Overview

China’s startup ecosystem has matured into one of the most formidable globally, producing a deep pool of unicorns—private companies valued at $1 bn or more.

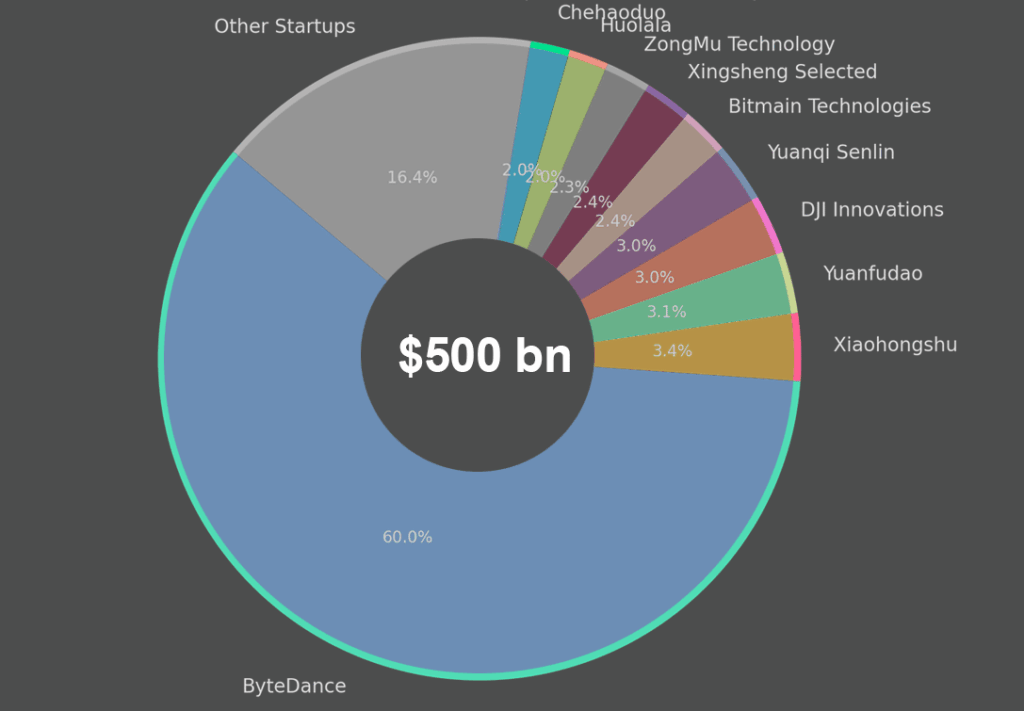

The country hosts over 158 unicorns across diverse industries, together representing more than $500 bn in valuation, according to Beinsure’s data.

While the list is crowned by the extraordinary $300 bn valuation of ByteDance, the distribution of capital across sectors and investors tells a more nuanced story of how Chinese innovation is evolving.

The scale of ByteDance dwarfs the rest of the unicorn field, accounting for nearly 60% of the combined top-10 valuation with its $300 bn market worth.

This outlier effect suggests that China’s unicorn ecosystem is top-heavy, where a handful of giants dominate market capitalization, while the long tail of startups remains much smaller in size, Beinsure noted.

Several themes emerge when analyzing the valuation data:

- Consumer Internet & Social Platforms remain dominant. Xiaohongshu ($17 bn) and Kuaikan Manhua ($1.25 bn) illustrate the strong pull of social commerce and digital content among younger demographics.

- Education Technology continues to show resilience despite regulatory tightening, with Yuanfudao ($15.5 bn), Zuoyebang ($3 bn), and VIPKid ($4.5 bn) still commanding multi-bn valuations.

- Deep Tech & AI are gaining momentum, highlighted by companies like MEGVII ($4 bn), Zhipu AI ($3 bn), Moonshot AI ($3.3 bn), and MiniMax AI ($1.2 bn). Collectively, these AI ventures account for more than $15 bn in value, underscoring Beijing’s national push for AI leadership.

- Electric Vehicles & Mobility represent one of the largest clusters, including Hozon Auto ($3.95 bn), BYTON ($2.5 bn), and Cao Cao Mobility ($1.6 bn). Together with battery firms like SVOLT ($6.51 bn) and Gokin Solar ($2.88 bn), this ecosystem exceeds $20 bn in valuation.

- Healthcare & Biotech unicorns, such as We Doctor ($7 bn), Abogen ($3.7 bn), and Shulan Health ($1.24 bn), signal growing capital interest in health innovation, especially post-pandemic.

Investor Landscape and Ecosystem

Investment in Chinese unicorns is heavily dominated by a small circle of powerful players. Sequoia Capital China appears across the spectrum, backing companies from ByteDance to AI and biotech startups. Tencent Holdings is equally influential, with stakes in Xiaohongshu, Yuanfudao, We Doctor, and more.

Other recurring names include IDG Capital, Warburg Pincus, GL Ventures, and Alibaba Group, collectively shaping much of the country’s innovation pipeline.

According to Beinsure, while the ecosystem boasts a $300 bn giant, the bulk of unicorns fall in the $1–$5 bn range. Nearly 100 of the 158 listed companies remain within this band, suggesting that although China fosters a wide base of high-growth firms, few have scaled to mega-unicorn status.

The middle tier, between $10–20 bn, is sparsely populated, with Xiaohongshu, Yuanfudao, DJI Innovations, and Yuanqi Senlin being notable exceptions.

Biggest 150+ Unicorn Startups in China by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | ByteDance | $300 bn | Sequoia Capital China, SIG Asia Investments, Sina Weibo, SoftBank Group |

| 2 | Xiaohongshu | $17 bn | GGV Capital, ZhenFund, Tencent |

| 3 | Yuanfudao | $15.5 bn | Tencent Holdings, Warbug Pincus, IDG Capital |

| 4 | DJI Innovations | $15 bn | Accel Partners, Sequoia Capital |

| 5 | Yuanqi Senlin | $15 bn | Sequoia Capital China, Longfor Capitalm, Gaorong Capital |

| 6 | Bitmain Technologies | $12 bn | Coatue Management, Sequoia Capital China, IDG Capital |

| 7 | Xingsheng Selected | $12 bn | KKR, Tencent Holdings, Sequoia Capital China |

| 8 | ZongMu Technology | $11.4 bn | LTW Capital, Legend Capital, Qualcomm Ventures |

| 9 | Huolala | $10 bn | MindWorks Ventures, Shunwei Capital Partners, Xiang He Capital |

| 10 | Chehaoduo | $10 bn | Sequoia Capital China, GX Capital |

| 11 | HEYTEA | $9.3 bn | Sequoia Capital China, Tencent Investment, BA Capital |

| 12 | We Doctor | $7 bn | Tencent, Morningside Group |

| 13 | Ziroom | $6.6 bn | Sequoia Capital China, Warburg Pincus, General Catalyst |

| 14 | SVOLT | $6.5 bn | IDG Capital, Bank Of China Group Investment,, SDIC CMC Investment Management |

| 15 | Easyhome | $5.8 bn | Alibaba Group, Boyu Capital, Borui Capital |

| 16 | Lianjia | $5.8 bn | Tencent, Baidu, Huasheng Capital |

| 17 | Chipone | $4.7 bn | China Grand Prosperity Investment, Silk Road Huacheng, Oriza Equity Investment |

| 18 | VIPKid | $4.5 bn | Sequoia Capital China, Tencent Holdings, Sinovation Ventures |

| 19 | Miaoshou Doctor | $4.3 bn | Sequoia Capital China, Qiming Venture Partners, Tencent Holdings |

| 20 | MEGVII | $4 bn | Ant Financial Services Group, Russia-China Investment Fund, Foxconn Technology Company |

| 21 | Medlinker | $3.9 bn | China Health Industry Investment Fund, China Renaissance, and Sequoia Capital China |

| 22 | Hozon Auto | $3.9 bn | HD Capital, Qihoo 360 Technology, China Fortune Land Development |

| 23 | Abogen | $3.7 bn | GL Ventures, SoftBank Group, Qiming Venture Partners |

| 24 | Youxia Motors | $3.4 bn | China Environmental Protection Industry, China Fortune Ocean |

| 25 | Moonshot AI | $3.3 bn | HongShan, Jinfu Investment, ZhenFund |

| 26 | Dadi Cinema | $3.2 bn | Alibaba Pictures Group |

| 27 | Zhipu AI | $3 bn | Qiming Venture Partners, Legend Capital, Jiangmen Venture Capital |

| 28 | Yixia | $3 bn | Sequoia Capital China, Sina Weibo, Kleiner Perkins Caufield & Byers, Redpoint Ventures |

| 29 | SouChe Holdings | $3 bn | Morningside Ventures, Warburg Pincus, CreditEase Fintech Investment Fund |

| 30 | Zuoyebang | $3 bn | Sequoia Capital China, Xiang He Capital, GGV Capital |

| 31 | KK Group | $3 bn | Matrix Partners China, Bright Venture Capita, Shenzhen Capital Group |

| 32 | TERMINUS Technology | $2.9 bn | China Everbright Limited, IDG Capital, iFLYTEK |

| 33 | Gokin Solar | $2.9 bn | IDG Capital, Puluo Capital, Midea Capital |

| 34 | Meicai | $2.8 bn | Tiger Global Management, Blue Lake Capital, ZhenFund |

| 35 | Baichuan AI | $2.7 bn | Shenzhen Capital Group, Shunwei Capital |

| 36 | BYTON | $2.5 bn | FAW Group, Tencent Holdings, Tus Holdings |

| 37 | Cgtz | $2.4 bn | Shunwei Capital Partners, China Media Group, Guangzhou Huiyin Aofeng Equity Investment Fund |

| 38 | Star Charge | $2.4 bn | Shunwei Capital Partners, China Media Group, Guangzhou Huiyin Aofeng Equity Investment Fund |

| 39 | Biren Technology | $2.3 bn | V FUND, IDG Capital, Green Pine Capital Partners |

| 40 | G7 Networks | $2.2 bn | Eastern Bell Capital 32, SDIC CMC Investment Management, Trustbridge Partners |

| 41 | YITU Technology | $2.1 bn | Sequoia Capital China, Banyan Capital |

| 42 | Tubatu.com | $2 bn | Sequoia Capital China, Matrix Partners China, 58.com |

| 43 | HuiMin | $2 bn | Zheshang Venture Capital, GP Capital, Western Capital Management |

| 44 | Mafengwo | $2 bn | Qiming Venture Partners, Capital Today, General Atlantic |

| 45 | Kujiale | $2 bn | GGV Capital, IDG Capital, Linear Venture |

| 46 | Xingyun Group | $2 bn | Matrix Partners China, Eastern Bell Capital, Hongtai Capital Holdings |

| 47 | Beisen | $2 bn | Matrix Partners China, Sequoia Capital China, Genesis Capital |

| 48 | ROX Motor | $2 bn | Sequoia Capital China, IDG Capital, Qiming Venture Partners |

| 49 | Geek+ | $2 bn | Volcanics Ventures, Vertex Ventures China, Warburg Pincus |

| 50 | SemiDrive | $1.9 bn | Vinno Capital, Shanghai STVC Group, Guozhong Venture Capital Management |

| 51 | eDaili | $1.9 bn | K2VC, Lightspeed China Partners, Sky9 Capital |

| 52 | ENOVATE | $1.8 bn | Automobile Industry Guidance Fund |

| 53 | Astronergy | $1.8 bn | |

| 54 | Apus Group | $1.7 bn | Redpoint Ventures, QiMing Venture Partners, Chengwei Capital |

| 55 | Jusfoun Big Data | $1.6 bn | Boxin Capital, DT Capital Partners, IDG Capital |

| 56 | Zhubajie | $1.6 bn | Cybernaut Growth Fund, IDG Capital |

| 57 | Cao Cao Mobility | $1.6 bn | People Electrical Appliance Group China, Zhongrong International Trust |

| 58 | GalaxySpace | $1.6 bn | Shunwei Capital Partners, 5Y Capital, Legend Capital |

| 59 | Fresh Life Style Supply Chain Management | $1.5 bn | Guiyang Venture Capital, Longfor Capital, CAOGENZHIBEN GROUP |

| 60 | Iluvatar CoreX | $1.5 bn | Centurium Capital, Cedarlake Capital, Unicom Innovation Venture Capital |

| 61 | Wenheyou | $1.5 bn | Sequoia Capital China, Warburg Pincus, IDG Capital |

| 62 | Ximalaya FM | $1.5 bn | China Creation Ventures, Sierra Ventures, Xingwang Investment Management |

| 63 | Carzone | $1.5 bn | Alibaba Group,Co-Stone Venture Capital, Buhuo Venture Capital |

| 64 | TuJia | $1.5 bn | GGV Capital, QiMing Venture Partnersl |

| 65 | Mofang Living | $1.5 bn | Warburg Pincus, Aviation Industry Corporation of China |

| 66 | DT Dream | $1.5 bn | Alibaba Group, China Everbright Investment Management, Yinxinggu Capital |

| 67 | Changingedu | $1.5 bn | Trustbridge Partners, IDG Capital, Sequoia Capital China |

| 68 | XiaoZhu | $1.5 bn | Morningside Ventures, Capital Today, JOY Capital |

| 69 | JOLLY Information Technology | $1.5 bn | Legend Capital, CDH Investments, Sequoia Capital China |

| 70 | Yijiupi | $1.5 bn | Source Code Capital, Meituan Dianping, Tencent Holdings |

| 71 | YQNlink | $1.5 bn | Source Code Capital, Coatue Management, DCM Ventures |

| 72 | Yipin Shengxian | $1.5 bn | Eastern Bell Capital, Capital Today, Longzhu Capital |

| 73 | Bordrin Motors | $1.4 bn | China Grand Prosperity Investment, CSC Group |

| 74 | Shukun Technology | $1.4 bn | Marathon Venture Partners, Huagai Capital, China Creation Ventures |

| 75 | Huasun | $1.4 bn | Hongtai Capital Holdings, Jintou Zhiyuan |

| 76 | Coocaa | $1.4 bn | Baidu, Tencent Holdings |

| 77 | Juma Peisong | $1.4 bn | Ding Xiang Capital, New Hope Fund, Sino-Ocean Capital |

| 78 | Ouyeel | $1.4 bn | Taigang Venture Capital |

| 79 | Valgen Medtech | $1.4 bn | Sequoia Capital China, China Life Investment Holding Company, Qiming Venture Partners |

| 80 | Zhiyuan Robot | $1.4 bn | Tencent Venture Capital, BlueRun Ventures |

| 81 | Fox Ess | $1.4 bn | Sparkedge Capital, Guotai Ruichengde Asset Management |

| 82 | Koudai | $1.4 bn | New Enterprise Associates, Tiger Global Management, Tencent |

| 83 | Yidian Zixun | $1.4 bn | Phoenix New Media, Tianjin Haihe Industry Fund |

| 84 | Hive Box | $1.4 bn | Eastern Bell Capital, SF Holding Co, STO Express |

| 85 | DeepBlue Technology | $1.3 bn | DESUN Capital, Yunfeng Capital, Meridian Capital |

| 86 | Jaguar Microsystems | $1.3 bn | Tencent Holdings, Glory Ventures, Shenzhen Capital Group |

| 87 | Tongdun Technology | $1.3 bn | Advantech Capital, Temasek Holdings Ltd., Tiantu Capital Co. |

| 88 | Unisound | $1.3 bn | Qiming Venture Partners, China Internet Investment Fund, Qualcomm Ventures |

| 89 | Unitree Robotics | $1.3 bn | |

| 90 | Manner | $1.3 bn | Coatue Management, H Capital, Capital Today |

| 91 | TUNGEE | $1.3 bn | UNITY VENTURES, Qiming Venture Partners, GGV Capital |

| 92 | Huisuanzhang | $1.2 bn | IDG Capital, Gaocheng Capital, Chuanrong Capital |

| 93 | WTOIP | $1.2 bn | Dark Horse Technology Group, Hopu Investment Management, Kefa Capital |

| 94 | Greater Bay Technology | $1.2 bn | Tencent Holdings, Utrust Venture Capital, GF Xinde Investment Management Co. |

| 95 | JMGO | $1.2 bn | IDG Capital, Yuanda Venture Investment, Primitive Forest Holdings Group |

| 96 | Kuaikan Manhua | $1.2 bn | Sequoia Capital China, CMC Capital Partners, Tencent Holdings |

| 97 | Enflame | $1.2 bn | Tencent Holdings, Delta Capital, Redpoint Ventures China |

| 98 | Shulan Health | $1.2 bn | Qiming Venture Partners |

| 99 | MiniMax AI | $1.2 bn | HongShan, IDG Capital |

| 100 | Pipa Coding | $1.2 bn | Source Code Capital, XVC Venture Capital, GL Ventures |

| 101 | Aibee | $1.2 bn | Sequoia Capital China, Lenovo Capital and Incubator, Group GSR Ventures |

| 102 | SmartMore | $1.2 bn | IDG Capital, ZhenFund, Sequoia Capital China |

| 103 | Mininglamp Technology | $1.2 bn | Russia-China Investment Fund, Tencent Holdings, Sequoia Capital China |

| 104 | Luoji Siwei | $1.2 bn | Sequoia Capital China, Qiming Venture Partners, Tencent Holdings |

| 105 | Yimidida | $1.2 bn | Source Code Capital, Global Logistic Properties, K2VC |

| 106 | TELD | $1.1 bn | China Reform Fund, Gaopeng Capital, Jinhui Xingye |

| 107 | TalkingData | $1.1 bn | N5 Capital, CR Capital Mgmt, JD Digits |

| 108 | Juanpi | $1.1 bn | Tiantu Capital, SAIF Partners China, Newsion Venture Capital |

| 109 | Qingting FM | $1.1 bn | China Culture Industrial Investment Fund, We Capital, China Minsheng Investment Group |

| 110 | Nxin | $1.1 bn | Beijing Juneng Hesheng Industry Investment Fund, Beijing Shuju Xinrong Fund |

| 111 | UISEE Technology | $1.1 bn | Shenzhen Capital Group, Robert Bosch Venture Capital, SeptWolves Ventures |

| 112 | 56PINGTAI | $1.1 bn | QF Capital, QC Capital, Unicom Innovation Venture Capital |

| 113 | Jiuxian | $1 bn | Sequoia Capital China, Rich Land Capital, Merrysunny Wealth |

| 114 | B&C Chemical | $1 bn | Suzhou International Development Venture Capital Holding, GP Capital |

| 115 | Xreal | $1 bn | Hongtai Capital Holdings, Shunwei Capital, GP Capital |

| 116 | 01.AI | $1 bn | |

| 117 | Percent | $1 bn | IDG Capital |

| 118 | LinkSure Network | $1 bn | N/A |

| 119 | BeiBei | $1 bn | Banyan Capital, New Horizon Capital, IDG Capital Partners |

| 120 | Lamabang | $1 bn | 5Y Capital, Matrix Partners China, K2VC |

| 121 | Jimu | $1 bn | Matrix Partners China, Ventech China, Shunwei Capital Partners |

| 122 | ShareCRM | $1 bn | IDG Capital, Northern Light Venture Capital, DCM Ventures |

| 123 | Mia.com | $1 bn | Sequoia Capital China, ZhenFund, K2 Ventures |

| 124 | 58 Daojia | $1 bn | KKR, Alibaba Group, Ping An Insurance |

| 125 | Womai | $1 bn | SAIF Partners China, Baidu, IDG Capital |

| 126 | HuJiang | $1 bn | China Minsheng Investment, Baidu, Wanxin Media |

| 127 | iCarbonX | $1 bn | Tencent, Vcanbio |

| 128 | Zhuan Zhuan | $1 bn | 58.com, Tencent Holdings |

| 129 | DianRong | $1 bn | Standard Chartered, FinSight Ventures, Affirma Capital |

| 130 | YH Global | $1 bn | Co-Energy Finance, Grandland |

| 131 | Maimai | $1 bn | Morningside Venture Capital, IDG Capital, DCM Ventures |

| 132 | Dxy.cn | $1 bn | Tencent Holdings, DCM Ventures |

| 133 | Huike Group | $1 bn | Fosun RZ Capital, Oceanwide Holdings, Shenzhen Qianhe Capital Management Co. |

| 134 | ChinaC.com | $1 bn | V Star Capital, GF Xinde Investment Management Co., Haitong Leading Capital Management |

| 135 | LinkDoc Technology | $1 bn | China Investment Corporation, New Enterprise Associates |

| 136 | Wacai | $1 bn | Qiming Venture Partners, China Broadband Capital, CDH Investments |

| 137 | FlashEx | $1 bn | Prometheus Capital, Matrix Partners China, JD Capital Management |

| 138 | Banma Network Technologies | $1 bn | Yunfeng Capital, SDIC Innovation Investment Management, Shang Qi Capital |

| 139 | Momenta | $1 bn | Sinovation Ventures, Tencent Holdings, Sequoia Capital China |

| 140 | Hosjoy | $1 bn | U.S.-China Green Fund, Founder H Fund, Richland Equities |

| 141 | Poizon | $1 bn | DST Global, Sequoia Capital China, Gaorong Capital |

| 142 | SITECH DEV | $1 bn | China Prosperity Capital |

| 143 | KnowBox | $1 bn | TAL Education Group, Legend Star, Alibaba Group |

| 144 | Hyperchain | $1 bn | Yinhong Equity Investment Fund, E Fund, Ideal International |

| 145 | Fiture | $1 bn | Bertelsmann Asia Investments, Sequoia Capital China, NIO Capital |

| 146 | XForcePlus | $1 bn | Eastern Bell Capital, Danhua Capital, MSA Capital |

| 147 | Zihaiguo | $1 bn | Xingwang Investment Management, China Capital Investment Group, Matrix Partners China |

| 148 | EcoFlow | $1 bn | Delian Capital, China International Capital Corporation, Sequoia Capital China |

| 149 | Xiaoe Tech | $1 bn | GGV Capital, GL Ventures, IDG Capital |

| 150 | Xiaoice | $1 bn | NetEase Capital, Northern Light Venture Capital, Microsoft |

| 151 | Caidya | $1 bn | Qiming Venture Partners, Vivo Capital, Sequoia Capital China |

| 152 | 1KMXC | $1 bn | Goldman Sachs Asset Management, SDP Investment, Alibaba Group |

| 153 | Keenon Robotics | $1 bn | Yunqi Partners, SoftBank Group, iVision Ventures |

| 154 | HAYDON | $1 bn | Tencent Holdings, GL Ventures |

| 155 | Moka | $1 bn | GGV Capital, GSR Ventures, FreesFund |

| 156 | Tezign | $1 bn | Sequoia Capital China, Linear Venture, Hearst Ventures |

| 157 | Gaussian Robotics | $1 bn | BlueRun Ventures, Grand Flight Investment, Meituan Dianping |

| 158 | Haomo.AI | $1 bn | Qualcomm Ventures, Nine Intelligence Capital, GL Ventures |

Valuation share of Top Unicorns in China

Top 20 FinTech Startups in China

| № | FinTech | Valuation, $ bn | VC raised, $ mn |

| 1 | JD Digits | 19,2 bn | 2 100 mn |

| 2 | Suning Finance | 7,9 bn | 2 200 mn |

| 3 | Ping An Healthcare | 7,5 bn | 1 600 mn |

| 4 | Qudian Group | 6,4 bn | 906 mn |

| 5 | Linklogis | 5,3 bn | 312 mn |

| 6 | Shuidi | 4,7 bn | 604 mn |

| 7 | Ant Consumer Finance Arm | 3,2 bn | 2 100 mn |

| 8 | 360 DigiTech | 2,4 bn | 530 mn |

| 9 | Bank of Ningxia | 2 bn | 47 mn |

| 10 | Edaili | 2 bn | 16 mn |

| 11 | AI Bank | 1,9 bn | 316 mn |

| 12 | MediTrust Health | 1,7 bn | 442 mn |

| 13 | Yaoshibang | 1,6 bn | 496 mn |

| 14 | X Financial | 1,4 bn | 146 mn |

| 15 | LianLian Digitech | 1,4 bn | 701 mn |

| 16 | 51credit | 1,3 bn | 469 mn |

| 17 | Yi’an Enterprise | 1,1 bn | 293 mn |

| 18 | Fenbeitong | 1,1 bn | 292 mn |

| 19 | XTransfer | 1,1 bn | 168 mn |

| 20 | E-Life Financial | 1,1 bn | 969 mn |

Strategic Implications

The distribution of valuations underscores both opportunity and fragility. On one hand, the breadth of unicorns across AI, green energy, mobility, and healthcare suggests diversification aligned with China’s policy priorities, Beinsure noted.

On the other, the overwhelming dominance of a single firm raises questions about sustainability and systemic risk. If ByteDance were removed, the average unicorn valuation would shrink dramatically, revealing a less mature landscape than headline figures imply.

China’s unicorn landscape reflects the country’s ambition to lead in consumer platforms, advanced technologies, and sustainable industries. With over $500 bn in combined startup value, the ecosystem remains a critical pillar of global innovation.

Yet the contrast between ByteDance’s extraordinary scale and the clustering of most firms in the $1–5 bn range highlights a system still in transition—from rapid capital accumulation toward long-term competitive depth.

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Singapore

- Unicorn Startups in Israel

- Unicorn Startups in Sweden

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

- Unicorn Startups in UAE

Methodology

The ranking of the top 10 unicorns in China is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in China. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in China.

FAQ

The combined valuation of China’s unicorns exceeds $500 bn, with ByteDance alone contributing $300 bn.

ByteDance leads by a wide margin at $300 bn, far ahead of Xiaohongshu ($17 bn) and Yuanfudao ($15.5 bn).

The leading sectors are consumer internet, education technology, artificial intelligence, healthcare/biotech, and mobility & EVs.

Sequoia Capital China and Tencent Holdings are the most prominent, followed by IDG Capital, Warburg Pincus, GL Ventures, and Alibaba Group.

Only about 10 startups surpass the $10 bn mark, with most clustered between $1–5 bn in valuation.

Sectors prioritized by Beijing, such as AI, EVs, green energy, and healthcare, receive stronger funding and regulatory support, directly influencing valuations.

China is the second-largest unicorn hub globally, trailing only the U.S. While the U.S. has more unicorns overall, China’s ecosystem is notable for rapid scaling and strong state-aligned sectors.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding