Overview

Sweden’s startup and venture capital landscape in 2025 demonstrates the country’s sustained ability to produce globally competitive companies across fintech, healthtech, clean energy, and consumer platforms.

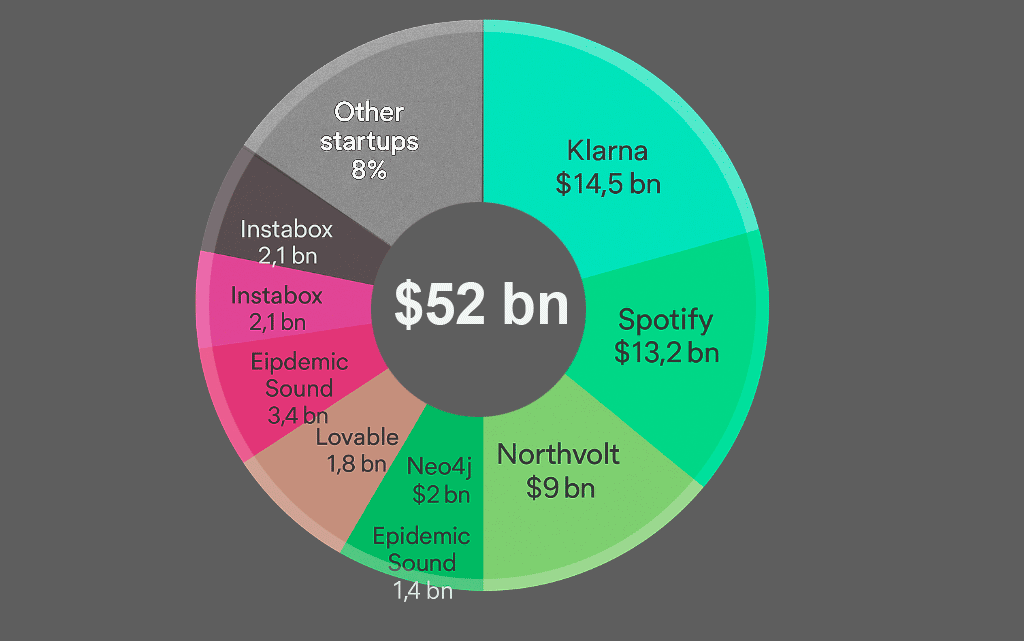

According to Beinsure’s data, the unicorn roster collectively exceeds $52 bn in valuation, highlighting the resilience of the Nordic innovation model despite tighter global liquidity conditions.

Sweden has more than 28.5K+ startups. Of these, 14 have become Unicorns.

For venture capital, the diversity of participants—from global giants like Sequoia, Blackstone, and Temasek to Nordic players such as EQT and Northzone—signals that Sweden is firmly embedded in the international investment flow.

Notably, CPP Investments appears across several leading startups, suggesting that large institutional investors see Swedish innovation as a long-term growth asset.

Fintech remains Sweden’s strongest pillar

- Klarna, valued at $14.5 bn, continues to dominate as the largest unicorn, supported by institutional investors such as Sequoia Capital and CPP Investments.

- Spotify follows closely at $13.2 bn, showing how digital platforms with strong international scaling power still attract large-scale backing from investors like ValueAct Capital.

These two startups alone account for over half of Sweden’s unicorn market capitalization, underlining the centrality of fintech and consumer digital services in the ecosystem, Beinsure noted.

Biggest Unicorn Startups in Sweden by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | Klarna | $14.5 bn | Institutional Venture Partners, Sequoia Capital, General Atlantic, Harmony Venture Partners, CPP Investments |

| 2 | Spotify | $13.2 bn | ValueAct Capital, Kaplan Group Investments |

| 3 | Northvolt | $9 bn | CPP Investments, Goldman Sachs |

| 4 | Kry | $2 bn | Index Ventures, Creandum, Accel, CPP Investments, Fidelity Investments |

| 5 | Neo4j | $2 bn | Morgan Stanley, Hermes GPE |

| 6 | Neko Health | $1.8 bn | Lightspeed Venture Partners, General Catalyst, Lakestar |

| 7 | Lovable | $1.8 bn | Accel, Creandum |

| 8 | Einride | $1.4 bn | Temasek, BUILD Capital Partners, Northzone Ventures, Barclays |

| 9 | Epidemic Sound | $1.4 bn | EQT Partners, Blackstone |

| 10 | Epidemic Sound | $1.4 bn | SEB, Blackstone |

| 11 | Instabox | $1.1 bn | Creades, Verdane |

| 12 | VOI | $1 bn | Vostok New Ventures, The Raine Group, Balderton Capital, Kreos Capital, Luxor Capital Group |

| 13 | Polarium | $1 bn | Beijer Ventures, Alecta |

| 14 | Oatly | $1 bn | Blackstone, K2 Global |

Sweden’s 2025 unicorn landscape is shaped by three forces: enduring fintech and consumer platforms, rapid expansion of green industrial tech, and accelerating healthtech and AI adoption, according to Beinsure.

Together, these dynamics ensure that Sweden remains one of Europe’s most attractive ecosystems for venture capital, with its startups commanding over $52 bn in value.

Valuation share of Top Unicorns in Sweden

The green transition is another driver of capital allocation

Northvolt, with a $9 bn valuation, illustrates how Sweden has become a European leader in sustainable battery production, backed by Goldman Sachs and CPP Investments. Similarly, Polarium, valued at $1 bn, reflects a growing cluster of energy storage startups benefiting from both local and global investor interest.

Healthtech and AI-driven platforms are also gaining traction

Kry, at $2 bn, has attracted a broad investor base including Index Ventures, Accel, and Fidelity. Neo4j, a $2 bn graph database company, demonstrates the rising importance of data infrastructure within enterprise technology.

Neko Health, valued at $1.8 bn, highlights investor appetite for preventive healthcare technologies, with backing from Lightspeed and Lakestar, Beinsure stated.

Lovable, also at $1.8 bn, positions itself at the intersection of AI and consumer platforms, drawing funding from Accel and Creandum.

Mobility and logistics

In mobility and logistics, Einride’s $1.4 bn valuation reflects Sweden’s leadership in electrified and autonomous transport. Instabox, valued at $1.1 bn, and VOI at $1 bn show continued investor confidence in last-mile delivery and micro-mobility, although valuations suggest a recalibration compared to earlier market exuberance.

Consumer and lifestyle brands maintain their global footprint

Oatly, despite market challenges, retains a $1 bn valuation with strong backing from Blackstone and K2 Global. Epidemic Sound, with dual listings of $1.4 bn each across investment rounds, underscores how Sweden continues to export cultural and creative platforms at scale.

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Singapore

- Unicorn Startups in Israel

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

- Unicorn Startups in UAE

Methodology

The ranking of the top 10 unicorns in Sweden is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in Sweden. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including Beinsure, CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in Sweden.

FAQ

Sweden’s unicorns collectively exceed $52 bn in valuation, placing the country among Europe’s leading startup hubs.

Fintech and digital consumer platforms lead, followed by green industrial technology, healthtech, AI, and mobility solutions.

Klarna at $14.5 bn and Spotify at $13.2 bn account for over half of the ecosystem’s total value.

Companies like Northvolt ($9 bn) and Polarium ($1 bn) highlight Sweden’s position as a leader in clean energy and storage solutions.

Global firms like Sequoia, Goldman Sachs, Blackstone, Temasek, and CPP Investments, along with Nordic investors such as EQT and Northzone, are heavily involved.

Kry ($2 bn) and Neko Health ($1.8 bn) showcase rising demand for digital healthcare and preventive medicine solutions.

Sweden’s startups are attracting both global institutional investors and local VCs, indicating long-term confidence in Nordic innovation.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding