Commercial motor insurer Zego is automating its fraud detection in response to significant recent growth. The company has recently featured in the FT 1000 list of Europe’s fastest-growing companies and the Deloitte UK Technology Fast 50.

The partnership will enable Zego to rapidly screen all policies with Synectics Solutions’ National SIRA – the UK’s largest syndicated database of cross-sector customer risk intelligence – to improve fraud detection rates and significantly reduce the amount of time spent on manual processing and investigations.

Working with Synectics Solutions is part of Zego’s long term strategy to leverage analytics, AI and syndicated data to enhance customer journeys and to support the motor insurance industry’s fight against fraudulent activity.

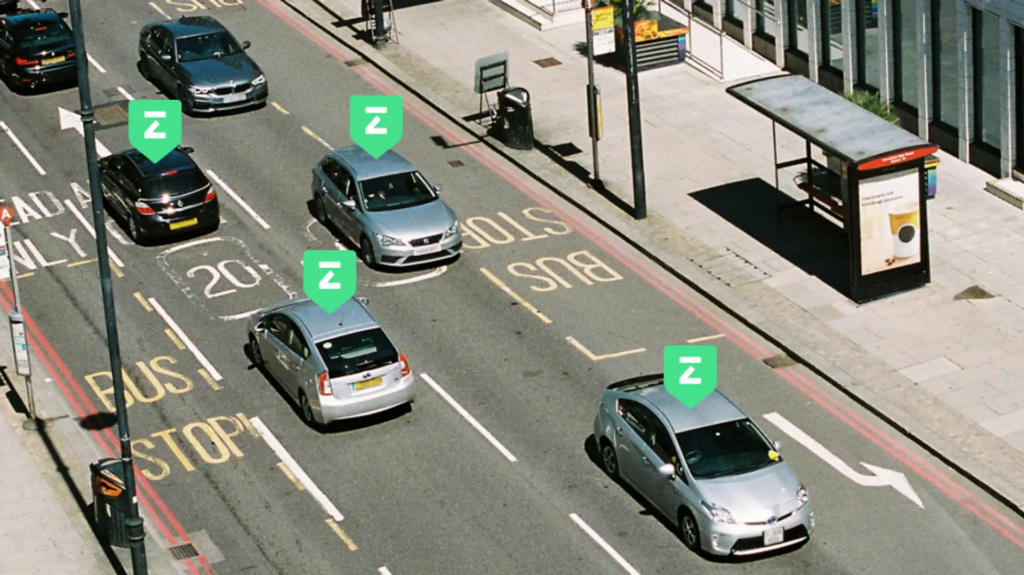

Zego combines advanced technology with multiple data sources to offer products ranging from flexible pay-as-you-go insurance for self-employed drivers & riders to annual policies for fleet managers.

With hourly, 7-day, 30-day and annual policies available, Zego needs a flexible way to identify genuine customers from fraudulent ones.

The partnership with Synectics Solutions will allow Zego to adopt different fraud screening strategies – in the future incorporating point of quote screening – depending on product type, changing fraud trends, and risk appetite. All of which will support informed critical decision making and customer service.

Zego will share their proven fraud data with the 100 plus National SIRA members and gain access to some of the unique datasets such as integrated alerts from National Vehicle Crime Intelligence Service (NaVCIS), enhancing Zego’s commitment to customer support including its Risk Management Academy which supplies behavioural insight to help fleet managers and drivers cut insurance claims.

We have always had a zero-tolerance policy to fraud and as we grow, we want to leverage every tool at our disposal to maintain this stance. Which is exactly why this partnership with Synectics Solutions is so important

“Using National SIRA to automate policy screening isn’t just a way for us to improve and streamline our own processes, it’s also a way for us to collaborate with the insurance industry as a whole – to share insights and help more of our customers minimise their risk. This is something we simply can’t get from other suppliers.”

Our partnership with Zego is a natural fit. This is a great opportunity to work with a likeminded company: one that sees the value in using data, is committed to fighting fraud, and wants to make insurance accessible to niche markets. We’re looking forward to growing our relationship further, while reducing fraud together.

Murray Raw, Head of Business Development at Synectics

Zego is a commercial motor insurance provider that powers opportunities for businesses, from entire fleets of vehicles to self-employed drivers and riders. It combines best-in-class technology with sophisticated data sources to offer insurance products that save businesses time and money.

Founded in the UK in 2016, Zego is now active in 9 countries across Europe. So far, Zego has raised over $280 million in funding and was the first UK insurtech to be valued at over $1 billion. It was also the first to be awarded its own insurance licence and recently featured 14th in the FT 1000 list of Europe’s fastest-growing companies and the Deloitte UK Technology Fast 50.

Synectics Solutions works with data, and lots of it. 1/3 billion records to be precise. That data is used as a force for good by partnering with public and private sector organisations to build data sharing syndicates that provide meaningful insights and help contributors solve common problems. The challenges that Synectics Solutions help to solve are around organised financial crime, money laundering, customer identification and financial inclusion, which can only be addressed through collaboration.

Synectics Solutions is trusted by tier one banks, insurance companies and the likes of the Cabinet Office. Very few organisations can combine data and advanced technology in that way.

by Peter Sonner