Overview

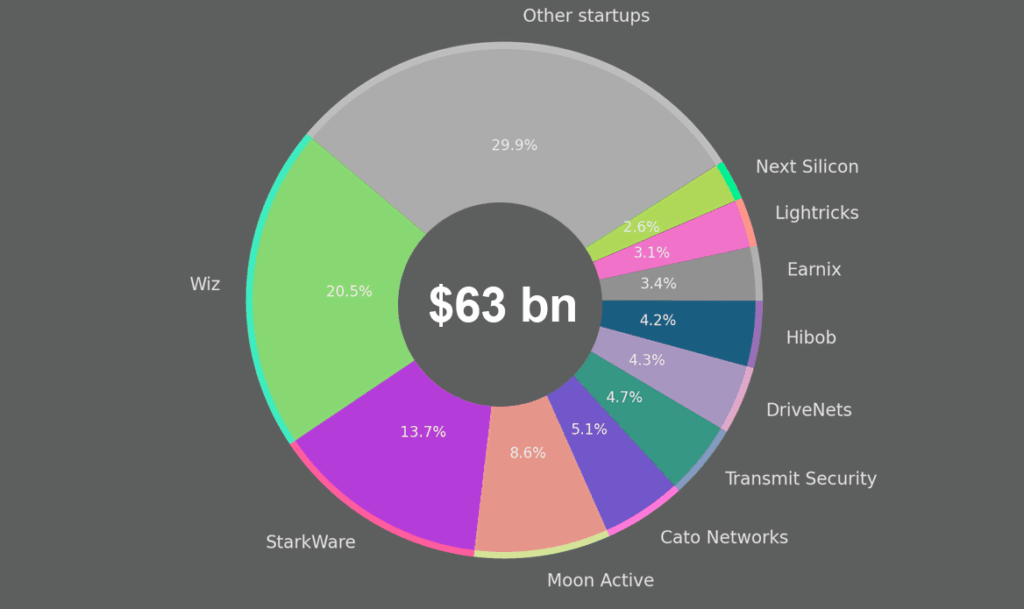

In 2025, Israel’s startup ecosystem remains one of the most dynamic globally, with 25 unicorns valued at over $63 bn dollars combined, according to Beinsure’s data. The distribution of capital and the concentration of investors highlight both the resilience and shifting priorities of the nation’s innovation economy.

At the top of the Israel unicorns is Wiz, valued at $12 bn, a cybersecurity giant backed by a syndicate of Silicon Valley’s most influential venture capital firms, including Andreessen Horowitz, Sequoia Capital, Lightspeed, and Thrive Capital.

Wiz alone accounts for nearly 19% of the total unicorn valuation in Israel, reflecting the continued dominance of cybersecurity as the country’s flagship sector.

- StarkWare, at $8 bn, underscores Israel’s presence in blockchain and cryptography, areas that continue to draw global investor attention despite market volatility.

- Moon Active, the leading gaming startup, holds a $5 bn valuation, demonstrating the strength of consumer-focused companies in a landscape often dominated by enterprise software and infrastructure.

The middle tier of unicorns, valued between $2 bn and $3 bn, includes Cato Networks, Transmit Security, DriveNets, Hibob, and Earnix. Together, these firms represent the diversification of Israeli innovation into network security, identity management, cloud networking, HR tech, and fintech, according to Beinsure.

DriveNets ($2.5 bn) and Hibob ($2.45 bn) are particularly notable for their rapid international expansion, supported by firms like Bessemer Venture Partners and Insight Partners, two of the most active backers of Israeli unicorns.

Below $2 bn, companies like Lightricks ($1.8 bn), Next Silicon ($1.5 bn), and StoreDot ($1.5 bn) showcase strength in creative tools, semiconductors, and next-generation energy storage.

- StoreDot’s backing by Samsung Ventures and BP Ventures signals the strategic role of corporate investors in scaling deep tech solutions.

- AI21 Labs, valued at $1.4 bn, illustrates Israel’s growing contribution to artificial intelligence research and commercialization, where Pitango and Walden Catalyst Ventures play a pivotal role.

At the lower end, but still at the billion-dollar threshold, lie companies like Silverfort, Aqua Security, Bringg, Simply, Pentera, and Vayyar. These startups, although valued at $1 bn, represent the long tail of Israel’s unicorn landscape and are important signals of sectors poised for growth: authentication, cloud security, logistics optimization, AI-driven consumer services, and advanced sensing technologies.

The investor landscape reveals recurring names

Insight Partners is present in at least six unicorns, while Bessemer Venture Partners backs five. Sequoia Capital, Pitango, and Aleph also appear repeatedly, emphasizing the central role of established VC firms in nurturing Israeli companies.

At the same time, strategic corporate investors like Samsung, Intel, BP, and Salesforce Ventures are increasingly embedded in the ecosystem, blending venture financing with market access.

Biggest Top 25 Unicorn Startups in Germany by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | Wiz | $12 bn | Andreessen Horowitz, Lightspeed Venture Partners, Thrive Capital, Greylock Partners, Wellington Management, Cyberstarts, Greenoaks, Index Ventures, Salesforce Ventures, Sequoia Capital and Howard Schultz |

| 2 | StarkWare | $8 bn | Sequoia Capital, Paradigm, Pantera Capital |

| 3 | Moon Active | $5 bn | Insight Partners, Andalusian Capital Partners |

| 4 | Cato Networks | $3 bn | Aspect Ventures, SingTel Innov8, Greylock Partners |

| 5 | Transmit Security | $2.7 bn | General Atlantic, Insight Partners, Vintage Investment Partners |

| 6 | DriveNets | $2.5 bn | Bessemer Venture Partners, Pitango Venture Capital, D1 Capital Partners |

| 7 | Hibob | $2.4 bn | Bessemer Venture Partners, Eight Roads Ventures, Battery Ventures |

| 8 | Earnix | $2 bn | Jerusalem Venture Partners, Israel Growth Partners, Insight Partners |

| 9 | Lightricks | $1.8 bn | Viola Ventures, Insight Partners, ClalTech, Goldman Sachs |

| 10 | Next Silicon | $1.5 bn | Amiti Ventures, Playground Global, Aleph |

| 11 | StoreDot | $1.5 bn | Samsung Ventures, SingulariTeam, BP Ventures |

| 12 | Liquidity | $1.4 bn | MUFG Innovation Partners, Spark Capital |

| 13 | Firebolt | $1.4 bn | TLV Partners, Zeev Ventures, Bessemer Venture Partners |

| 14 | AI21 Labs | $1.4 bn | Walden Catalyst Ventures, Pitango Venture Capital, TPY Capital |

| 15 | Optibus | $1.3 bn | Bessemer Venture Partners, Insight Partners, Pitango Venture Capital |

| 16 | Hailo | $1.2 bn | Glory Ventures, Maniv Mobility |

| 17 | Coralogix | $1.1 bn | NewView Capital, Brighton Park Capital, Aleph |

| 18 | Dream Security | $1.1 bn | Bain Capital Ventures, Aleph |

| 19 | OrCam Technologies | $1 bn | Intel Capital, Aviv Venture Capital |

| 20 | Silverfort | $1 bn | SingTel Innov8, Citi Ventures, Maor Investments |

| 21 | Aqua Security | $1 bn | TLV Partners, Lightspeed Venture Partners, M12 |

| 22 | Bringg | $1 bn | Salesforce Ventures, next47, Pereg Ventures |

| 23 | Simply | $1 bn | Genesis Partners, Aleph, Insight Partners |

| 24 | Pentera | $1 bn | AWZ Ventures, Blackstone, Insight Partners |

| 25 | Vayyar | $1 bn | Battery Ventures, Bessemer Venture Partners, MoreVC |

Valuation share of Top Unicorns in Israel

Israel’s unicorn valuations

Israel’s unicorn valuations reflect a concentration of capital in cybersecurity, enterprise infrastructure, and fintech, but with meaningful diversification into AI, gaming, semiconductors, and energy, Beinsure noted.

2024-2025 was marked globally by a slowdown in venture funding and compressed valuations, Israeli startups appear to have weathered the storm by leaning on sectors where demand is resilient and geopolitically significant.

With $63 bn in total unicorn value and a dense network of global VC participation, Israel continues to punch far above its weight in the global innovation economy.

In 2025, the key question is not whether Israeli startups can maintain their momentum, but how they will navigate exits, public offerings, and consolidation in a funding environment that is becoming more selective.

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Singapore

- Unicorn Startups in Sweden

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

- Unicorn Startups in UAE

Methodology

The ranking of the top 10 unicorns in Israel is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in Israel. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in Israel.

FAQ

Israel has 25 unicorns in 2025 with a combined valuation of about $63 bn.

Wiz, a cybersecurity company, leads with a valuation of $12 bn.

Cybersecurity, enterprise infrastructure, fintech, and artificial intelligence account for most of the high-valued startups, though gaming, semiconductors, and energy storage are growing.

Insight Partners and Bessemer Venture Partners are among the most active, each backing multiple unicorns. Sequoia Capital, Pitango, and Aleph also play key roles.

Corporate investors like Samsung Ventures, Intel Capital, BP Ventures, and Salesforce Ventures provide not only capital but also strategic partnerships and market access.

Israel remains one of the top ecosystems worldwide relative to its population, consistently ranking just behind the United States, China, and the UK in unicorn count and valuation.

Challenges include navigating tighter global venture funding, sustaining high valuations in public markets, and scaling internationally in competitive and regulated industries.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding