses caused by a supplier’s failure to deliver raw materials or the energy needed for a business to operate.

Businesses suffering losses due to a Russian gas cut-off may be able to claim under political risk insurance policies.

Fitch says it does not expect such claims to be straightforward as the policy wording is likely to be restrictive and it could be difficult for claimants to successfully contest claims rejected on the grounds of wording.

Gas shortages across Europe won’t be a significant source of BI claims.

European businesses could also be disrupted by government-led rationing of gas in anticipation of lower supplies from Russia, but losses resulting from this would not be covered by insurance.

If households are unable to maintain their heating through the winter, there could be an increase in claims due to burst water pipes. Factory shutdowns could lead to more claims due to industrial machinery breakdowns. Fitch says it would not expect claims indirectly linked to a gas cut-off to have a material impact on insurers’ profits.

Fitch believes that the insurance sector, like the wider economy, could be affected by the negative macroeconomic impact of a gas cut-off. Slower economic growth or a fall in GDP and even higher inflation would put pressure on households’ disposable income, leading to lower demand for insurance products.

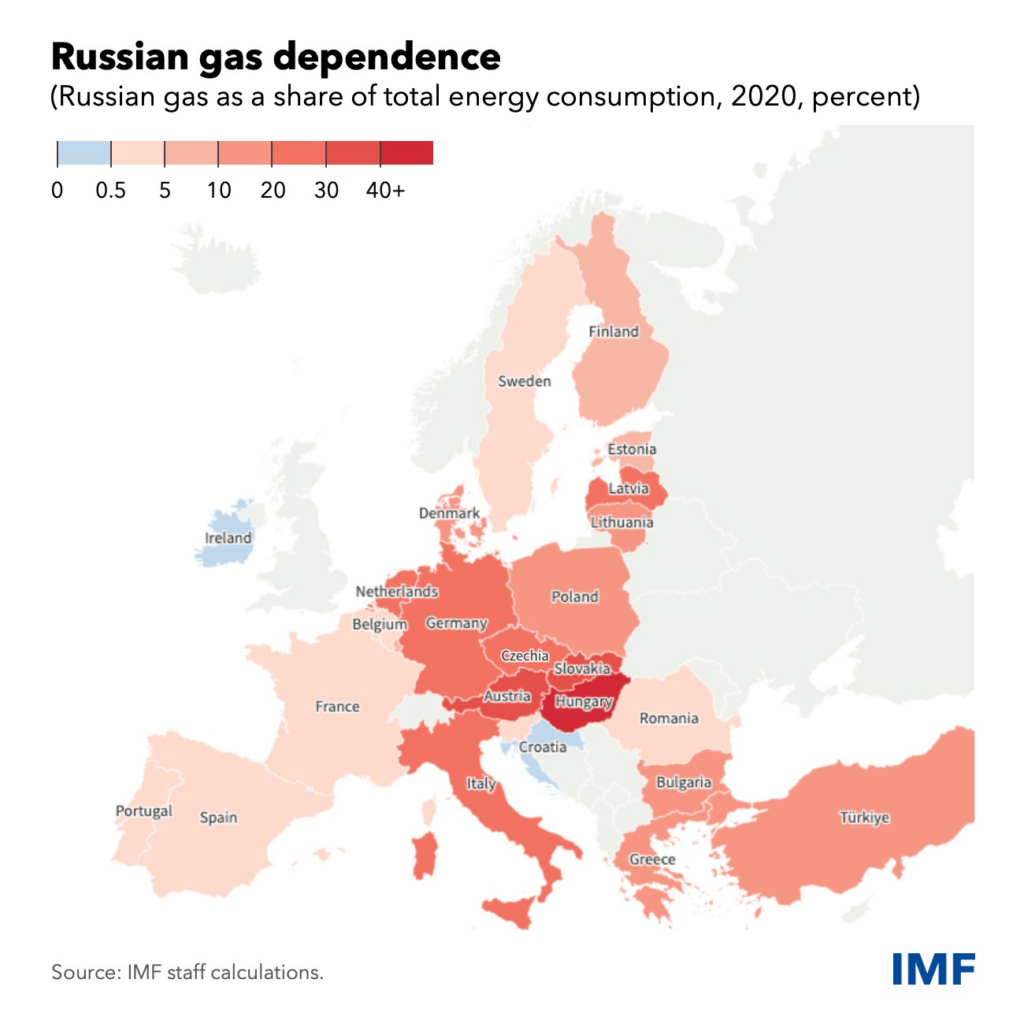

Russia’s invasion of Ukraine has further darkened the global growth outlook, with the European economy facing a serious setback given trade, investment, and financial links with the warring countries. Now, Europe is enduring a partial cutoff of natural gas exports from Russia, its largest energy supplier.

The prospect of an unprecedented total shutoff is fueling concern about gas shortages, still higher prices, and economic impacts. While policymakers are moving swiftly, they lack a blueprint to manage and minimize impact.

The partial shutoff of gas deliveries is already affecting European growth

Three new IMF working papers examine these important issues. They examine how fragmented markets and delayed price pass-through can aggravate impacts, the role of the global liquefied natural gas market in moderating outcomes, and how such factors could play out in Germany, Europe’s largest economy.

In some of the most-affected countries in Central and Eastern Europe—Hungary, the Slovak Republic and the Czech Republic—there is a risk of shortages of as much as 40% of gas consumption and of gross domestic product shrinking by up to 6 percent. The impacts, however, could be mitigated by securing alternative supplies and energy sources, easing infrastructure bottlenecks, encouraging energy savings while protecting vulnerable households, and expanding solidarity agreements to share gas across countries.

European infrastructure and global supply have coped, so far, with a 60% drop in Russian gas deliveries since June 2021. Total gas consumption in the first quarter was down 9% from a year earlier, and alternative supplies are being tapped, especially LNG from global markets.

Our work suggests that a reduction of up to 70 percent in Russian gas could be managed in the short term by accessing alternative supplies and energy sources and given reduced demand from previously high prices.

This explains why some countries have been able to unilaterally halt Russian imports. However, diversification would be much harder in a total shutoff. Bottlenecks could reduce the ability to re-route gas within Europe because of insufficient import capacity or transmission constraints. These factors could lead to shortages of 15 percent to 40 percent of annual consumption in some countries in Central and Eastern Europe.

Economic impact

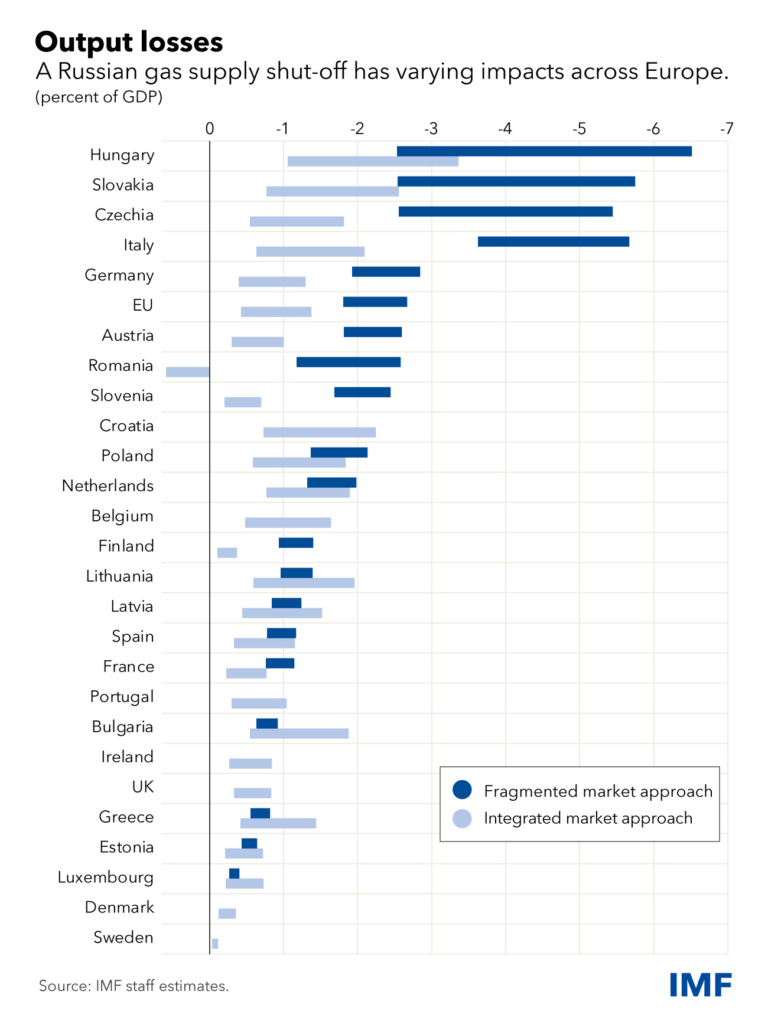

We gauge impacts two ways. One is an integrated-market approach that assumes gas can get where it is needed, and prices adjust. Another is a fragmented-market approach that is best used when the gas cannot go where needed no matter how much prices rise. However, estimation is complicated by the fact that the hit to the European economy is already happening.

Using the integrated-market approach—as the market remains so—to estimate the direct impact to date suggests that it may have amounted to a 0.2 percent reduction for European Union economic activity in the first half of 2022.

When we consider a full Russian gas shutoff from mid-July, we focus on the impact relative to a baseline of no supply disruption this year. This simplifies the estimation and makes it comparable with other economic research.

We derive a broad range of estimates of impact over the next 12 months. Reflecting the unprecedented nature of a full Russian gas shut-off, the right modeling assumptions are highly uncertain and vary between countries.

If EU markets remain integrated both internally and with the rest of the world, our integrated-market approach suggests that the global LNG market would help buffer economic impacts. That is because reduced consumption is distributed across all countries connected to the global market.

At the extreme, assuming no LNG support, the impact is magnified: soaring gas prices would have to work by depressing consumption only in the EU.

If physical constraints impede gas flows, the fragmented market approach suggests that the negative impact on economic output would be especially significant, as much as 6 percent for some countries in Central and Eastern Europe where the intensity of Russian gas use is high and alternative supplies are scarce, notably Hungary, the Slovak Republic and the Czech Republic. Italy would also face significant impacts due to its high reliance on gas in electricity production.

The effects on Austria and Germany would be less severe but still significant, depending on the availability of alternative sources and the ability to lower household gas consumption. Economic impacts would be moderate, possibly under 1 percent, for other countries with sufficient access to international LNG markets.