Overview

Finland’s startup ecosystem in 2025 illustrates how a relatively small market can produce globally competitive companies with billion-dollar valuations.

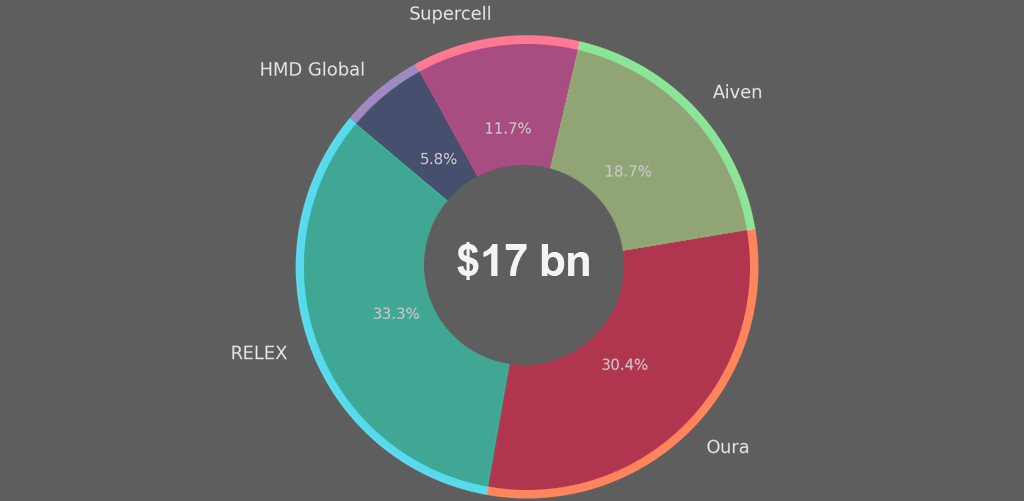

According to Beinsure’s data, the country now counts 5 notable unicorns whose combined valuation surpasses $17 bn, underscoring the role of both local entrepreneurial capacity and international venture capital in driving growth.

In 2025, Finland’s unicorns collectively show how the country balances deep B2B technology (RELEX, Aiven), global consumer platforms (Oura, Supercell), and hardware expertise (HMD Global).

Investment Landscape in Finland

The investment landscape around these unicorns demonstrates how Finnish startups have become magnets for global capital.

Venture firms such as Atomico, Lifeline Ventures, and IVP have established long-term positions, while strategic investors like Google and Qualcomm anchor technology partnerships.

The cumulative presence of U.S. growth equity, European venture firms, and strategic corporate investors points to Finland’s increasing integration into global startup capital flows.

The largest player, RELEX, valued at $5.7 bn, has emerged as a global leader in supply chain optimization, according to Beinsure. Its trajectory highlights Finland’s strength in B2B technology, attracting backing from private equity giant Blackstone alongside venture investors such as Technology Crossover Ventures and Summit Partners.

This blend of growth equity and strategic capital reflects confidence in RELEX’s ability to scale in mature markets like North America and Europe.

Biggest Unicorn Startups in Finland by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | RELEX | $5.7 bn | Blackstone, Technology Crossover Ventures, Summit Partners |

| 2 | Oura | $5.2 bn | Forerunner Ventures, Lifeline Ventures, MSD Capital |

| 3 | Aiven | $3.2 bn | Institutional Venture Partners, Atomico, Earlybird Venture Capital |

| 4 | Supercell | $2 bn | IVP, RocketSpace |

| 5 | HMD Global | $1 bn | Ginko Ventures, Qualcomm, Google |

The combined valuation suggests that while the ecosystem remains small compared to larger European markets, Finnish startups continue to attract disproportionate global attention and capital.

This trajectory positions Finland not just as a Nordic innovation hub, but as a consistent producer of scalable companies with international investor backing.

Valuation share of Top Unicorns in Finland

- Consumer-focused innovation is represented by Oura, the health-tech company behind the Oura Ring, now valued at $5.2 bn, Beinsure stated. With Forerunner Ventures and MSD Capital among its backers, Oura has benefited from growing demand for personalized health tracking. Its valuation demonstrates how Finnish startups are extending beyond software and gaming into global lifestyle and wellness markets.

- Aiven, at $3.2 bn, showcases Finland’s rising influence in developer tools and cloud infrastructure. Supported by Atomico, Earlybird, and IVP, the company has positioned itself at the center of open-source adoption. The scale of its funding indicates that venture investors see Finland not just as a producer of niche solutions, but as a hub capable of building infrastructure-level companies with worldwide relevance.

- Supercell, although valued at a lower $2 bn compared to its 2016 peak, remains a central figure in Finland’s startup narrative. Backed by IVP and RocketSpace, its trajectory illustrates both the cyclical nature of the gaming industry and the durability of Finnish expertise in mobile entertainment.

- HMD Global, the Nokia handset revival venture, retains a $1 bn valuation. Backed by investors such as Google and Qualcomm, its presence in the unicorn list reflects Finland’s unique legacy in telecommunications and hardware, though its growth has been steadier compared to newer SaaS and health-tech leaders.

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Singapore

- Unicorn Startups in Israel

- Unicorn Startups in Sweden

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

- Unicorn Startups in UAE

Methodology

The ranking of the top 5 unicorns in Finland is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in Finland. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 5 highest-valued firms. Valuations were cross-checked against multiple sources, including Beinsure, CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in Finland.

FAQ

The five leading unicorns in Finland collectively hold a valuation of $17.1 bn, reflecting steady growth across B2B, consumer tech, and gaming.

RELEX is the largest unicorn at $5.7 bn, driven by demand for supply chain optimization and significant backing from Blackstone and major venture firms.

Venture capital is critical, as most unicorns rely on international investors such as Atomico, IVP, and MSD Capital. This global participation allows Finnish startups to scale beyond domestic markets.

The main sectors are enterprise software (RELEX, Aiven), health-tech (Oura), gaming (Supercell), and telecommunications hardware (HMD Global).

Supercell remains profitable but its valuation reflects the volatility of the gaming industry, where hit-driven cycles influence long-term investor sentiment.

Corporates like Google and Qualcomm back HMD Global, while health-tech investors support Oura, showing that partnerships are as important as pure capital in scaling Finnish startups.

While smaller than markets like Germany or the UK, Finland consistently produces globally relevant startups. Its $17.1 bn unicorn pool proves that it punches above its weight in innovation and venture-backed growth.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding