Overview

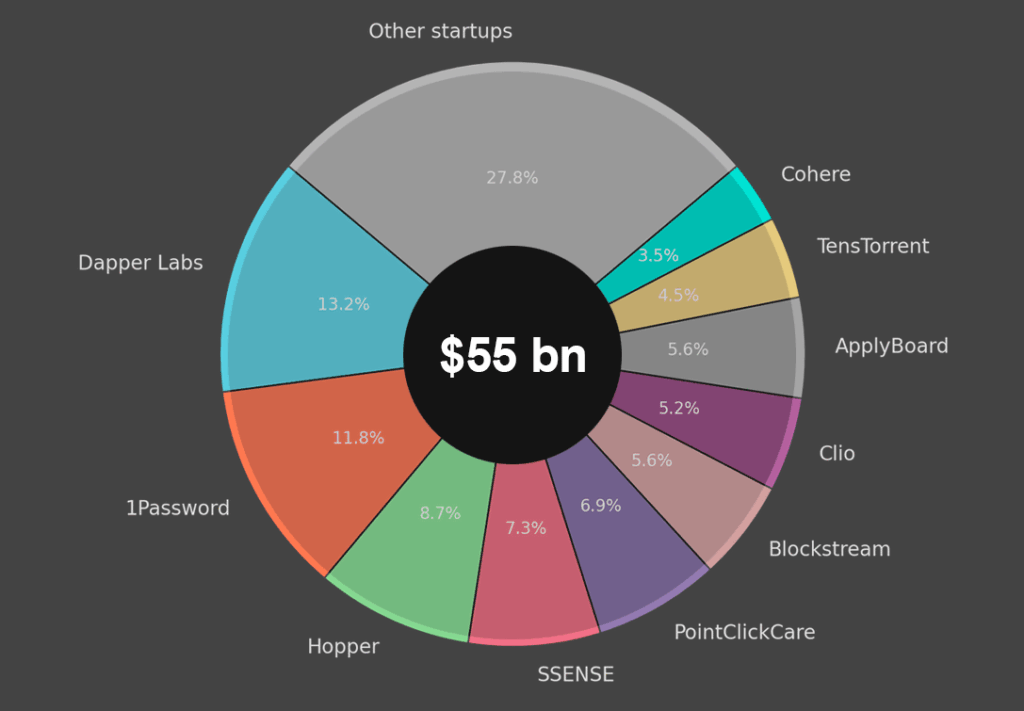

Canada’s startup ecosystem has matured into a global innovation hub, producing more than 20 unicorns valued collectively at over $55 bn, according to Beinsure’s data.

These companies span a range of industries—from artificial intelligence and blockchain to fintech and software-as-a-service—illustrating both the diversity and depth of Canada’s entrepreneurial capacity.

The Canadian unicorn landscape is dominated by a few high-valuation giants. Dapper Labs, the blockchain innovator best known for NBA Top Shot, leads the pack at $7.6 bn. It is closely followed by cybersecurity firm 1Password at $6.8 bn, and travel technology platform Hopper at $5 bn, Beinsure stated.

Together, these three companies account for more than a third of the total unicorn valuation in the country, underscoring how a handful of players still command a disproportionate share of investor confidence and media attention.

While the top companies capture headlines, the broader ecosystem reveals a balanced distribution across sectors.

- Enterprise software remains a stronghold, with firms like 1Password, Clio, FreshBooks, and PointClickCare exporting Canadian-built SaaS products globally.

- Blockchain and Web3 continue to thrive despite market volatility, with startups such as Blockstream, Figment, Axelar, and Dapper Labs together contributing more than $13 bn in value.

- Artificial intelligence and deep tech are also emerging pillars, with companies like Cohere, Tenstorrent, and quantum computing venture Xanadu positioning Canada as a world leader in research commercialization.

- Meanwhile, e-commerce and consumer-facing platforms such as SSENSE and ApplyBoard highlight Canada’s ability to compete in global online marketplaces.

Biggest Unicorn Startups in Canada by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | Dapper Labs | $7.6 bn | Union Square Ventures, Venrock, Andreessen Horowitz |

| 2 | 1Password | $6.8 bn | Slack Fund, Accel, Skip Capital |

| 3 | Hopper | $5 bn | Capital One Growth Ventures, Citi Ventures, OMERS Ventures |

| 4 | SSENSE | $4.2 bn | Sequoia Capital |

| 5 | PointClickCare | $4 bn | Dragoneer Investment Group, Hellman & Friedman, JMI Equity |

| 6 | Blockstream | $3.2 bn | AME Cloud Ventures, Future Perfect Ventures, Blockchain Capital |

| 7 | Clio | $3 bn | OMERS Private Equity, T. Rowe Price, Technology Crossover Ventures |

| 8 | ApplyBoard | $3.2 bn | Artiman Ventures, Plug and Play Ventures, Anthos Capital |

| 9 | TensTorrent | $2.6 bn | Eclipse Ventures, Fidelity Investments, Moore Capital Management |

| 10 | Cohere | $2 bn | Index Ventures, Salesforce Ventures, Section 32 |

| 11 | Cohere | $2 bn | Index Ventures, Salesforce Ventures, Section 32 |

| 12 | Clearco | $2 bn | Highland Capital Partners, Oak HC/FT Partners, Emergence Capital Partners |

| 13 | Trulioo | $1.8 bn | Blumberg Capital, American Express Ventures, BDC Venture Capital |

| 14 | Tailscale | $1.5 bn | Accel |

| 15 | Figment | $1.4 bn | Bonfire Ventures, Two Sigma Ventures, FJ Labs |

| 16 | Ada | $1.2 bn | Version One Ventures, Bessemer Venture Partners, FirstMark Capital |

| 17 | eSentire | $1.1 bn | Edison Partners, Georgian Partners, VentureLink |

| 18 | Xanadu | $1 bn | BDC Capital, Georgian, Bessemer Venture Partners |

| 19 | Visier | $1 bn | Foundation Capital, Summit Partners, Adams Street Partners |

| 20 | Freshbooks | $1 bn | Accomplice, Oak Investment Partners, Georgian Partners |

| 21 | Assent | $1 bn | Vista Equity Partners, Warburg Pincus, First Ascent Ventures |

| 22 | Axelar | $1 bn | Lemniscap VC, North Island Ventures, Polychain Capital |

The Rise of Canadian Unicorns: Investment patterns

Investment patterns reflect a combination of domestic support and international attention. Canadian institutions like OMERS Ventures and Georgian Partners have played a critical role in nurturing early growth, while global venture capital leaders including Andreessen Horowitz, Sequoia Capital, and Accel continue to pour capital into Canadian companies, according to Beinsure.

This dual backing not only validates Canada’s innovation but also provides the capital and networks needed to scale internationally.

Looking ahead, Canada faces the challenge of turning its growing pool of mid-tier unicorns—firms valued between $1 bn and $3 bn—into global category leaders.

If these companies successfully navigate capital markets and scale into higher valuation tiers, Canada could shift from being perceived as a feeder system to Silicon Valley into a self-sustaining innovation powerhouse.

Valuation share of Top Unicorns in Canada

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Singapore

- Unicorn Startups in Israel

- Unicorn Startups in Sweden

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

- Unicorn Startups in UAE

Methodology

The ranking of the top 10 unicorns in Canada is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in Canada. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in Canada.

FAQ

Canada currently has 22 unicorns with a combined valuation exceeding $55 bn.

The largest is Dapper Labs at $7.6 bn, followed by 1Password at $6.8 bn and Hopper at $5 bn.

Enterprise SaaS, fintech, blockchain/Web3, and AI/deep tech make up the bulk of valuations, showing Canada’s strength in both business infrastructure and frontier technologies.

AI and deep tech unicorns such as Cohere, Tenstorrent, and Xanadu signal that Canada is evolving into a global hub for applied AI and quantum computing.

Most are B2B or infrastructure-focused, especially in SaaS, fintech, and blockchain. However, consumer brands like Hopper, SSENSE, and ApplyBoard provide balance.

A mix of domestic institutions such as OMERS Ventures and Georgian Partners and global venture capital leaders including Andreessen Horowitz, Sequoia Capital, and Accel.

The biggest challenge is scaling mid-tier unicorns ($1–3 bn) into global leaders while competing for talent, navigating tighter capital markets, and maintaining growth momentum.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding