Overview

Brazil has become one of the hottest startup hubs in Latin America, producing a wave of unicorns—private companies valued at over $1 bn.

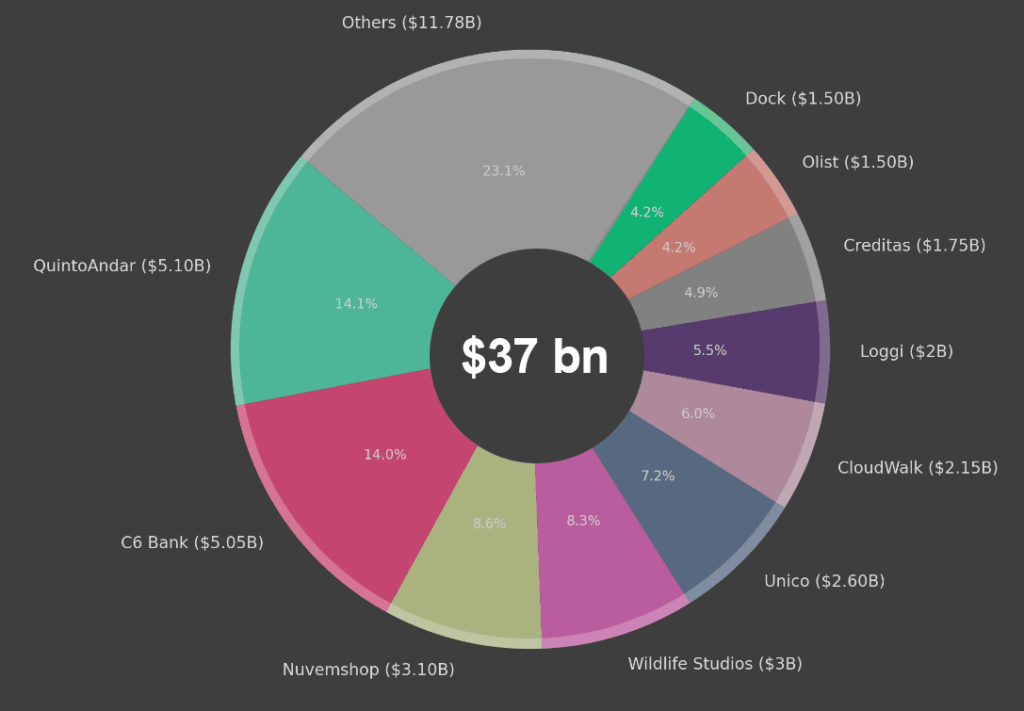

The total combined valuation of Brazil’s unicorn startups is $37 bn, according to Beinsure’s data.

Fueled by a growing middle class, rapid digital adoption, and strong interest from global venture capital, these startups are reshaping industries from fintech and e-commerce to gaming and logistics.

The Unicorn Landscape in Brazil

As of the latest data, Brazil boasts 18 unicorns spanning diverse sectors. Leading the pack are QuintoAndar and C6 Bank, each valued at over $5 bn, signaling investor confidence in both digital real estate platforms and next-generation financial services, Beinsure noted.

Biggest Unicorn Startups in Brazil by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | QuintoAndar | $5.1 bn | Kaszek Ventures, General Atlantic, SoftBank Group |

| 2 | C6 Bank | $5.1 bn | Credit Suisse |

| 3 | Nuvemshop | $3.1 bn | Kaszek Ventures, Qualcomm Ventures, Accel |

| 4 | Wildlife Studios | $3 bn | Benchmark, Bessemer Venture Partners |

| 5 | Unico | $2.6 bn | Big Bets, General Atlantic, SOFTBANK Latin America Ventures |

| 6 | CloudWalk | $2.2 bn | Plug and Play Ventures, Valor Capital Group, DST Global |

| 7 | Loggi | $2 bn | Qualcomm Ventures, SoftBank Group. Monashees+ |

| 8 | Creditas | $1.8 bn | Kaszek Ventures, Amadeus Capital Partners, Quona Capital |

| 9 | Olist | $1.5 bn | Redpoint e.ventures, Valor Capital Group, SoftBank Latin America Fund |

| 10 | Dock | $1.5 bn | Viking Global Investors, Riverwood Capital, Lightrock |

| 11 | Agibank | $1.5 bn | |

| 12 | Loft | $1.5 bn | Monashees+, Andreessen Horowitz, QED Investors |

| 13 | Neon | $1.4 bn | Propel Venture Partners, Monashees+, BBVA |

| 14 | QI Tech | $1 bn | General Atlantic |

| 15 | Movile | $1 bn | Innova Capital – FIP, 3G Capital Management, Prosus Ventures |

| 16 | EBANX | $1 bn | FTV Capital, Endeavor |

| 17 | MadeiraMadeira | $1 bn | Flybridge Capital Partners, SoftBank Group, Monashees+ |

| 18 | CargoX | $1 bn | Valor Capital Group, Lightrock, Softbank Group |

Other notable unicorns include Agibank ($1.49 bn), Loft ($1.46 bn), Neon ($1.38 bn), and QI Tech ($1 bn), according to Beinsure’s report. Consumer-focused startups such as MadeiraMadeira (home goods e-commerce), CargoX (digital freight platform), and Movile (mobile services) also reflect Brazil’s appetite for technology-driven solutions.

Valuation share of Top Brazilian Unicorns

Investor Landscape in Brazil

The Brazilian unicorn wave has been propelled by a mix of local and global investors. Prominent venture capital firms such as Kaszek Ventures and Monashees+ have been instrumental in backing early-stage startups, while international heavyweights like SoftBank, General Atlantic, and Accel provide large-scale funding to accelerate growth.

- Kaszek Ventures has stakes in QuintoAndar, Nuvemshop, and Creditas.

- SoftBank has repeatedly bet on Brazilian startups, investing in QuintoAndar, Loggi, Olist, MadeiraMadeira, and CargoX.

- General Atlantic is backing both fintech (C6 Bank, QI Tech) and proptech (QuintoAndar, Unico).

Why Brazil?

Several factors explain why Brazil has become fertile ground for unicorns:

- Massive Consumer Base – With over 215 mn people, Brazil is Latin America’s largest economy and market.

- Underbanked Population – Fintech startups thrive by addressing gaps in traditional banking and credit.

- E-commerce Growth – Online retail and logistics demand surged during the pandemic and continues strong.

- Global Capital Influx – International investors see Brazil as a gateway to Latin America’s digital economy.

Brazil’s unicorns showcase the country’s transformation into a global innovation hub. As capital flows continue and technology adoption accelerates, new sectors—such as healthtech, edtech, and sustainability-focused startups—are likely to produce the next wave of billion-dollar companies.

With a strong pipeline of entrepreneurs and investors, Brazil is cementing its place not only as Latin America’s startup leader but also as an emerging force on the global stage.

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Singapore

- Unicorn Startups in Israel

- Unicorn Startups in Sweden

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

- Unicorn Startups in UAE

Methodology

The ranking of the top 10 unicorns in Brazil is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in Brazil. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in Brazil.

FAQ

A unicorn startup is a privately held company valued at over $1 bn. The term was coined to highlight the rarity of such companies, though Brazil has seen a surge in their numbers.

Brazil has 18 unicorns across sectors such as fintech, e-commerce, gaming, proptech, and logistics.

The largest unicorns are QuintoAndar (real estate platform) and C6 Bank (digital bank), both valued at around $5.1 billion each.

Key drivers include a large consumer market (215+ million people), an underbanked population that creates demand for fintech, rapid e-commerce growth, and strong venture capital inflows from both local and global investors.

Prominent investors include Kaszek Ventures, Monashees+, SoftBank, General Atlantic, and Accel. These firms have collectively funded multiple billion-dollar startups in the region.

The leading sectors are fintech (C6 Bank, CloudWalk, Creditas, Neon), e-commerce and SaaS (Nuvemshop, Olist, MadeiraMadeira), and logistics/gaming (Loggi, Wildlife Studios).

The next wave of unicorns is expected to emerge from healthtech, edtech, and sustainability-focused startups, as investors and entrepreneurs look beyond fintech and e-commerce for growth opportunities.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding