Insurtech Wrisk, a provider of embedded insurance solutions for the automotive industry, closed its Series B funding round, raising £12 mn to support European growth and further development of its data-driven insurance platform.

The funding round was co-led by Mundi Ventures and Opera Tech Ventures, the venture arm of BNP Paribas, both of which will join Wrisk’s board of directors.

Existing investors QBN and Volution also participated, reinforcing their ongoing support for Wrisk’s strategy.

Wrisk specializes in embedded insurance for the automotive sector and has developed programs for global brands such as BMW, MINI, Volvo, Mercedes-Benz, Jaguar Land Rover, and Stellantis.

The company reported triple-digit revenue growth in 2024 and issued over 100,000 policies during the past year.

Building on this growth, Wrisk is expanding its presence in Europe to meet increasing demand for branded, digital-first insurance solutions as automakers digitize customer journeys.

With a commercial team established in Munich and regulatory licenses in place, Wrisk is positioned to support new clients in mainland Europe while helping existing U.K. partners scale internationally.

This expansion comes as original equipment manufacturers seek integrated insurance offerings aligned with their brand, improving customer experience and loyalty.

CEO Nimeshh Patel said the funding validates Wrisk’s vision and will accelerate U.K. and European growth, strengthen data and intelligence capabilities, and expand partner programs.

He highlighted Wrisk’s ability to deliver digital automotive insurance solutions that have attracted globally recognized partners and significant investment interest.

Our approach to innovation, with a focus on exceptional user experience, has attracted and retained globally recognisable partners, demonstrating the value in our propositions. It has also attracted significant investment interest, and we now welcome Mundi Ventures and Opera Tech Ventures to our board, firms that align with our strategic ambitions.

Nimeshh Patel, CEO of Wrisk

“This funding represents an endorsement of Wrisk’s vision, as we aim to accelerate UK and European growth, enhance our data and intelligence capabilities, and scale our partner programmes, transforming how insurers and automotive brands connect with their customers,” Nimeshh Patel added.

Wrisk’s long-term vision is to become the embedded insurance partner of choice for the global automotive industry. With a dedicated focus on the sector, the company has developed a deep understanding of the industry’s evolving landscape.

Major structural shifts such as electrification, connected vehicles, changing ownership models and the development of autonomous technologies are reshaping mobility and, with it, the role of insurance.

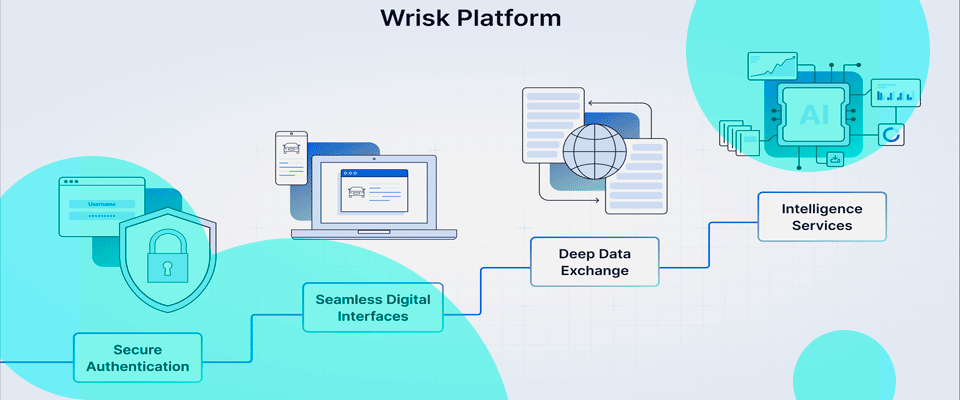

The company’s embedded insurance platform is built on a proprietary data framework designed for automotive use cases.

This framework connects insurance, vehicle, financial, and behavioral data to deliver scalable, personalized, and intelligent insurance experiences integrated into the ownership journey.

- Rafaela Andrade, Partner at Mundi Ventures, said Wrisk demonstrates a clear understanding of the needs of automotive manufacturers, delivering effective insurance solutions at scale.

- Marinus Oosterbeek, Partner at Opera Tech Ventures, noted Wrisk’s robust technology stack and ability to integrate OEM, finance, and insurance data for innovative services.

Wrisk aims to deepen collaboration with current partners, acquire new customers, and lead the next phase of embedded insurance in the automotive sector.

Its focus on connected, brand-aligned offerings seeks to reshape how insurers, automakers, and customers interact throughout the vehicle lifecycle.

- Founded in 2015, Mundi Ventures is a Venture Capital firm headquartered in Madrid with €500 mn in assets under management. Mundi Ventures and its team have supported over 70 tech companies worldwide, with a focus on Insurance, Retail, and Deep Tech.

- Launched in 2018, Opera Tech Ventures (OTV) is a Venture Capital fund operating exclusively for the BNP Paribas Group and entrusted to BNP Paribas Asset Management’s Private Assets teams. Dedicated to the transformation of the financial industry, the fund supports start-ups by investing minority stakes from €3 mn to €15 mn from Series A to Series C, mainly in Europe and North America.