Overview

Singapore’s startup and venture capital ecosystem in 2025 reflects both regional dynamism and global investor confidence.

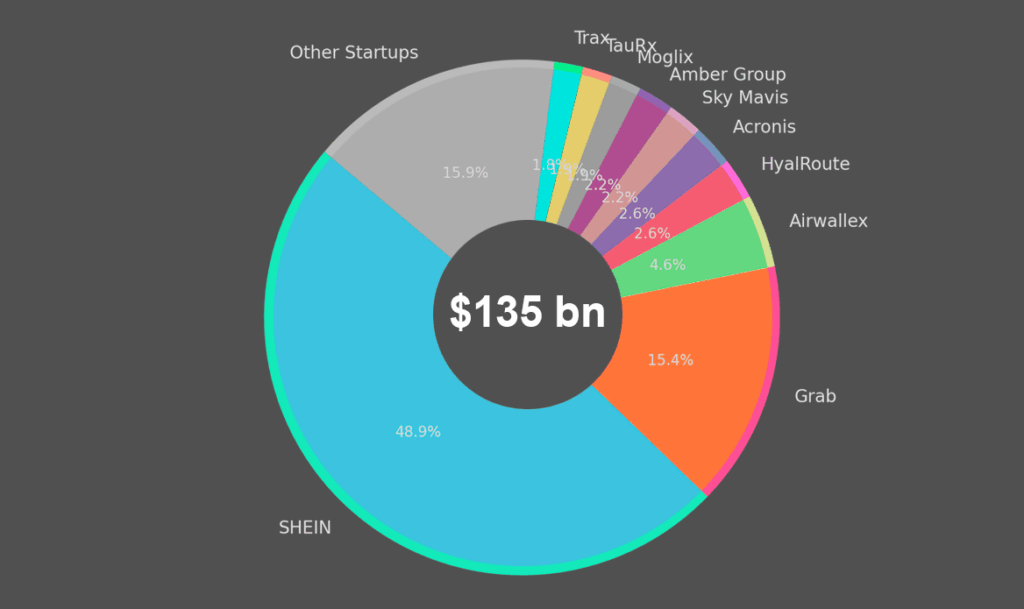

According to Beinsure’s data, with a portfolio of 30 unicorns collectively valued at more than $135 bn, the city-state continues to consolidate its role as Southeast Asia’s innovation hub, attracting capital inflows from global heavyweights such as Sequoia Capital China, Temasek, SoftBank, and BlackRock.

Singapore has more than 43K startups. Of these, 30 have become Unicorns.

- At the top, SHEIN’s $66 bn valuation underscores the scale advantage that consumer-facing platforms can achieve from Singapore’s strategic base, despite its China-centric origins.

- Grab follows at $20.8 bn, positioning itself not only as a ride-hailing and food delivery leader but also as a regional fintech operator, drawing support from Vulcan Capital, GPI Capital, and SoftBank.

- Airwallex at $6.2 bn highlights the rising importance of cross-border payments, while HyalRoute and Acronis, each at $3.5 bn, showcase demand for both infrastructure and cybersecurity in the region.

Singapore’s VC market reveals a pattern

State-linked investors such as Temasek, GIC affiliates, and EDBI are deeply embedded in key unicorns. Temasek alone appears across major rounds in Amber Group ($3 bn), Atome ($2 bn), ONE ($1.3 bn), Lazada ($1.1 bn), and Carro ($1 bn), according Beinsure.

This presence signals Singapore’s dual strategy of fostering domestic champions while anchoring regional players within its ecosystem.

The mid-range of unicorns, valued between $2 bn and $3 bn, illustrates diversity across verticals. Sky Mavis, the blockchain gaming pioneer, maintains a $3 bn valuation despite market volatility.

Moglix ($2.6 bn) and Ninja Van ($1.9 bn) highlight Singapore’s role in supply chain and logistics innovation. Meanwhile, fintech remains a core strength with NIUM ($1.4 bn), Kredivo Holdings ($1.7 bn), and Matrixport ($1.1 bn), all attracting significant institutional capital.

Healthcare and deep tech also hold a notable share

TauRx ($2.5 bn), focused on neurodegenerative disease treatments, and Silicon Box ($1 bn), a semiconductor startup, show that Singapore’s ecosystem is broadening beyond consumer and fintech plays. PatSnap ($1 bn), a knowledge management and IP analytics firm, further cements Singapore’s reputation for R&D-driven ventures.

From a capital flows perspective, investors are increasingly global

US-based Accel and Andreessen Horowitz back Sky Mavis, while Middle Eastern sovereign wealth funds, such as Qatar Investment Authority in ONE, are strengthening their footprint. Chinese capital remains influential, with Sequoia China and Shunwei appearing repeatedly, particularly in SHEIN, PatSnap, and Multichain.

Biggest 30 Unicorn Startups in Singapore by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | SHEIN | $66 bn | Tiger Global Management, Sequoia Capital China, Shunwei Capital Partners |

| 2 | Grab | $20.8 bn | Vulcan Capital, GPI Capital, Softbank China and India Holdings |

| 3 | Airwallex | $6.2 bn | Public Investment Fund, G Squared |

| 4 | HyalRoute | $3.5 bn | Asia Investment Capital, Kuang-Chi |

| 5 | Acronis | $3.5 bn | Kaplan Group Investments, CPP Investments |

| 6 | Sky Mavis | $3 bn | Accel, Andreessen Horowitz |

| 7 | Amber Group | $3 bn | Temasek, Paradigm Capital |

| 8 | Moglix | $2.6 bn | Jungle Ventures, Accel, Venture Highway |

| 9 | TauRx | $2.5 bn | Evia Capital Partners, Dundee Corporation |

| 10 | Trax | $2.4 bn | Hopu Investment Management, Boyu Capital, DC Thomson Ventures |

| 11 | bolttech | $2.1 bn | Mundi Ventures, Doqling Capital Partners, Activant Capital |

| 12 | Advance Intelligence Group | $2 bn | Vision Plus Capital, GSR Ventures, ZhenFund |

| 13 | Atome | $2 bn | BlackRock, Temasek |

| 14 | Advance | $2 bn | Warburg Pincus, Farallon Capital Management |

| 15 | Ninja Van | $1.9 bn | YJ Capital, Alibaba Group |

| 16 | Kredivo Holdings | $1.7 bn | Jungle Ventures, Square Peg Capital, OpenSpace Ventures |

| 17 | NIUM | $1.4 bn | Vertex Ventures SE Asia, Global Founders Capital, Visa Ventures |

| 18 | ONE | $1.3 bn | Temasek, Guggenheim Investments, Qatar Investment Authority |

| 19 | Multichain | $1.2 bn | IDG Capital, Sequoia Capital China |

| 20 | Carousell | $1.1 bn | 500 Global, Rakuten Ventures, Golden Gate Ventures |

| 21 | Matrixport | $1.1 bn | Dragonfly Captial, Qiming Venture Partners, DST Global |

| 22 | Lazada | $1.1 bn | Access Industries, Summit Partners, Temasek |

| 23 | PatSnap | $1 bn | Sequoia Capital China, Shunwei Capital Partners, Qualgro, Summit Partners, Tencent |

| 24 | Carro | $1 bn | SingTel Innov8, Alpha JWC Ventures, Golden Gate Ventures, EDBI, Temasek |

| 25 | Ninja Van | $1 bn | B Capital Group, Monk’s Hill Ventures, Dynamic Parcel Distribution |

| 26 | JustCo | $1 bn | Pinetree Capital, Sansiri |

| 27 | Polyhedra Network | $1 bn | UOB, Polychain |

| 28 | Silicon Box | $1 bn | UMC Capital, Hillhouse |

| 29 | MEGAROBO | $1 bn | GGV Capital, WuXi AppTec |

| 30 | Sygnum | $1 bn | SBI Group, Singtel Innov8, Fulgur Ventures |

Valuation share of Top Unicorns in Singapore

Singapore’s 2025 startup landscape demonstrates maturity

Unicorn creation is no longer a rare event but a structural feature of its economy, Beinsure notes.

The challenge now lies less in attracting capital than in sustaining valuations amid tighter global liquidity and increasing scrutiny of business models.

The $135 bn-plus in unicorn value shows that Singapore has become the region’s capital magnet, balancing state-backed resilience with global VC dynamism.

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Israel

- Unicorn Startups in Sweden

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

- Unicorn Startups in UAE

Methodology

The ranking of the top 10 unicorns in Singapore is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in Singapore. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in Singapore.

FAQ

Singapore-based and Singapore-linked 30 unicorns are valued at more than $135 bn collectively.

SHEIN leads with a $66 bn valuation, followed by Grab at $20.8 bn.

Fintech, logistics, e-commerce, gaming, healthtech, and deep tech (semiconductors, IP analytics) are the most represented sectors.

Temasek is one of the most active investors, with stakes in Amber Group, Atome, ONE, Lazada, and Carro, among others.

Yes, global venture capital firms such as Sequoia Capital China, Andreessen Horowitz, BlackRock, and sovereign wealth funds like Qatar Investment Authority play major roles.

Singapore remains the capital hub, hosting the largest concentration of unicorns and drawing the most global VC attention compared to neighbors such as Indonesia or Vietnam.

Key challenges include maintaining high valuations in a tighter global funding environment, navigating regulatory shifts, and scaling sustainable business models.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding