Overview

In 2025, the United Arab Emirates continues to establish itself as a regional hub for startups and venture investment, with unicorn valuations reflecting both global confidence and local strategic support. The UAE presents an impressive roster of eleven unicorn-valued startups, collectively highlighting a vibrant ecosystem where innovation meets deep-pocketed global capital.

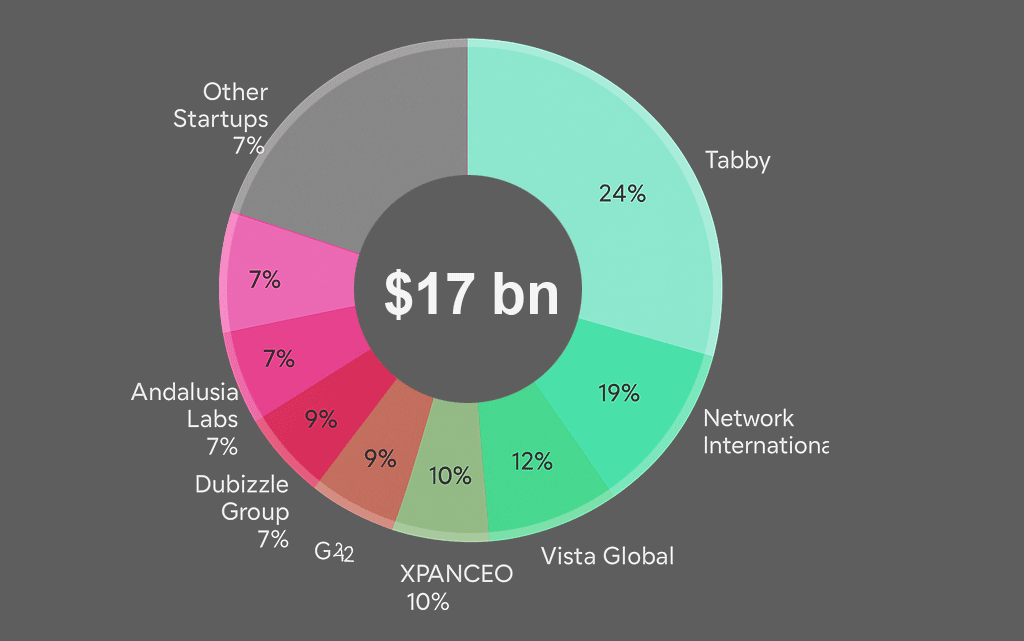

According to Beinsure’s data, the total valuation of the UAE unicorns in 2025 is $17.2 bn. Startups span finance, e-commerce, food tech, AI, and beyond. United Arab Emirates has more than 48K+ startups. Of these, 11 have become Unicorns.

The distribution shows a clear clustering of valuations between $1 bn and $3.3 bn. High valuations correlate with fintech (Tabby), payments infrastructure (Network International), and aviation technology (Vista Global), sectors where scalable growth and recurring revenue models are robust.

From fintech and cloud kitchens to blockchain, transport, classifieds, and e-commerce, these unicorns demonstrate how the UAE’s ecosystem nurtures a broad tech spectrum, Beinsure stated. This diversity helps insulate the ecosystem from sector-specific shocks.

- The country’s most valuable startup is Tabby, valued at $3.3 bn and backed by investors such as Wellington, J.P. Morgan, Arbor Ventures, STV and Global Founders Capital.

- Close behind is Network International at $2.7 bn with the backing of private equity giants Warburg Pincus and General Atlantic, while Vista Global stands at $2.5 bn supported by Rhone Group and RRJ Capital.

Moving into the mid-range, Kitopi, a cloud kitchen operator, is valued at $1.6 bn with capital from CE-Ventures, BECO Capital, Nordstar, GIC and B. Riley Financial. The blockchain-focused 5ire holds a $1.5 bn valuation with Global Emerging Markets and Alphabit as key investors, while XPANCEO follows at $1.4 bn with support from Opportunity Venture.

Several companies cluster around the $1 bn mark, including Careem with backing from Alpha Venture Partners and DCM Ventures, Andalusia Labs with Framework Ventures, Bain Capital Ventures and Dale Ventures, Dubizzle Group with OLX Group, KCK Group, EXOR Seeds and VNV Global, G42 with Silver Lake and Mubadala, and Souq with Vulcan Capital and IFC Asset Management Company.

Valuation Tiers and Investor Profiles

- Top Tier (~$3 bn): Leading the pack is Tabby at $3.3 bn, backed by heavyweight global funds such as Wellington, J.P. Morgan, Arbor Ventures, STV, and Global Founders Capital. These investors are known for backing high-growth fintech and e-commerce platforms—Tabby’s valuation reflects both regional traction and global investor confidence.

- Upper-Mid Tier (~$2.5–2.7 bn): Network International ($2.7 bn) enjoys support from seasoned private equity giants Warburg Pincus and General Atlantic. Similarly, Vista Global ($2.5 bn), operating in aviation and related services, attracts capital from Rhone Group and RRJ Capital—investors experienced in complex, asset-heavy verticals.

- Middle Tier (~$1.4–1.6 bn): This segment includes Kitopi ($1.6 bn), strongly backed by regional and multinational firms like CE-Ventures, BECO Capital, Nordstar, GIC, and B. Riley Financial, reflecting its rapid expansion in cloud kitchens, according to Beinsure. 5ire at $1.5 bn, a player in the blockchain or Web3 space, draws backing from funds like Global Emerging Markets and Alphabit—indicative of high-risk, high-reward positioning. XPANCEO, valued at $1.4 bn, supported by Opportunity Venture, likely represents a unique startup story, perhaps in deep tech or specialized software.

- Lower Tier (~$1 bn): The remaining quartet—Careem, Andalusia Labs, Dubizzle Group, G42, and Souq—each sit at the $1 bn mark. They attract a varied group of investors:

- Careem: Alpha Venture Partners, DCM Ventures

- Andalusia Labs: Framework Ventures, Bain Capital Ventures, Dale Ventures

- Dubizzle Group: OLX Group, KCK Group, EXOR Seeds, VNV Global

- G42: Silver Lake, Mubadala

- Souq: Vulcan Capital, IFC Asset Management Company

These investors range from regional sovereign and strategic funds (Mubadala) to global private equity and early-stage VCs, suggesting that even at this entry-level valuation, investor types are diverse—reflecting varied growth stories from regional scaling (Careem, Dubizzle, Souq) to emerging tech (Andalusia Labs, G42).

The valuation distribution highlights distinct tiers within the UAE ecosystem

The upper tier is dominated by fintech and payments platforms like Tabby and Network International, which combine scalable business models with broad regional adoption and investor trust.

Aviation and logistics players such as Vista Global represent another pillar, drawing funding from investors comfortable with asset-heavy industries.

The middle tier is characterized by emerging technologies including cloud kitchens and blockchain, where rapid growth prospects attract venture-driven capital.

At the lower tier, Beinsure reports, mature platforms like Careem, Dubizzle and Souq illustrate the role of regional expansion and market consolidation, while newer entrants such as Andalusia Labs and G42 emphasize deep tech, AI and blockchain.

Biggest Unicorn Startups in UAE by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | Tabby | $3.3 bn | Wellington, J P Morgan, Arbor Ventures, STV, Global Founders Capital |

| 2 | Network International | $2.7 bn | Warburg Pincus, General Atlantic |

| 3 | Vista Global | $2.5 bn | Rhone Group, RRJ Capital |

| 4 | Kitopi | $1.6 bn | CE-Ventures, BECO Capital, Nordstar, GIC, B. Riley Financial |

| 5 | 5ire | $1.5 bn | Global Emerging Markets, Alphabit |

| 6 | XPANCEO | $1.4 bn | Opportunity Venture |

| 7 | Careem | $1.2 bn | Alpha Venture Partners, DCM Ventures |

| 8 | Andalusia Labs | $1 bn | Framework Ventures, Bain Capital Ventures, Dale Ventures |

| 9 | Dubizzle Group | $1 bn | OLX Group, KCK Group, EXOR Seeds, VNV Global |

| 10 | G42 | $1 bn | Silver Lake, Mubadala |

| 11 | Souq | $1 bn | Vulcan Capital, IFC Asset Management Company |

Valuation share of Top Unicorns in United Arab Emirates

The Composition of Investors is Equally Revealing

Global institutional funds like Wellington, J.P. Morgan and General Atlantic gravitate toward the highest-valued startups, indicating the maturity of these firms and their readiness for large-scale international expansion.

By contrast, mid-range unicorns rely on a blend of regional VCs, sovereign wealth funds such as Mubadala and GIC, and niche technology investors, underscoring the UAE’s hybrid financing landscape.

- The highest valuations draw backing from global institutional investors (e.g., Wellington, J.P. Morgan), indicating these startups have matured enough to attract institutional-grade capital.

- Lower to mid-tier unicorns lean on a mix of regional VCs, sovereign funds, and growth investors, illustrating that earlier-stage or niche tech players still command attention but through more venture-centric capital.

The Government’s Broader Strategy to Foster Unicorns

The government’s broader strategy to foster unicorns, supported by policies like Dubai’s D33 agenda aiming for thirty unicorns by 2033, underpins this growth, according to Beinsure.

Sovereign capital and regional investors play a catalytic role in scaling local champions while global private equity and institutional players validate their long-term potential.

As a result, the UAE’s unicorn ecosystem in 2025 is marked by diversity across fintech, e-commerce, mobility, food tech, blockchain and AI, positioning the country not only as a regional powerhouse but also as a global contender in venture-backed innovation.

- UAE’s unicorn pool is concentrated in Dubai and Abu Dhabi, supported by governmental strategies like Dubai’s D33 agenda aimed at nurturing 30 unicorns by 2033.

- The presence of sovereign capital (GIC, Mubadala) and regional giants like CE-Ventures signals strong domestic support infrastructure, vital for scaling startups in logistics, cloud kitchens, and AI-driven solutions (Kitopi, G42).

Global Unicorns Ranked by Country

- Unicorn Startups in the US

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Singapore

- Unicorn Startups in Israel

- Unicorn Startups in Sweden

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

Methodology

The ranking of the top 10 unicorns in United Arab Emirates is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in UAE. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in United Arab Emirates.

FAQ

The UAE has eleven unicorns valued between $1 bn and $3.3 bn, spanning fintech, aviation, food tech, blockchain, mobility, e-commerce and AI, reflecting a balanced ecosystem between mature platforms and emerging deep-tech ventures.

Tabby leads the ranking at $3.3 bn, backed by major global investors like Wellington and J.P. Morgan, highlighting fintech’s dominance in the region’s unicorn pool.

Global private equity and institutional investors such as General Atlantic, Warburg Pincus, Silver Lake and Bain Capital Ventures play a central role in scaling UAE unicorns, signaling global trust in the market.

Sovereign funds like Mubadala and GIC, alongside regional VCs such as BECO Capital and CE-Ventures, are vital in bridging early-stage growth to institutional funding rounds, ensuring continuity of capital flow.

Fintech, payments, mobility, food tech, classifieds and blockchain are core drivers, while AI and deep-tech startups such as G42 and Andalusia Labs reflect a shift toward knowledge-driven innovation.

Initiatives such as Dubai’s D33 agenda, which targets 30 unicorns by 2033, provide regulatory support, infrastructure and access to sovereign-backed funding, creating a fertile environment for startups to scale.

With global and regional capital converging, and diversification strategies pushing beyond fintech and e-commerce, the UAE unicorn pool is expected to expand in both number and valuation, with AI, blockchain and health tech likely to drive the next wave.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding