Overview

South Korea’s startup and venture capital ecosystem in 2025 shows a sharp maturation, with nearly 30 unicorns spanning fintech, mobility, e-commerce, gaming, and digital services. South Korea has more than 27K startups. Of these, 30 have become Unicorns.

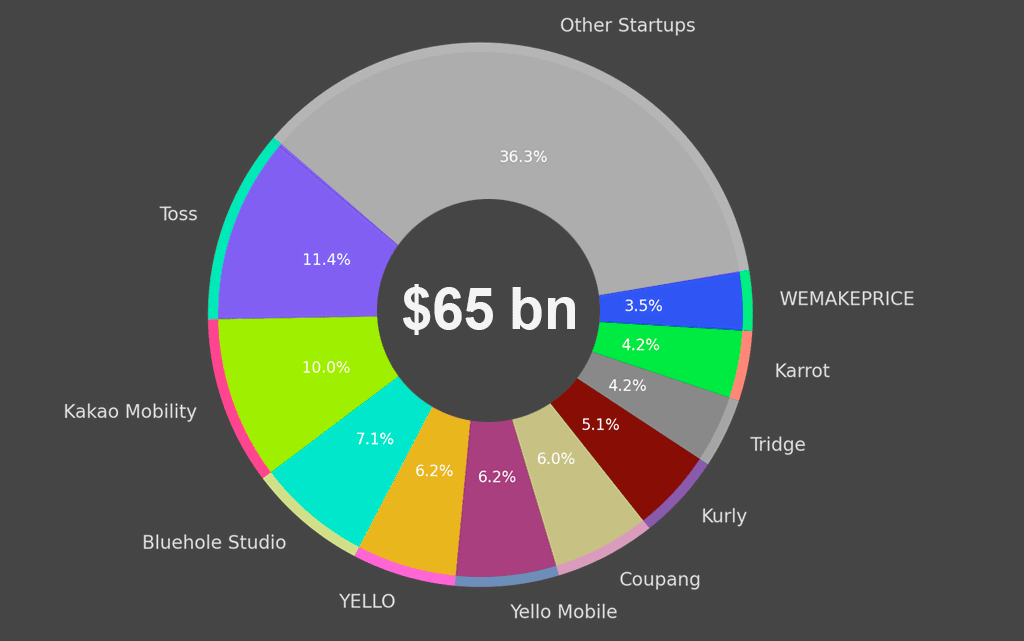

According to Beinsure’s data, the unicorn valuations collectively exceed $65 bn, underscoring the country’s position as one of Asia’s most dynamic innovation hubs after China and India.

South Korea’s unicorns are no longer dominated by one or two categories. Fintech, mobility, gaming, e-commerce, and digital infrastructure all share the stage, attracting capital from Sequoia, SoftBank, Tencent, GIC, and Carlyle alongside strong domestic players.

Valuation share of Top Unicorns in South Korea

The $65 bn-plus collective valuation indicates not only Korea’s strength in exporting culture and consumer products, but also its ability to engineer scalable digital ecosystems capable of global competition, Beinsure noted.

The leader of the pack remains Toss, valued at $7.4 bn. As a fintech pioneer, Toss has attracted global heavyweights like Bessemer Venture Partners, Qualcomm Ventures, Kleiner Perkins, and Singapore’s GIC.

This reflects the broader trend of financial innovation in Korea, where the intersection of mobile payments, digital banking, and consumer finance is pulling in foreign capital. The spin-off Toss Bank, with its own $1 bn valuation, adds another layer to the sector’s influence.

Mobility is the second engine of growth

Kakao Mobility stands at $6.5 bn with backing from TPG and The Carlyle Group, proving that Korea’s dense urban structure continues to reward scale in transportation platforms, according to Beinsure’s report.

The sector’s appeal echoes in the broader Kakao ecosystem, with Kakao Enterprise also hitting unicorn status.

Gaming and digital entertainment retain their centrality

Bluehole Studio, at $4.6 bn, remains the flagbearer, its rise reinforced by Tencent and domestic investors like NHN.

Entertainment and social platforms are seeing global investor traction as well—ZEPETO, backed by SoftBank Vision Fund, has anchored itself in the $1 bn club with its metaverse-focused play.

E-commerce and retail technology form another strong layer

Coupang, though valued at $3.9 bn in this dataset (below its global market cap due to U.S. listing distortions), remains an anchor of Korea’s consumer internet narrative.

Kurly ($3.3 bn) and Musinsa ($2.4 bn) reflect the specialization of e-commerce niches, from grocery delivery to fashion, while Bucketplace and ABLY expand into lifestyle and content commerce.

The presence of Sequoia Capital in multiple bets—Coupang, Musinsa, Kurly—shows the persistence of U.S. investors in Korea’s consumer internet.

Biggest 30 Unicorn Startups in South Korea by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | Toss | $7.4 bn | Bessemer Venture Partners, Qualcomm Ventures, Kleiner Perkins Caufield & Byers, GIC |

| 2 | Kakao Mobility | $6.5 bn | TPG, The Carlyle Group |

| 3 | Bluehole Studio | $4.6 bn | NHN Investment, Partners Investment, Tencent |

| 4 | YELLO | $4 bn | Macquarie Group, SBI Investment |

| 5 | Yello Mobile | $4 bn | Formation 8 |

| 6 | Coupang | $3.9 bn | HTIF, Odenn Ventures, Sequoia Capital |

| 7 | Kurly | $3.3 bn | Sequoia Capital China, DST Global, DST Global, G Squared, Mirae Asset Venture |

| 8 | Tridge | $2.7 bn | Forest Partners, Softbank Ventures Asia |

| 9 | Karrot | $2.7 bn | DST Global Partners, SBVA |

| 10 | WEMAKEPRICE | $2.3 bn | IMM Investment, NXC |

| 11 | Musinsa | $2.4 bn | Sequoia Capital |

| 12 | ABLY | $2.1 bn | LB Investment, KOLON INVESTMENT, Capstone Partners |

| 13 | Wemakeprice | $2 bn | IMM Investment, Kim Jung-ju |

| 14 | ZigBang | $1.9 bn | Black Pearl Ventures, Stonebridge Ventures, Yuanta Investment Korea |

| 15 | Megazone Cloud | $1.9 bn | Salesforce Ventures, ATP Investment, kt investment |

| 16 | Bucketplace | $1.4 bn | IMM Investment, Mirae Asset Capital, BOND |

| 17 | RIDI | $1.3 bn | Atinum Investment, Company K Partners, GIC |

| 18 | GPclub | $1.3 bn | Goldman Sachs |

| 19 | L&P Cosmetic | $1.2 bn | CDIB Capital |

| 20 | IGAWorks | $1 bn | Korea Investment Private Equity, Atinum Investment, Korea Investment Partners |

| 21 | Korea Credit Data | $1 bn | Morgan Stanley, Kolon Investments |

| 22 | Toss Bank | $1 bn | Premier Partners, Ribbit Capital |

| 23 | FADU | $1 bn | Company K Partners, Capstone Partners |

| 24 | ZEPETO | $1 bn | SoftBank Vision Fund, SBVA |

| 25 | Kakao Enterprise | $1 bn | Korean Development Bank, Korea Development Bank Europe |

| 26 | Sygnum | $1 bn | SBI Group, Singtel Innov8, Fulgur Ventures |

| 27 | Yanolja | $1 bn | GIC, Aju IB Investment, GIC, Booking |

| 28 | Aprogen | $1 bn | Lindeman Asia Investment, DA Value Investment, |

| 29 | Mediheal | $1 bn | Credit Suisse, CDIB Capital |

| 30 | VA | $1 bn | Paratus Investment |

South Korea’s investment landscape

The investment landscape also reveals deep local participation.

IMM Investment appears across several names from WEMAKEPRICE to Bucketplace, while Mirae Asset anchors Kurly and Bucketplace.

Korea Investment Partners and Atinum Investment also play significant roles, highlighting how local funds complement foreign LPs in scaling startups.

Healthcare and cosmetics remain important but more modest

GPclub and L&P Cosmetic, both above $1 bn, are backed by global players like Goldman Sachs and CDIB Capital, proving the export-driven power of Korean beauty brands, according to Beinsure. Biotech names like Aprogen and Mediheal add to the diversification of the unicorn pool.

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Singapore

- Unicorn Startups in Israel

- Unicorn Startups in Sweden

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in UAE

Methodology

The ranking of the top 10 unicorns in South Korea is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in South Korea. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including Beinsure, CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in South Korea.

FAQ

Collectively, Korean unicorns are valued at more than $65 bn across fintech, mobility, gaming, e-commerce, and healthcare.

Toss leads with a $7.4 bn valuation, reflecting the strength of fintech and digital banking.

Fintech, mobility, gaming, e-commerce, and digital entertainment are the primary drivers, with strong representation across consumer-facing industries.

Sequoia Capital, SoftBank Vision Fund, Tencent, GIC, Carlyle, and Goldman Sachs are among the most active foreign players.

Domestic funds like IMM Investment, Mirae Asset, Korea Investment Partners, and Atinum Investment remain crucial, often co-investing alongside global funds to scale startups.

Gaming, K-beauty, and digital entertainment (e.g., Bluehole, ZEPETO, GPclub) attract global capital by riding on the wave of Korean cultural influence worldwide.

It has become more diversified. While Toss and Kakao Mobility dominate the top tier, multiple unicorns now span niches from grocery delivery (Kurly) to cloud services (Megazone Cloud) and fashion platforms (Musinsa).

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding