Insurers quickly shored up digital capabilities to enable virtual consumer engagement after COVID-19 made face-to-face contact problematic even for those who still preferred to buy and be serviced that way.

However, as the environment begins to stabilize, carriers should be considering how to build on these adaptations and better integrate them with legacy approaches to product development, marketing, and distribution.

P&C insurers recognizes the need to align strategies

Deloitte`s Global outlook survey shows most insurance marketing executives across sectors believe buyer expectations for acceleration of digital distribution channels to be very high.

Many P&C respondents in particular appear to clearly recognize the need to align strategies with this trend, but there may be a small disconnect between how some life carriers perceive consumer behavior and preferences versus their plans to bolster online or mobile sales.

However, while digitization is an important priority, insurers also should not neglect the value of the human touch, given product and process complexities embedded throughout the insurance life cycle. A shift to “right-channeling”—thinking strategically about which insurance interactions require digital versus human intervention to create the ideal experience for each consumer—should guide insurer distribution and service strategies.

While consumer preferences appear to be shifting toward greater digitization and self-service capabilities, agent/broker interaction remains a vital component to prospecting, sales, and service.

That doesn’t mean the legacy agency force won’t need to be digitally enabled to succeed in this increasingly virtual business world. Indeed, insurers should support their agents by providing customer relationship management platforms and systems to engage remotely more effectively with consumers.

Many agents are already looking to expand their capabilities in this area to supplement and enhance traditional approaches to sales and service. The 2020 Agency Universe Study by the Independent Insurance Agents & Brokers of America found social media and digital marketing cited by 58% as a top marketing strategy.

Insurance marketers should adapt to shifts in consumer media consumption

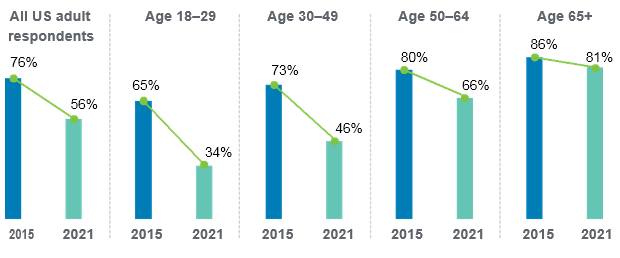

Insurers should be rethinking their advertising approaches as well to reflect new digital realities. A Pew Research Center survey revealed that US adults who say they watch television on cable or satellite declined from 76% in 2015 to 51% in 2022, with an even steeper decline in younger segments.

To be most impactful, carriers and agents should therefore be shifting to alternative media drawing a growing share of eyeballs. US auto insurers already increased investments in digital advertising 20% to about US$1.5 billion in 2021, which still only represented 22% of their overall ad spending at that time.

Since traditional marketing, such as a 30-second Super Bowl spot, is far more expensive than social media ads, paid search, or other digital options, insurers should also be able to get a lot of mileage from relatively small but steady increases in digital ad investments.

Insurer media spend should also be more personalized to reach emerging target audiences. A Deloitte media trends survey revealed 55% of Generation Z and 66% of millennial respondents said ads on social media are influential. They also typically preferred ads on social media more than in streaming video content and other channels.

When our global outlook survey queried marketing respondents about their company’s long-term changes in customer communication and engagement strategy, P&C insurer respondents ranked social media interaction highest. However, life respondents did not list this as one of their company’s top three priorities, which could result in missing a key opportunity to influence a substantial and growing market segment.

Percentage of US adults who say they receive TV via cable or satellite at home

Investing in digital media strategies may be foundational to reaching more consumers going forward, but customization is also likely to be critical to maximize prospecting, acquisition, and retention efforts.

Such initiatives could perhaps be bolstered by more advanced customer data analytics. For example, Prudential Financial Inc. purchased Assurance IQ to offer consumers personalized health and financial wellness solutions through a direct-to-consumer platform.

While many insurers have already integrated customer data platforms, more comprehensive customer relationship management systems, and master data management architecture platforms, licenses, and software, some may continue to struggle with analyzing all the data they have traditionally collected, let alone make emerging alternative data sources actionable.

It is therefore encouraging that Deloitte’s survey respondents across sectors largely agree their company’s highest investment in marketing, sales, and distribution budgets over the next year will go toward data and analytics.

Insurers can differentiate value through modernized product offerings

In addition to advancing prospecting, sales, and distribution strategies, insurers should also consider innovative ways to differentiate their overall value proposition beyond price and coverage.

The potential to offer more products based on real-time risk monitoring resonated across sectors and regions. However, it’s becoming increasingly challenging for insurers to offer such customized client experience on their own.

They should, therefore, consider forming alliances or partnerships with entities that can provide seamless interaction and data sources to create more holistic, consumer-centric experiences.

For example, AXA XL is partnering with innovation leaders, contractor customers, and technology companies to create a construction ecosystem using sensors and cameras to collect data for more impactful engagement with commercial customers.

Insurers are increasingly finding it hard to offer customized client experiences on their own. They should, therefore, consider forming alliances or partnerships with entities that can provide seamless interaction and data sources to create more holistic, consumer-centric experiences.

Moreover, a recent Deloitte survey of underserved US life insurance consumers showed most segments may be more interested in purchasing coverage if it included the possibility of an adjustable premium based on lifestyle and healthy eating—perhaps measured by fitness apps or other data sources.

Increasing product flexibility was cited as a top priority for P&C respondents, which aligns with results from an earlier Global Auto and Homeowners Consumer Survey, in which US respondents indicated interest in being able to more easily and frequently adjust their coverage depending on what they need and can afford.