North American insurtech Foxquilt, specializing in small business and micro-enterprise markets, has announced a successful raise of $12 mn in Series B funding.

The financing spanned two rounds with the initial closing at the end of 2022, led by ICM, and the latter in recent weeks with participation from both existing and new investors.

This substantial investment underscores the confidence in Foxquilt’s innovative approach to insurance and its potential to transform the insurance industry landscape.

Founded in 2016, Foxquilt’s success can be attributed to a combination of proprietary technology and insurance products – combined with large-scale growth through B2B enterprise and Broker/Agent distribution channels.

This investment reinforces the trust our investors have in our embedded insurance technology and its potential to reshape the way insurance is delivered

Mark Morissette, CEO & Co-Founder of Foxquilt

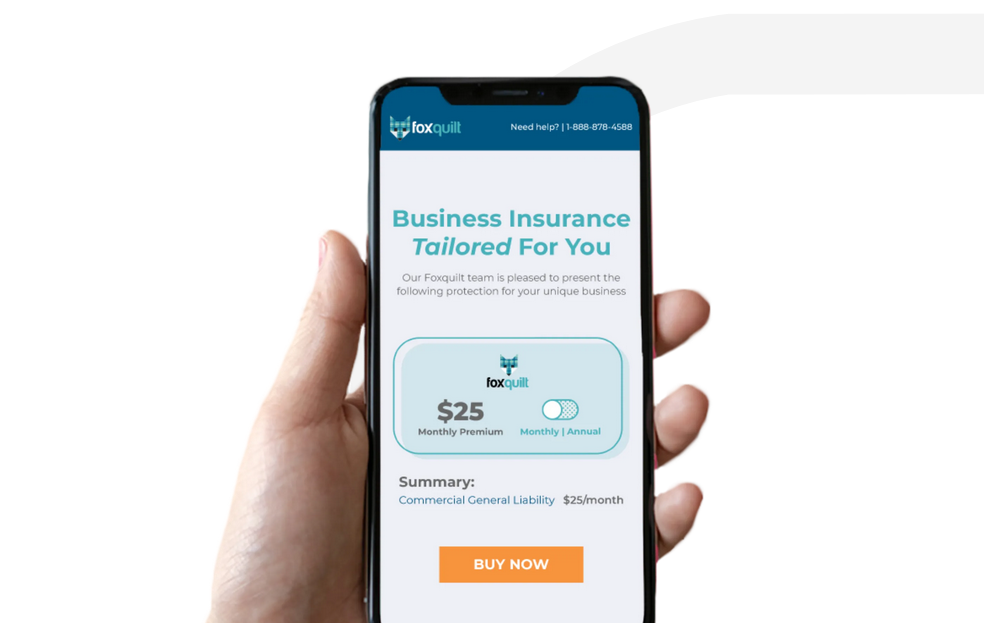

As the only cross-border platform of its kind, the company uses a combination of data analytics and dynamic underwriting logic to deploy fully automated, multi-operational coverage to meet the needs of both affinity partners’ insurance requirements and associated small business customers.

Embedded insurance technology lies at the core of Foxquilt’s disruptive strategy. By seamlessly integrating insurance products into various platforms and services, Foxquilt is enabling businesses and communities to provide tailored coverage solutions to their customers and networks with ease.

This approach empowers consumers to seamlessly gain access to insurance products by eliminating traditional barriers and delivering a superior user experience.

The Series B funding will fuel Foxquilt’s North American expansion plans, enabling the company to scale its embedded enterprise capabilities, further enhance its technology infrastructure, and broaden its product offerings.

The increased resources will also support the development of cutting-edge data analytics capabilities, helping Foxquilt to better understand customer needs and refine its insurance solutions for different markets.

By leveraging the power of advanced technology, data analytics, and customer-centricity, Foxquilt is driving a paradigm shift in the insurance sector – empowering businesses and communities to better serve their customers’ unique needs.

Foxquilt is well positioned for continued growth throughout 2023, forecasting profitability by end of year.