Overview

In 2025, the United States remains the epicenter of global venture capital and startup activity, commanding the largest pool of unicorns—private companies valued at $1 bn or more, according to Beinsure’s data.

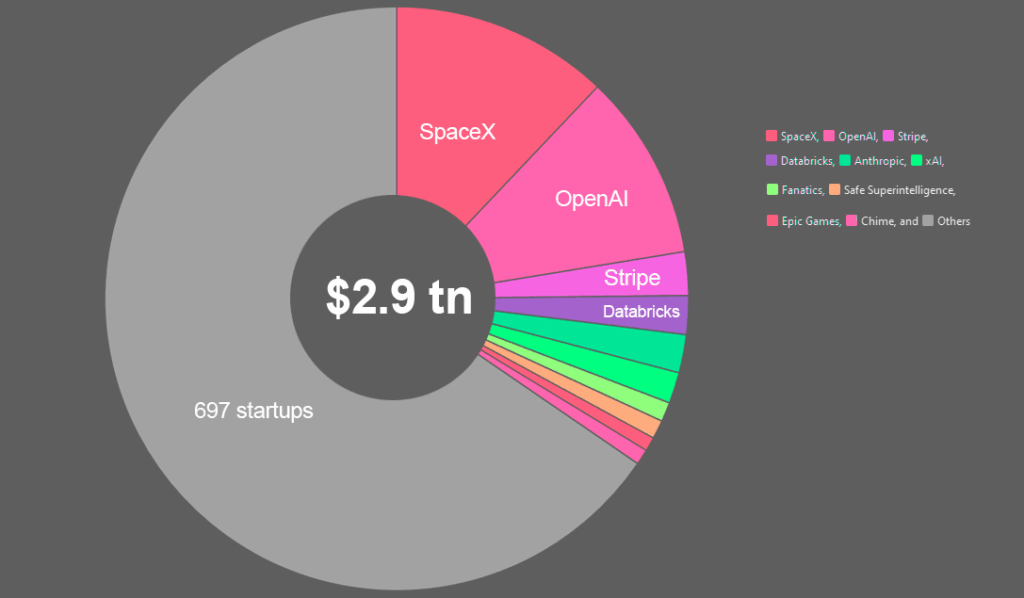

The cumulative valuation of the top 707 unicorns in the U.S. surpasses $2.9 tn, underscoring both the scale of entrepreneurial ambition and the depth of capital flowing into innovation.

U.S. Unicorns’ Concentration of Value

The three largest unicorns illustrate the dominant themes of the decade:

- SpaceX ($350 bn) reflects the surge of private investment in space technology and defense applications, with Founders Fund and DFJ at the center of its backers.

- OpenAI ($300 bn) demonstrates the monetization of artificial intelligence at unprecedented scale, supported by Thrive Capital, Sequoia Capital, and Khosla Ventures.

- Stripe ($70 bn) shows fintech’s resilience in redefining global payment infrastructure.

Together, these three companies alone account for more than $700 bn, or roughly a quarter of total unicorn market value in the U.S., Beinsure noted.

AI in particular has become the defining growth engine of 2025. Beyond OpenAI, companies like Anthropic ($61.5 bn), xAI ($50 bn), Safe Superintelligence ($30 bn), Perplexity ($9 bn), and Hugging Face ($4.5 bn) illustrate how investor capital has shifted toward both foundation model developers and applied AI platforms.

The Venture Capital Power Players

A handful of firms dominate unicorn capitalization:

- Andreessen Horowitz (a16z) appears across categories, backing Databricks, Anduril, OpenSea, Anysphere, and dozens more. Its exposure to AI, defense, and fintech gives it unmatched breadth.

- Sequoia Capital is embedded in nearly every tier, from OpenAI and xAI to Perplexity, Retool, and Zapier, ensuring it remains the most diversified franchise.

- NEA, Accel, and Khosla Ventures continue to lead in enterprise SaaS, fintech, and healthcare, while SoftBank is heavily exposed to consumer platforms and late-stage bets.

Google’s venture arms (GV, CapitalG, and strategic corporate investments) also play a striking role, backing Anthropic, Scale, Niantic, and healthcare startups, reaffirming the strategic importance of AI alignment for Big Tech.

Biggest 300 Unicorn Startups in the U.S. by Valuation

| Rank | Unicorn | Valuation, bn | Investors |

| 1 | SpaceX | $350 | Founders Fund, Draper Fisher Jurvetson, Rothenberg Ventures |

| 2 | OpenAI | $300 | Khosla Ventures, Thrive Capital, Sequoia Capital |

| 3 | Stripe | $70 | Khosla Ventures, LowercaseCapital, capitalG |

| 4 | Databricks | $62 | Andreessen Horowitz, New Enterprise Associates, Battery Ventures |

| 5 | Anthropic | $61.5 | |

| 6 | xAI | $50 | Sequoia Capital, Andreessen Horowitz, VY Capital |

| 7 | Fanatics | $31 | SoftBank Group, Andreessen Horowitz, Temasek Holdings |

| 8 | Safe Superintelligence | $30 | Sequoia Capital, DST Global, Andreessen Horowitz |

| 9 | Chime | $25 | Forerunner Ventures, Crosslink Capital, Homebrew |

| 10 | Epic Games | $22.5 | Tencent Holdings, KKR, Smash Ventures |

| 11 | Miro | $17.5 | Accel, AltaIR Capital, Technology Crossover Ventures |

| 12 | Rippling | $16.8 | Initialized Capital, Y Combinator, Kleiner Perkins Caufield & Byers |

| 13 | Discord | $15 | Benchmark, Greylock Partners, Tencent Holdings |

| 14 | Gopuff | $15 | Accel, SoftBank Group, Anthos Capital |

| 15 | Ripple | $15 | IDG Capital, Venture51, Lightspeed Venture Partners |

| 16 | Anduril | $14 | Andreessen Horowitz, Founders Fund, Revolution Ventures |

| 17 | Scale | $13.8 | Accel, Y Combinator, Index Ventures |

| 18 | OpenSea | $13.3 | Andreessen Horowitz, Thirty Five Ventures, Sound Ventures |

| 19 | Ramp | $13 | D1 Capital Partners, Stripe, Coatue Management |

| 20 | Grammarly | $13 | General Catalyst, Institutional Venture Partners, Breyer Capital |

| 21 | Devoted Health | $12.9 | Andreessen Horowitz, F-Prime Capital, Venrock |

| 22 | Faire | $12.6 | Khosla Ventures, Forerunner Ventures, Sequoia Capital |

| 23 | Brex | $12.3 | DST Global, Ribbit Capital, Greenoaks Capital Management |

| 24 | JUUL Labs | $12 | Tiger Global Management |

| 25 | GoodLeap | $12 | New Enterprise Associates, BDT Capital Partners, Davidson Kempner Capital Management |

| 26 | Deel | $12 | Andreessen Horowitz, Spark Capital, Y Combinator |

| 27 | Airtable | $11.7 | Caffeinated Capital, CRV, Founder Collective |

| 28 | Bolt | $11 | Activant Capital, Tribe Capital, General Atlantic |

| 29 | Alchemy | $10.2 | DFJ Growth Fund, Coatue Management, Addition |

| 30 | Colossal | $10.2 | Animal Capital, Breyer Capital, In-Q-Tel |

| 31 | Thinking Machines Lab | $10 | Andreessen Horowitz, Accel |

| 32 | Gusto | $10 | General Catalyst Partners, Google Ventures, Kleiner Perkins Caufield & Byers |

| 33 | Talkdesk | $10 | DJF, Salesforce Ventures, Storm Ventures |

| 34 | Notion | $10 | Index Ventures, Draft Ventures, Felicis Ventures |

| 35 | Digital Currency Group | $10 | Ribbit Capital, capitalG, Softbank Group |

| 36 | Navan | $9.2 | Andreessen Horowitz, Lightspeed Venture Partners, Zeev Ventures |

| 37 | VAST Data | $9.1 | Norwest Venture Partners, Goldman Sachs, Dell Technologies Capital |

| 38 | Anysphere | $9 | Andreessen Horowitz, Thrive Capital, OpenAI Startup Fund |

| 39 | Perplexity | $9 | New Enterprise Associates, Institutional Venture Partners, NVentures |

| 40 | Tanium | $9 | Andreessen Horowitz, Nor-Cal Invest, TPG Growth |

| 41 | Niantic | $9 | Nintendo, Google, Pokemon Company International, Spark Capital |

| 42 | Chainalysis | $8.6 | Addition, Benhcmark, Accel |

| 43 | Tipalti | $8.3 | 01 Advisors, Zeev Ventures, Group 11 |

| 44 | Fireblocks | $8 | Tenaya Capital, Coatue Management, Stripes Group |

| 45 | Flexport | $8 | Bloomberg Beta, Founders Fund, First Round Capital |

| 46 | FalconX | $8 | Tiger Global Management, American Express Ventures, B Capital Group |

| 47 | Caris | $7.8 | Sixth Street Partners, OrbiMed Advisors, Highland Capital Management |

| 48 | Netskope | $7.5 | Lightspeed Venture Partners, Social Capital, Accel |

| 49 | Flock Safety | $7.5 | Matrix Partners, Initialized Capital, Tiger Global Management |

| 50 | Automattic | $7.5 | Insight Venture Partners, Lowercase Capital, Polaris Partners |

| 51 | iCapital | $7.5 | BlackRock, Blackstone, UBS |

| 52 | Carta | $7.4 | Menlo Ventures, Spark Capital, Union Square Ventures |

| 53 | Snyk | $7.4 | BOLDstart Ventures, Google Ventures, Accel |

| 54 | Gong | $7.3 | Norwest Venture Partners, Next World Capital, Wing Venture Capital |

| 55 | Gemini | $7.1 | Morgan Creek Digital, Marcy Venture Partners, 10T Fund |

| 56 | Wonder | $7 | Accel, Forerunner Ventures |

| 57 | Ro | $7 | Initialized Capital, General Catalyst, SignalFire |

| 58 | ConsenSys | $7 | Third Point, Electric Capital, Coinbase Ventures |

| 59 | Automation Anywhere | $6.8 | General Atlantic, Goldman Sachs, New Enterprise Associates |

| 60 | PsiQuantum | $6.8 | Playground Global, M12, BlackRock |

| 61 | Snorkel AI | $6.4 | Greylock Partners, Google Ventures, BlackRock |

| 62 | DataRobot | $6.3 | New Enterprise Associates, Accomplice, IA Ventures |

| 63 | Upgrade | $6.3 | Union Square Ventures, Ribbit Capital, VY Capital |

| 64 | Black Unicorn Factory | $6.1 | Barter Ventures |

| 65 | Plaid | $6.1 | New Enterprise Associates, Spar Capital, Index Ventures |

| 66 | Benchling | $6.1 | Thrive Capital, Benchmark, MenloVentures |

| 67 | Grafana Labs | $6 | Lightspeed Venture Partners, Lead Edge Capital, Coatue Management |

| 68 | Cyera | $6 | Accel, CyberStarts, Sequoia Capital |

| 69 | Applied Intuition | $6 | Andreessen Horowitz, Lux Capital, General Catalyst |

| 70 | Commure | $6 | General Catalyst, HCA Healthcare |

| 71 | Nuro | $6 | SoftBank Group, Greylock Partners, Gaorong Capital |

| 72 | 6Sense | $6 | Venrock, Battery Ventures, Insight Partners |

| 73 | Attentive | $6 | NextView Ventures, Eniac Ventures, Sequoia Capital |

| 74 | Lyra Health | $5.85 | Greylock Partners, Venrock, Providence Ventures |

| 75 | SandboxAQ | $5.75 | Breyer Capital, Parkway VC, TIME Ventures |

| 76 | Workato | $5.7 | Battery Ventures, Storm Ventures, Redpoint Ventures |

| 77 | Vuori | $5.7 | SoftBank Group, Norwest Venture Partners |

| 78 | The Boring Company | $5.7 | VY Capital, 8VC, Craft Ventures |

| 79 | Postman | $5.6 | Nexus Venture Partners, CRV, Insight Partners |

| 80 | FiveTran | $5.6 | Matrix Partners, Andreessen Horowitz, General Catalyst |

| 81 | Helion Energy | $5.4 | Mithril Capital Management, Y Combinator, Capricorn Investment Group |

| 82 | Shield AI | $5.3 | Andreessen Horowitz, Homebrew, Point72 Ventures |

| 83 | NinjaOne | $5 | |

| 84 | Redwood Materials | $5 | Breakthrough Energy Ventures, Capricorn Investment Group, Valor Equity Partners |

| 85 | Abnormal Security | $5 | Greylock Partners, Insight Partners,Menlo Ventures |

| 86 | SambaNova Systems | $5 | Walden International, Google Ventures, Intel Capital |

| 87 | Whatnot | $5 | Y Combinator, Andreessen Horowitz, Wonder Ventures |

| 88 | Cockroach Labs | $5 | Google Ventures, Benchmark, FirstMark Capital |

| 89 | Icertis | $5 | Eight Roads Ventures, Greycroft, Ignition Partners |

| 90 | Coalition | $5 | Two Sigma Ventures, Flint Capital, Commerce Ventures |

| 91 | Cerebral | $4.8 | Oak HC/FT Partners, Artis Ventures, WestCap Group |

| 92 | Reify Health | $4.8 | Sierra Ventures, Battery Ventures, Asset Management Ventures |

| 93 | BetterUp | $4.7 | Threshold Ventures, Lightspeed Venture Partners, Crosslink Capital |

| 94 | Checkr | $4.6 | Y Combinator, Accel, T. Rowe Price |

| 95 | Glean | $4.6 | General Catalyst, Kleiner Perkins Caufield & Byers, Lightspeed Venture Partners |

| 96 | Skims | $4.6 | Thrive Capital, Alliance Consumer Growth, Imaginary Ventures |

| 97 | Color | $4.6 | General Catalyst, Viking Global Investors, T. Rowe Price |

| 98 | Socure | $4.5 | Two Sigma Ventures, Flint Capital, Commerce Ventures |

| 99 | Sierra | $4.5 | Benchmark, Sequoia Capital, Greenoaks |

| 100 | OneTrust | $4.5 | Insight Partners |

| 101 | Hugging Face | $4.5 | Betaworks Ventures, Addition, Lux Capital |

| 102 | Outreach | $4.4 | Mayfield Fund, M12, Trinity Ventures |

| 103 | Lightmatter | $4.4 | Google Ventures, Spark Capital, Matrix Partners |

| 104 | Guild Education | $4.4 | General Atlantic, Blackstone, ICONIQ Growth |

| 105 | Arctic Wolf Networks | $4.3 | Lightspeed Venture Partners, Redpoint Ventures, Viking Global Investors |

| 106 | Island | $4.3 | Insight Partners, Sequoia Capital, Stripes Group |

| 107 | OutSystems | $4.3 | KKR, ES Ventures, North Bridge Growth Equity |

| 108 | Zipline | $4.2 | Sequoia Capital, Baillie Gifford & Co., Google Ventures |

| 109 | Relativity Space | $4.2 | Playground Global, Bond, Tribe Capital |

| 110 | ThoughtSpot | $4.2 | Lightspeed Venture Partners, Khosla Ventures, Geodesic Capital |

| 111 | Globalization Partners | $4.2 | Vista Equity Partners, Wincove, TDR Capital |

| 112 | dbt Labs | $4.2 | Andreessen Horowitz, Amplify Partners, Sequoia Capital |

| 113 | Dataminr | $4.1 | Venrock, Institutional Venture Partners, Goldman Sachs |

| 114 | Weee! | $4.1 | Goodwater Capital, iFly, XVC Venture Capital |

| 115 | AlphaSense | $4 | Viking Global Investors, GS Growth, BlackRock |

| 116 | Saronic Technologies | $4 | 8VC, Caffeinated Capital, Andreessen Horowitz |

| 117 | The Brandtech Group | $4 | Undisclosed |

| 118 | Cognition AI | $4 | Founders Fund, Khosla Ventures |

| 119 | Houzz | $4 | New Enterprise Associates, Sequoia Capital, Comcast Ventures |

| 120 | Inflection AI | $4 | Gates Frontier, Greylock Partners, Horizons Ventures |

| 121 | Impossible Foods | $4 | Khosla Ventures, Horizons Ventures, Temasek Holdings |

| 122 | Radiology Partners | $4 | New Enterprise Associates, Starr Investment Holdings |

| 123 | Next Insurance | $4 | Zeev Ventures, Ribbit Capital, TLV Partners |

| 124 | Zapier | $4 | Sequoia Capital, Bessemer Venture Partners, Threshold Ventures |

| 125 | Clubhouse | $4 | Andreessen Horowitz, TQ Ventures |

| 126 | ClickUp | $4 | Georgian Partners, Craft Ventures |

| 127 | Cerebras Systems | $4 | Benchmark, Foundation Capital, Sequoia Capital |

| 128 | Farmers Business Network | $4 | Blackrock, Kleiner Perkins Caulfield & Byers, Google Ventures |

| 129 | Branch | $4 | New Enterprise Associates, Pear, Cowboy Ventures |

| 130 | Aurora Solar | $4 | Fifth Wall Ventures, Energize Ventures, ICONIQ Capital |

| 131 | Webflow | $4 | Accel, Silversmith Capital Partners, capitalG |

| 132 | Yuga Labs | $4 | Andreessen Horowitz, Thrive Capital, Sound Ventures |

| 133 | StockX | $3.8 | Google Ventures, Battery Ventures, DST Global |

| 134 | Articulate | $3.75 | Blackstone, ICONIQ Growth, General Atlantic |

| 135 | Dutchie | $3.75 | Casa Verde Capital, Gron Ventures, Thrity Five Ventures |

| 136 | Cohesity | $3.7 | SoftBank Group, Sequoia Capital, Wing Venture Capital |

| 137 | Abba Platforms | $3.7 | Run4 Capital |

| 138 | Dataiku | $3.7 | Alven Capital, FirstMark Capital, capitalG |

| 139 | GOAT | $3.7 | Upfront Ventures, Webb Investment Network, D1 Capital Partners |

| 140 | Noom | $3.7 | Qualcomm Ventures, Samsung Ventures, Silver Lake |

| 141 | Papaya Global | $3.7 | Bessemer Venture Partners, Insight Partners, New Era Ventures |

| 142 | Harness | $3.7 | Menlo Ventures, Alkeon Capital Management, Citi Ventures |

| 143 | o9 Solutions | $3.7 | KKR |

| 144 | Relativity | $3.6 | Silver Lake, ICONIQ Capital |

| 145 | Whoop | $3.6 | NextView Ventures, Promus Ventures, Two Sigma Ventures |

| 146 | Course Hero | $3.6 | NewView Capital, Maveron, Ridge Ventures |

| 147 | SpotOn | $3.6 | Dragoneer Investment Group, DST Global, Franklin Templeton |

| 148 | Chainguard | $3.5 | Amplify Partners, MANTIS Venture Capital, Sequoia Capital |

| 149 | Cribl | $3.5 | Institutional Venture Partners, CRV, Sequoia Capital |

| 150 | Vultr | $3.5 | AMD Ventures |

| 151 | Indigo Ag | $3.5 | Activant Capital Group, Alaska Permanent Fund, Baillie Gifford & Co. |

| 152 | Rec Room | $3.5 | First Round Capital, Sequoia Capital, Index Ventures |

| 153 | Tekion | $3.5 | Airbus Ventures, Index Ventures, Advent International |

| 154 | Highspot | $3.5 | Madrona Venture Group, Shasta Ventures, Salesforce Ventures |

| 155 | Handshake | $3.5 | Kleiner Perkins Caufield & Byers, Lightspeed Venture Partners, True Ventures |

| 156 | ChargeBee Technologies | $3.5 | Insight Partners, Tiger Global Management, Accel |

| 157 | Rokt | $3.5 | Square Peg Capital, TDM Growth Partners, Tiger Global Management |

| 158 | Via | $3.5 | 83North, RiverPark Ventures, Pitango Venture Capital |

| 159 | Aledade | $3.5 | Venrock, CVF Capital Partners, ARCH Venture Partners |

| 160 | A24 Films | $3.5 | Stripes Group, Neuberger Berman |

| 161 | GrubMarket | $3.5 | GGV Capital, BlackRock, ACE & Company |

| 162 | MoonPay | $3.4 | New Enterprise Associates, Coatue Management, Tiger Global Management |

| 163 | Starburst | $3.4 | Index Ventures, Coatue Management, Andreessen Horowitz |

| 164 | Together AI | $3.3 | Definition Capital, Long Journey Ventures, Lux Capital |

| 165 | ElevenLabs | $3.3 | Andreessen Horowitz, Credo Ventures, Sequoia Capital |

| 166 | Sila | $3.3 | Bessemer Venture Partners, Sutter Hill Ventures, Matrix Partners |

| 167 | Komodo Health | $3.3 | Andreessen Horowitz, IA Ventures, Felicis Ventures |

| 168 | Spring Health | $3.3 | Rethink Impact, Work-Bench, RRE Ventures |

| 169 | BlockDaemon | $3.25 | BOLDstart Ventures, Lerer Hippeau, Kenetic Capital |

| 170 | Bilt Rewards | $3.25 | Camber Creek, Kairos HQ, Fifth Wall Ventures |

| 171 | Vercel | $3.25 | CRV, Accel, Google Ventures |

| 172 | Thumbtack | $3.2 | Tiger Global, Sequoia Capital, Google Capital |

| 173 | Cedar | $3.2 | Thrive Capital, Founders Fund, Cocnord Health Partners |

| 174 | Runway | $3.2 | Lux Capital, Compound, Amplify Partners |

| 175 | Addepar | $3.2 | 8VC, D1 Capital Partners, Sway Ventures |

| 176 | Innovaccer | $3.2 | M12, WestBridge Capital, Lightspeed Venture Partners |

| 177 | Ironclad | $3.2 | Accel, Sequoia Capital, Y Combinator |

| 178 | Eikon Therapeutics | $3.2 | The Column Group, Foresite Capital, Foresite Capital |

| 179 | Retool | $3.2 | Sequoia Capital |

| 180 | Verkada | $3.2 | next47, First Round Capital, Sequoia Capital |

| 181 | HighRadius | $3.1 | Susquehanna Growth Equity, Citi Ventures, ICONIQ Capital |

| 182 | Phantom | $3 | Paradigm, Andreessen Horowitz, Jump Capital |

| 183 | LayerZero Labs | $3 | Andreessen Horowitz, FTX Ventures, Tiger Global Management |

| 184 | Harvey | $3 | OpenAI Startup Fund, Kleiner Perkins, Sequoia Capital |

| 185 | Crusoe | $3 | Bain Capital Ventures, Founders Fund, Winklevoss Capital |

| 186 | Monad Labs | $3 | HTX Ventures, Electric Capital, Coinbase Ventures |

| 187 | Circle | $3 | General Catalyst, Digital Currency Group, Accel |

| 188 | Forter | $3 | Sequoia Capital Israel, Scale Venture Partners, Commerce Ventures |

| 189 | Calendly | $3 | ICONIQ Capital, OpenView Venture Partners |

| 190 | BlockFi | $3 | ConsenSys Ventures, Valar Ventures, PUC |

| 191 | ActiveCampaign | $3 | Silversmith Capital Partners, Susquehanna Growth Equity, Tiger Global Management |

| 192 | Lucid Software | $3 | Spectrum Equity, ICONIQ Capital, Grayhawk Capital |

| 193 | Age of Learning | $3 | Iconiq Capital |

| 194 | Carbon Health | $3 | Brookfield Asset Management, Blackstone, Data Collective |

| 195 | LaunchDarkly | $3 | Uncork Capital, Threshold Ventures, Bloomberg Beta |

| 196 | Seismic | $3 | Jackson Square Ventures, General Atlantic, Lightspeed Venture Partners |

| 197 | Outschool | $3 | Uniion Square Ventures, Tiger Global Management, Lightspeed Venture Capital |

| 198 | TradingView | $3 | Tiger Global Management, Insight Partners, Jump Capital |

| 199 | Podium | $3 | Accel, Summit Partners, Google Ventures |

| 200 | Anchorage Digital | $3 | Andreessen Horowitz, Blockchain Capital, Lux Capital |

| 201 | Inxeption | $3 | Coatue Management, BMO Capital, Schonfeld Strategic Advisors |

| 202 | Lattice | $3 | Khosla Ventures, Thrive Capital, Y Combinator |

| 203 | Flutterwave | $3 | Green Visor Capital, CRE Venture Capital, Greycroft |

| 204 | Cross River Bank | $3 | Battery Ventures, Andreessen Horowitz, Ribbit Capital |

| 205 | Remote | $3 | Index Ventures, Sequoia Capital, General Catalyst |

| 206 | Sentry | $3 | New Enterprise Associates, Accel, Bond |

| 207 | Sword Health | $3 | Khosla Ventures, Green Innovations, Founders Fund |

| 208 | Kraken | $2.9 | Bnk To The Future, Trammell Ventures, SBI Investment |

| 209 | Workrise | $2.9 | Founders Fund, Quantum Energy Partners, Bedrock Capital |

| 210 | DriveWealth | $2.85 | Point72 Ventures, Route 66 Ventures, Accel |

| 211 | Physical Intelligence | $2.8 | Khosla Ventures, Sequoia Capital, Lux Capital |

| 212 | Motive | $2.8 | Google Ventures, Index Ventures, Scale Venture Partners |

| 213 | Nutrabolt | $2.8 | MidOcean Partners |

| 214 | Abridge | $2.75 | Institutional Venture Partners, Spark Capital, Lightspeed Venture Partners |

| 215 | Illumio | $2.75 | Data Collective, Formation 8, General Catalyst Partners |

| 216 | MasterClass | $2.75 | Institutional Venture Partners, New Enterprise Associates, Javelin Venture Partners |

| 217 | Ethos | $2.7 | Sequoia Capital, Google Ventures, Accel |

| 218 | Tradeshift | $2.7 | Notion Capital, Scentan Ventures, Kite Ventures |

| 219 | Nextiva | $2.7 | Goldman Sachs Asset Management |

| 220 | Figure | $2.7 | Intel Capital, Parkway VC, Amazon Industrial Innovation Fund |

| 221 | Sourcegraph | $2.6 | Redpoint Ventures, Goldcrest Capital, Insight Partners |

| 222 | Pendo | $2.6 | Contour Venture Partners, Battery Ventures, Core Capital Partners |

| 223 | Plume | $2.6 | Insight Partners, Jackson Square Ventures, Liberty Gloval Ventures |

| 224 | Axonius | $2.6 | Vertex Ventures Israel, Bessemer Venture Partners, Emerge |

| 225 | JumpCloud | $2.6 | Foundry Group, General Atlantic, BlackRock |

| 226 | JUST Egg | $2.5 | Khosla Ventures, Horizons Ventures, Founders Fund |

| 227 | Groq | $2.5 | TDK Ventures, Social Capital, D1 Capital Partners |

| 228 | Peregrine | $2.5 | Sequoia Capital, Fifth Down Capital |

| 229 | Lambda Labs | $2.5 | 1517 Fund, Gradient Ventures, Bloomberg Beta |

| 230 | Jetti Resources | $2.5 | BMW i Ventures, BHP Ventures |

| 231 | Claroty | $2.5 | Bessemer Venture Partners, MoreVC, Team8 |

| 232 | Side | $2.5 | Coatue Managemeny, Trinity Ventures, Matrix Partners |

| 233 | Varo Bank | $2.5 | Warburg Pincus, The Rise Fund, HarbourVest Partners |

| 234 | Aura | $2.5 | Warburg Pincus, General Catalyst |

| 235 | Sysdig | $2.5 | Accel, Bain Capital Ventures, Insight Partners |

| 236 | Uniphore | $2.5 | Chiratae Ventures, March Capital Partners, National Grid Partners |

| 237 | Somatus | $2.5 | The Blue Venture Fund, Flare Capital Partners, Longitude Capital |

| 238 | SiFive | $2.5 | Sutter Hill Ventures, Osage University Partners, Spark Capital |

| 239 | Fetch | $2.5 | Greycroft, Loeb.NYC, DST Global |

| 240 | Vanta | $2.5 | Craft Ventures, Sequoia Capital, Verissimo Ventures |

| 241 | insitro | $2.4 | Foresite Capital, ARCH Venture Partners, Third Rock Ventures |

| 242 | Carbon | $2.4 | Google Ventures, Sequoia Capital, Wakefield Group |

| 243 | Paxos | $2.4 | Liberty City Ventures, RRE Ventures, Mithril Capital Management |

| 244 | BitSight Technologies | $2.4 | Menlo Ventures, GGV Capital, Flybridge Capital Partners |

| 245 | Trumid | $2.4 | T. Rowe Price, Dragoneer Investment Group, BlackRock |

| 246 | ABL Space Systems | $2.4 | T. Rowe Price, Lockheed Martin Ventures, Fidelity Investment |

| 247 | HoneyBook | $2.4 | Norwest Venture Partners, Hillsven Capital, Aleph |

| 248 | Beta Technologies | $2.4 | The Rise Fund, Fidelity Investments. RedBird Capital Partners |

| 249 | Project44 | $2.4 | Emergence Capital Partners, 8VC, Chicago Ventures |

| 250 | Freenome | $2.4 | Andreessen Horowitz, Data Collective, Roche Venture Fund |

| 251 | Gympass | $2.4 | General Atlantic, SoftBank Group, Atomico |

| 252 | Uptake | $2.3 | Revolution, New Enterprise Associates, Caterpillar |

| 253 | Greenlight | $2.3 | Relay Ventures, TTV Capital, Canapi Ventures |

| 254 | Story Protocol | $2.25 | A16z Crypto, Andreessen Horowitz, Two Small Fish Ventures |

| 255 | Algolia | $2.25 | Accel, Alven Capital, Storm Ventures |

| 256 | Pattern | $2.25 | Knox Lane, Ainge Advisory, Carlson Private Capital Partners |

| 257 | Transcarent | $2.2 | Alta Partners, General Catalyst, Jove Equity Partners |

| 258 | Newfront Insurance | $2.2 | Founders Fund, Meritech Capital Partners, GS Growth |

| 259 | Skydio | $2.2 | Andreessen Horowitz, Andreessen Horowitz, Institutional Venture Partners, Accel |

| 260 | Current | $2.2 | Expa, QED Investors, Foundation Capital |

| 261 | Dialpad | $2.2 | Andreessen Horowitz, Google Ventures, Section 32 |

| 262 | BloomReach | $2.2 | Bain Capital Ventures, Sixth Street Growth, Lightspeed Venture Partners |

| 263 | Inari | $2.17 | Flagship Pioneering, Alexandria Venture Investments, Investment Corporation of Dubai |

| 264 | Qualia | $2.17 | 8VC, Menlo Ventures, Tiger Global Management |

| 265 | Xaira Therapeutics | $2.15 | ARCH Venture Partners, Foresite Capital, Two Sigma Ventures |

| 266 | Eightfold | $2.1 | Foundation Capital, Institutional Venture Partners, General Catalyst |

| 267 | Medable | $2.1 | GSR Ventures, Sapphire Ventures, Streamlined Ventures |

| 268 | Jeeves | $2.1 | Tencent Holdings, CRV, Clocktower Technology Ventures |

| 269 | Supabase | $2 | Accel, Coatue, Craft Ventures |

| 270 | CHAOS Industries | $2 | Accel, 8VC |

| 271 | Zeta | $2 | Sodexo Ventures, SoftBank Group |

| 272 | Neo4j | $2 | Eight Roads Ventures, One Peak Partners, Creandum |

| 273 | Kalshi | $2 | Sequoia Capital |

| 274 | Melio | $2 | Accel, Aleph, American Express Ventures |

| 275 | The Bot Company | $2 | |

| 276 | CHAOS Industries | $2 | Noosphere Ventures, RPM Ventures, SMS Capital Investment |

| 277 | Firefly Aerospace | $2 | Noosphere Ventures, RPM Ventures, SMS Capital Investment |

| 278 | Clear Street | $2 | NextGen Venture Partners, Prysm Capital, McLaren Strategic Ventures |

| 279 | Drata | $2 | Cowboy Ventures, Leaders Fund, GGV Capital |

| 280 | Mysten Labs | $2 | Andreessen Horowitz, Coinbase Ventures, Circle Ventures |

| 281 | Liquid AI | $2 | OSS Capital, Duke Capital Partners, Samsung NEXT |

| 282 | Avant | $2 | RRE Ventures, Tiger Global, August Capital |

| 283 | Formlabs | $2 | Pitango Venture Capital, DFJ Growth Fund, Foundry Group |

| 284 | Calm | $2 | Insight Venture Partners, TPG Growth, Sound Ventures |

| 285 | Kaseya | $2 | Insight Partners, TPG Alternative & Renewable Technologies, Ireland Strategic Investment Fund |

| 286 | Druva | $2 | Nexus Venture Partners, Tenaya Capital, Sequoia Capital |

| 287 | AppsFlyer | $2 | Magma Venture Partners, Pitango Venture Capital, Qumra Capital |

| 288 | Redis | $2 | Viola Ventures, Dell Technologies Capital, Bain Capital Ventures |

| 289 | Unqork | $2 | Blackrock, capitalG, World Lab Innovation |

| 290 | Virta Health | $2 | Caffeinated Capital, Obvious Ventures, Venrock |

| 291 | ISN | $2 | Blackstone |

| 292 | Hive | $2 | Tomales Bay Capital, Bain & Company, General Catalyst |

| 293 | Kajabi | $2 | Meritech Capital Partners, Tiger Global Management, Spectrum Equity |

| 294 | Pipe | $2 | next47, MaC Venture Capital, FinVC |

| 295 | Iterable | $2 | CRV, Blue Cloud Ventures, Index Ventures |

| 296 | MURAL | $2 | Insight Partners, Tiger Global Management, Gradient Ventures |

| 297 | Apeel Sciences | $2 | Upfront Ventures, Tao Capital Partners, Andreessen Horowitz |

| 298 | Aviatrix | $2 | Ignition Partners, Formation 8, CRV |

| 299 | Misfits Market | $2 | Accel, D1 Capita Partners, Greenoaks Capital Management |

| 300 | Modern Treasury | $2 | Benchmark, Altimeter Capital, Quiet Capital |

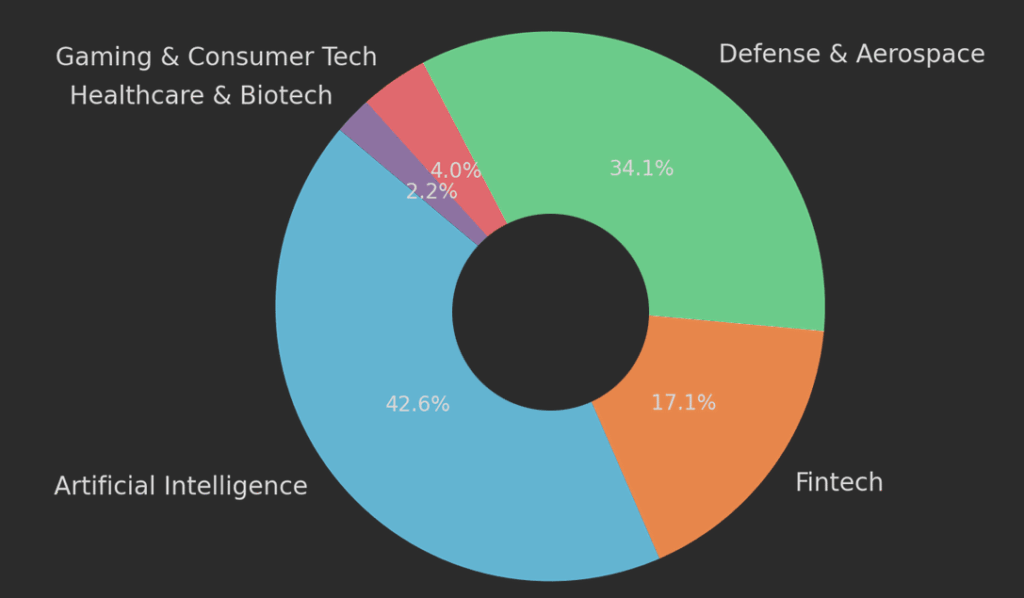

Sectoral Distribution of Capital

- Artificial Intelligence: Collectively valued at over $500 bn, AI is the largest single concentration of unicorn value. The sector includes general-purpose AI (OpenAI, Anthropic, xAI), infrastructure (Scale, Snorkel AI, Together AI), and applied verticals like Perplexity, Harvey, and Cognition AI.

- Fintech: Stripe, Chime ($25 bn), Ripple ($15 bn), and Brex ($12.3 bn) anchor a sector still worth well over $200 bn, even after regulatory scrutiny and consolidation.

- Defense and Aerospace: SpaceX, Anduril ($14 bn), and Relativity Space ($4.2 bn) reflect national-security-aligned investment. Collectively, aerospace and defense unicorns are valued at more than $400 bn, a surge from 2020 levels.

- Gaming and Consumer Tech: Epic Games ($22.5 bn), Discord ($15 bn), and Niantic ($9 bn) show how digital entertainment still scales into multi-bn valuations, though at a slower pace than AI or fintech.

- Healthcare & Biotech: Devoted Health ($12.9 bn), Benchling ($6.1 bn), and Lyra Health ($5.85 bn) demonstrate resilience as VC capital flows into precision medicine and healthcare SaaS.

Top 25 US FinTech Startups

| № | FinTech | Valuation, $ bn | VC raised, $ mn |

| 1 | Robinhood | 32 bn | 5 600 |

| 2 | Chime | 25 bn | 2 600 |

| 3 | Citadel Securities | 22 bn | 1 100 |

| 4 | Ripple | 15 bn | 325 |

| 5 | Marqeta | 14,3 bn | 525 |

| 6 | Plaid | 13,4 bn | 734 |

| 7 | OpenSea | 13,3 bn | 423 |

| 8 | Faire | 12,6 bn | 1 500 |

| 9 | Brex | 12,3 bn | 1 200 |

| 10 | Goodleap | 12 bn | 800 |

| 11 | Affirm | 11,9 bn | 1 500 |

| 12 | NeueHealth | 11,1 bn | 1 600 |

| 13 | Bolt | 11 bn | 958 |

| 14 | Kraken | 10,8 bn | 112 |

| 15 | Digital Currency Group | 10 bn | |

| 16 | Gusto | 9,6 bn | 751 |

| 17 | Navan | 9,2 bn | 1 400 |

| 18 | Chainalysis | 8,6 bn | 537 |

| 19 | Avalara | 8,4 bn | 395 |

| 20 | Tipalti | 8,3 bn | 556 |

| 21 | FalconX | 8 bn | 427 |

| 22 | Fireblocks | 8 bn | 1 000 |

| 23 | Ramp | 7,7 bn | 1 700 |

| 24 | Circle | 7,7 bn | 1 100 |

| 25 | Better Home & Finance | 7,7 bn | 1 200 |

Valuation share of Top Unicorns in the U.S.

Shifts in Investor Strategy

Two shifts characterize the 2025 market:

- AI Crowding Effect: AI has drawn extraordinary late-stage capital, with a handful of firms (Sequoia, Andreessen Horowitz, Thrive, Khosla) competing for ownership in overlapping portfolios. This has created both inflated valuations and blurred lines between competitive bets, Beinsure said.

- Defense and National Interest Capital: Unlike the consumer and SaaS-driven unicorn wave of the 2010s, 2025 unicorns reflect strategic imperatives: space, quantum, defense AI, and biotech. Investors now increasingly align portfolios with geopolitical realities, particularly U.S.–China competition.

Global Unicorns Ranked by Country

- Unicorn Startups in the UK

- Unicorn Startups in China

- Unicorn Startups in Germany

- Unicorn Startups in France

- Unicorn Startups in Canada

- Unicorn Startups in Singapore

- Unicorn Startups in Israel

- Unicorn Startups in Sweden

- Unicorn Startups in Finland

- Unicorn Startups in Norway

- Unicorn Startups in India

- Unicorn Startups in Brazil

- Unicorn Startups in Australia

- Unicorn Startups in South Korea

- Unicorn Startups in UAE

Methodology

The ranking of the top 10 unicorns in the United States is based on publicly available data from venture capital databases, company announcements, and reliable industry sources. A unicorn is defined here as a privately held, venture-backed company with a valuation of $1 bn or more, measured at the most recent funding round (post-money valuation).

We first identified all active unicorns headquartered in the U.S. Companies that had gone public, been acquired, or fallen below the $1 bn threshold were excluded.

From this list, we selected the 10 highest-valued firms. Valuations were cross-checked against multiple sources, including CB Insights, PitchBook, and press releases from investors and companies.

Investor information was included to illustrate the breadth of global capital supporting these startups. The ranking is presented in descending order by valuation, with data rounded to the nearest $10 mn where necessary.

This methodology ensures transparency, consistency, and comparability across companies. While valuations can fluctuate with market conditions, this ranking reflects the latest available figures at the time of publication.

It provides a snapshot of the most influential and highly valued startups shaping the innovation landscape in the United States.

FAQ

The combined valuation of U.S.-based unicorns in 2025 exceeds $2.9 tn, spread across more than 700 companies.

SpaceX ($350 bn), OpenAI ($300 bn), Stripe ($70 bn) – together, they represent nearly a quarter of total unicorn market value.

Artificial Intelligence leads with over $500 bn in value, followed by Defense & Aerospace ($400 bn) and Fintech ($200 bn).

VC firms like Sequoia Capital, Andreessen Horowitz (a16z), Khosla Ventures, Accel, and NEA dominate portfolios, while Google’s GV and CapitalG remain strategically important in AI and biotech.

Two defining shifts:

Heavy concentration of capital in AI and defense technologies.

Rising alignment between startups and national strategic priorities (space, quantum, biotech, defense).

Yes, but at a slower pace. Companies like Epic Games ($22.5 bn), Discord ($15 bn), and Niantic ($9 bn) remain valuable, but consumer platforms no longer dominate as they did in the 2010s.

Overvaluation in AI due to intense capital inflows.

Geopolitical dependencies around space and defense funding.

Regulatory challenges in fintech and healthcare.

……………..

AUTHORS: Peter Sonner — Lead Tech Editor of Beinsure Media, Oleg Parashchak — CEO & Founder of Finance Media Holding