Papara, the market-leading Turkish fintech, today announces the launch of pet insurance product to users in Turkey.

Papara’s pet insurance – underwritten by Anadolu Sigorta, one of Turkey’s largest insurance companies – provides cover for pet health, harm to third parties, examination, and treatment.

Papara’s mobile insurance coverage, in partnership with Axa Sigorta, offers two options: the most price-competitive screen coverage package in the market, as well as a full coverage package to protect against theft, liquid contact, use of faulty accessories and screen breakage.

In line with the Papara Cashback programme, users will be able to earn 5% cashback instantly by purchasing Mobile Phone insurance.

Accepted by all veterinarians across Turkey, policies are modular and can be flexed to pets’ needs, with additional services available including annual veterinary examinations, discounts on microchip kits, nail clipping and eye-ear cleaning.

Currently live are mobile and pet insurance products, with more to come in the first half of the year.

Users will be able to access modular, tailor-made products, flexed to their needs, and can make a claim or access customer support. All policies can be paid for with a Papara account or credit card and offer an additional cashback of up to 5%, providing greater affordability.

This is the first expansion of Papara’s product suite outside of its core banking and money management products since launching six years ago. It marks the next step in Papara’s mission to become one of Europe’s leading financial SuperApps, providing users with all the accessible and affordable financial services they need in one place.

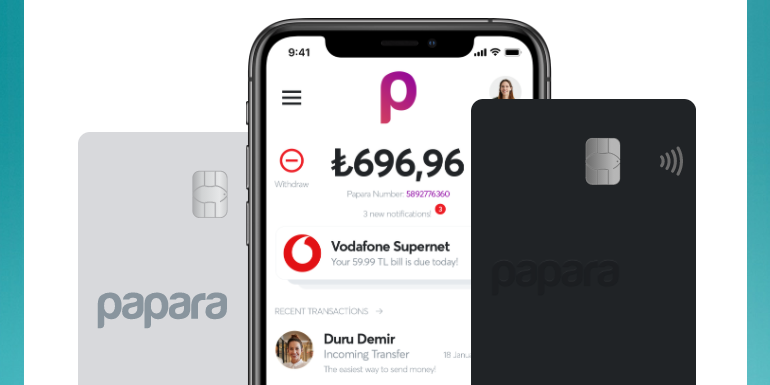

As well as its Papara Card product, which enables zero-fee, cross-border transactions, the fintech offers consumers a one-stop shop for paying bills, transferring foreign currencies to other Papara accounts, and tracking their spending habits. For businesses, Papara also facilitates mass-payment, providing a corporate card that can be tailored to enable varying spending patterns and a secure check-out option for merchants.