Overview

India’s startup and venture capital (VC) ecosystem in 2025 reflects a maturing yet highly dynamic landscape, with a significant number of unicorns commanding multi-billion-dollar valuations.

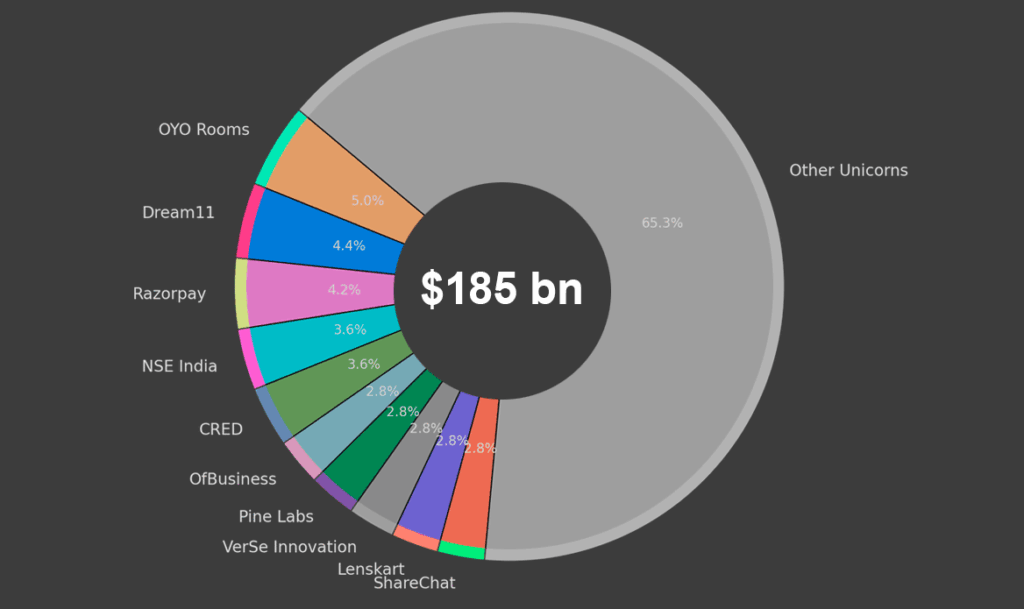

According to Beinsure’s data, the cumulative valuations of these ventures exceed $185 bn in 71 Indian unicorns, with the top 10 startups alone accounting for over $61 bn.

This signals both investor confidence and the scale of market opportunities across sectors such as fintech, edtech, SaaS, e-commerce, mobility, and gaming.

The largest privately held company remains OYO Rooms at $9 bn, maintaining its dominance in the travel and hospitality segment despite volatility in the sector.

Close behind, Dream11 at $8 bn underscores how online gaming has transformed from niche entertainment into a mainstream consumer business with global investor participation.

Razorpay at $7.5 bn highlights the rise of fintech as the core of India’s digital economy, supported by venture backers such as Sequoia Capital India and Tiger Global, two of the most prolific investors in the country.

VC Investors in Indian Startups

What emerges clearly from the data is the extraordinary influence of a handful of venture capital firms.

- Sequoia Capital India has invested in at least 20 unicorns across sectors ranging from fintech (Razorpay, CRED, Groww) to edtech (Unacademy, Eruditus, PhysicsWallah) and consumer platforms (Lenskart, Purplle).

- Tiger Global Management also plays a decisive role, with stakes in CRED, Upstox, Groww, Infra Market, Games24x7, and others, reflecting its strategy of aggressive early bets in high-growth digital businesses.

- SoftBank Group continues to act as a scale-up capital provider, writing some of the largest cheques into companies like OYO, Lenskart, and OfBusiness, although its presence is more concentrated at the upper end of valuations.

Biggest 70+ Unicorn Startups in India by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | OYO Rooms | $9 bn | SoftBank Group, Sequoia Capital India, Lightspeed India Partners |

| 2 | Dream11 | $8 bn | Kaalari Capital, Tencent Holdings, Steadview Capital |

| 3 | Razorpay | $7.5 bn | Sequoia Capital India, Tiger Global Management, Matrix Partners India |

| 4 | National Stock Exchange of India | $6.5 bn | TA Associates, SoftBank Group, GS Growth |

| 5 | CRED | $6.4 bn | Tiger Global Management, DST Global, Sequoia Capital India |

| 6 | OfBusiness | $5 bn | Matrix Partners India, Falcon Edge Capital, SoftBank Group |

| 7 | Pine Labs | $5 bn | Sequoia Capital India, Temasek, PayPal Ventures |

| 8 | VerSe Innovation | $5 bn | Falcon Edge Capital, Omidyar Network, Sequoia Capital India |

| 9 | Lenskart | $5 bn | Chiratae Ventures, PremjiInvest, Softbank |

| 10 | ShareChat | $5 bn | India Quotient, Elevation Capital, Lightspeed Venture Partners |

| 11 | Zepto | $5 bn | Nexus Venture Partners, Contrary, Global Founders Capital |

| 12 | Meesho | $4 bn | Venture Highway, Sequoia Capital India, Prosus Ventures |

| 13 | Unacademy | $3.4 bn | Blume Ventures, Nexus Venture Partners, Sequoia Capital India |

| 14 | Upstox | $3.4 bn | Tiger Global Management, Kalaari Capital |

| 15 | Cars24 | $3.3 bn | Moore Strategic Ventures, DST Global, Sequoia Capital India |

| 16 | Eruditus Executive Education | $3.1 bn | Sequoia Capital India, Softbank, Bertelsmann India Investments |

| 17 | Zetwerk | $3.1 bn | Peak XV Partners, Greenoaks, Kae Capital |

| 18 | Groww | $3 bn | Tiger Global Management, Sequoia Capital India, Ribbit Capital |

| 19 | BharatPe | $2.9 bn | Insight Partners, Sequoia Capital India, BEENEXT |

| 20 | Infra.Market | $2.8 bn | Accel, Tiger Global Management, Nexus Venture Partners |

| 21 | PhysicsWallah | $2.8 bn | GSV Ventures, WestBridge Capital |

| 22 | PolicyBazaar | $2.5 bn | Premji Invest, Burman Family Holdings, Alpha Wave Global |

| 23 | Games24x7 | $2.5 bn | Tiger Global Management, The Raine Group, Malabar Investments |

| 24 | Mobile Premier League | $2.5 bn | Sequoia Capital India, RTP Global, Go-Ventures |

| 25 | UpGrad | $2.3 bn | Qualcomm Ventures, Accel, Canaan Partners |

| 26 | CoinDCX | $2.2 bn | Polychain Capital, Coinbase Ventures, Jump Capital |

| 27 | Urban Company | $2.1 bn | VY Capital, Accel, Elevation Capital |

| 28 | CoinSwitch | $1.9 bn | Tiger Global Management, Sequoia Capital India, Ribbit Capital |

| 29 | Slice | $1.8 bn | Gunosy Capital, Blume Ventures, Das Capital |

| 30 | Spinny | $1.8 bn | General Catalyst, Eleation Capital, Avenir Growth Capital |

| 31 | Udaan | $1.8 bn | DST Global, Lightspeed Venture Partners, Microsoft ScaleUp |

| 32 | DealShare | $1.7 bn | Alpha Wave Global, Matrix Partners India, Tiger Global Management |

| 33 | cult.fit | $1.5 bn | Chiratae Ventures, Accel, Kalaari Capital |

| 34 | ElasticRun | $1.5 bn | Kalaari Capital, Norwest Venture Partners, Prosus Ventures |

| 35 | Yubi | $1.5 bn | Insight Partners, B Capital Group, Lightspeed Venture Partners |

| 36 | BillDesk | $1.5 bn | General Atlantic, Temasek and 28 others |

| 37 | Aragen | $1.4 bn | ChrysCapital, Goldman Sachs, WestBridge Capital, Sequoia Capital |

| 38 | Amagi | $1.4 bn | Mayfield, Accel, Norwest Venture Partners |

| 39 | Xpressbees | $1.4 bn | Norwest Venture Partners, Investcorp, Blackstone |

| 40 | Rebel Foods | $1.4 bn | Sequoia Capital India, Lightbox Ventures, Coatue Management |

| 41 | OneCard | $1.4 bn | Sequoia Capital India, Hummingbird Ventures, Matrix Partners India |

| 42 | boAT | $1.4 bn | Qualcomm Ventures, Fireside Ventures |

| 43 | Purplle | $1.3 bn | Blume Ventures, JSW Ventures, IvyCap Ventures |

| 44 | Shiprocket | $1.2 bn | Bertelsmann India Investments, March Capital Partners, Tribe Capital, Nirvana Venture Advisors |

| 45 | MoneyView | $1.2 bn | Accel, Nexus Ventures, Nippon Life Global Investors America |

| 46 | CarDekho | $1.2 bn | Sequoia Capital India, Hillhouse Capital Management, Sunley House Capital Management |

| 47 | The Good Glamm Group | $1.2 bn | L’Occitane, Trifecta Capital, Bessemer Venture Partners |

| 48 | Pristyn Care | $1.2 bn | Sequoia Capital India, Hummingbird Ventures, Epiq Capital |

| 49 | LivSpace | $1.2 bn | Jungle Ventures, Helion Venture Partners, INGKA Investments |

| 50 | Rapido | $1.1 bn | Nexus Venture Partners, Astarc Ventures, Shell Ventures |

| 51 | Krutrim | $1.1 bn | Matrix Partners India |

| 52 | apna | $1.1 bn | Sequoia Capital India, Rocketship.vc, Lightspeed India Partners |

| 53 | Acko General Insurance | $1.1 bn | Intact Ventures, Munich Re Ventures, General Atlantic |

| 54 | GlobalBees | $1.1 bn | Chiratae Ventures, SoftBank Group, Trifecta Capital |

| 55 | LEAD | $1.1 bn | WestBridge Capital, GSV Ventures, Elevar Equity |

| 56 | InCred | $1.1 bn | Morgan Stanley India Infrastructure, FMO, KKR, Paragon Partners |

| 57 | Porter | $1.1 bn | Kedaara Capital, Vitruvian Partners |

| 58 | JSW One Platforms | $1 bn | Principal Asset Management, OneUp, parent JSW Steel |

| 59 | Perfios | $1 bn | Bessemer Venture Partners, Teachers’ Venture Growth |

| 60 | Snapdeal | $1 bn | SoftBankGroup, Blackrock, Alibaba Group |

| 61 | InMobi | $1 bn | Kleiner Perkins Caufield & Byers, Softbank Corp., Sherpalo Ventures |

| 62 | Vedantu | $1 bn | Accel, Tiger Global Management, Omidyar Network |

| 63 | Licious | $1 bn | 3one4 Capital Partners, Bertelsmann India Investments, Vertex Ventures SE Asia |

| 64 | Mensa Brands | $1 bn | Accel, Falcon Edge Capital, Norwest Venture Partners |

| 65 | NoBroker | $1 bn | General Atlantic, Elevation Capital, BEENEXT |

| 66 | Fractal Analytics | $1 bn | TPG Capital, Apax Partners, TA Associates |

| 67 | Darwinbox | $1 bn | Lightspeed India Partners, Sequoia Capital India, Endiya Partners |

| 68 | Hasura | $1 bn | Nexus Venture Partners, Vertex Ventures, STRIVE |

| 69 | Open | $1 bn | 3one4 Capital Partners, Tiger Global Management, Temasek |

| 70 | LeadSquared | $1 bn | Gaja Capital Partners, Stakeboat Capital, WestBridge Capital |

| 71 | Lentra | $1 bn | Bessemer Venture Partners, MUFG, and Dharana Capital |

Top FinTech Unicorn Startups in India

Fintech and financial services dominate with more than a dozen unicorns, together valued above $40 bn. This includes companies offering payments (Razorpay, Pine Labs), credit (CRED, Slice, OneCard), investment platforms (Groww, Upstox), and insurance (Acko, Policy-linked ventures).

| № | FinTech | Valuation, $ bn | VC raised, $ mn |

| 1 | Razorpay | 7.5 bn | 747 |

| CRED | 6.4 bn | 1 100 | |

| 2 | Groww | 3 bn | 395 |

| 3 | BharatPe | 2.9 bn | 1 200 |

| 4 | PolicyBazaar | 2.5 bn | 640 |

| 5 | CoinDCX | 2,1 bn | 250 |

| 6 | CoinSwitch | 1,9 bn | 302 |

| 7 | Five Star Business Finance | 1,7 bn | 455 |

| 8 | BillDesk | 1,5 bn | 185 |

| 9 | Acko | 1,5 bn | 666 |

| 10 | Slice | 1,3 bn | 388 |

| 11 | OneCard | 1,3 bn | 236 |

| 12 | Lentra | 1 bn | 400 |

| 13 | Perfios | 1 bn | 441 |

| 14 | Open | 1 bn | 188 |

| 15 | LeapFinance | 1 bn | 153 |

Consumer tech platforms such as Meesho, ShareChat, and Zepto, each valued at or above $4 bn, represent the ongoing demand for social commerce and quick commerce, even as these models continue to face operational and profitability challenges.

Edtech, once the brightest star of the pandemic era, has moderated in valuation terms. PhysicsWallah at $2.8 bn and Unacademy at $3.44 bn demonstrate that while scale remains, investor sentiment has shifted toward sustainable growth and profitability rather than rapid customer acquisition.

Similarly, mobility and logistics startups like Rapido, Porter, Xpressbees, and Shiprocket, each around or above $1 bn, highlight the infrastructure backbone being built for India’s digital economy.

Valuation share of Top Unicorns in India

The Valuation Spread also Illustrates the Ecosystem’s Diversity

The top five unicorns account for $37.4 bn, while the long tail of over 40 startups valued between $1 bn and $2 bn adds depth and resilience.

This indicates that India is no longer dependent on a few poster-child startups but has evolved into a broad-based ecosystem capable of producing high-value companies across industries.

From a macro perspective, India’s unicorn landscape in 2025 embodies both maturity and fragmentation.

Maturity is visible in the presence of well-capitalized late-stage firms backed by global investors, while fragmentation is evident in the rising number of niche, sector-specific unicorns targeting specialized consumer and enterprise needs.

With venture capital inflows remaining robust and the capital market slowly opening to tech IPOs, the trajectory of these valuations will depend on execution discipline, regulatory clarity, and the ability to scale sustainably.

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Singapore

- Unicorn Startups in Israel

- Unicorn Startups in Sweden

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

- Unicorn Startups in UAE

Methodology

The ranking of the top 10 unicorns in India is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in India. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in India.

FAQ

India has over 71 unicorns valued collectively at more than $185 bn dollars, spanning fintech, e-commerce, gaming, logistics, edtech, and SaaS.

OYO Rooms leads with a valuation of $9 bn, followed by Dream11 at $8 bn and Razorpay at $7.5 bn.

Fintech dominates with over a dozen unicorns, collectively worth more than 40 bn, covering payments, credit, wealth management, and insurance.

Sequoia Capital India, Tiger Global Management, and SoftBank Group are the most influential, participating across multiple sectors and stages of growth.

Edtech valuations have moderated. While PhysicsWallah ($2.8 bn) and Unacademy ($3.44 bn) remain strong, investor focus has shifted toward profitability and sustainable models.

The top 5 unicorns account for $37.4 bn, while a long tail of more than 40 unicorns ranges between $1 and $2 bn, reflecting both concentration at the top and depth in the ecosystem.

Key drivers include access to late-stage capital, regulatory clarity in fintech and gaming, scaling profitability, global expansion, and eventual IPO readiness.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding