San Francisco area-based Life360 is evaluating the impact of Silicon Valley Bank being closed on March 10, 2023 by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (“FDIC”) as receiver.

The FDIC has stated that it will pay uninsured depositors an advance dividend, which will be a portion of the amount of uninsured deposits they have at SVB. Uninsured depositors are expected to receive a receivership certificate for the remaining amount of their uninsured funds.

A receivership certificate entitles the holder to the remaining amount of their uninsured funds to be satisfied from (but only to the extent of available) proceeds from the liquidation of SVB’s assets in the form of additional dividends. As the FDIC sells the assets of SVB, future dividend payments may be made to uninsured depositors.

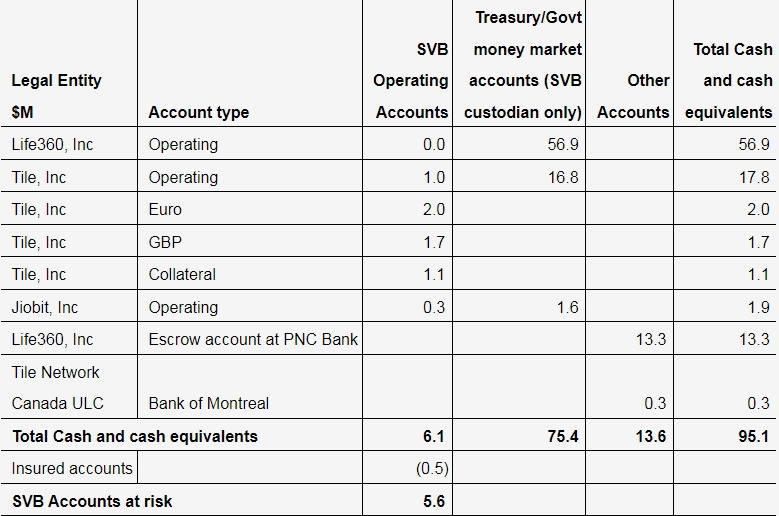

As of March 10, 2023, the Company had cash and cash equivalents of approximately $95.1 million, including $6.1 million in deposits with SVB, and $75.4 million in shares of money market mutual funds managed by Morgan Stanley, Blackrock and Western Asset, which are invested in short-term, AAA-rated U.S.

Government Treasury and Government Agency securities. Although SVB acted as custodian of these accounts, the Company understands that these accounts were not co-mingled with SVB’s assets.

As a result, the Company expects that the FDIC should act to liquidate the funds and disburse these amounts, or otherwise make the funds available, to the Company (subject to FDIC confirmation of customer ownership) in the near term, but timing has not been confirmed by the FDIC.

In addition, $13.3 million, representing most of Life360’s restricted cash, is held by PNC Bank as escrow funds related to the Tile acquisition. An additional $0.3 million is held in an operating account with the Bank of Montreal.

The remaining $6.1 million was held in several operating and collateral accounts with SVB as detailed in the table below and is therefore under the control of the FDIC.

Across the three entities in the group, the Company expects to have access to approximately $0.5 million in the aggregate in FDIC-insured funds.

The FDIC has stated that it expects to pay uninsured depositors an advance dividend. There remains considerable uncertainty as to the extent of these dividends and the overall eventual recovery of these funds, if any, will depend on the success of the FDIC in selling the assets of SVB.

As a result, management believes that its exposure to loss may be between zero and approximately $5.6 million.

Management currently expects there to be material updates as to the timing of release of funds prior to the opening of U.S. public markets tomorrow (Monday U.S. time). The Company will provide the market with an update as soon as any material further information comes to hand.

Life360’s cash components are set out in the table below

The SVB closure occurred at the peak of the Company’s monthly cash cycle and as a result the Company expects its cash position at the end of the first quarter to be in line with previous estimates (assuming normal operating cadence) in the range of $70-75 million, including restricted funds.

Notwithstanding the closure of SVB, the Company continues to believe that its existing cash and cash equivalents balance and cash flow from operations will be sufficient to meet its working capital, capital expenditures, and material cash requirements from known contractual obligations for the next twelve months.

What happened to SVB?

As the preferred bank for the tech sector, SVB’s services were in hot demand throughout the pandemic years.

The initial market shock of Covid-19 in early 2020 quickly gave way to a golden period for startups and established tech companies, as consumers spent big on gadgets and digital services.

Many tech companies used SVB to hold the cash they used for payroll and other business expenses, leading to an influx of deposits. The bank invested a large portion of the deposits, as banks do, according to CNBC.

The seeds of its demise were sown when it invested heavily in long-dated US government bonds, including those backed by mortgages. These were, for all intents and purposes, as safe as houses.

But bonds have an inverse relationship with interest rates; when rates rise, bond prices fall. So when the Federal Reserve started to hike rates rapidly to combat inflation, SVB’s bond portfolio started to lose significant value.

SVB didn’t have enough cash on hand, and so it started selling some of its bonds at steep losses, spooking investors and customers.