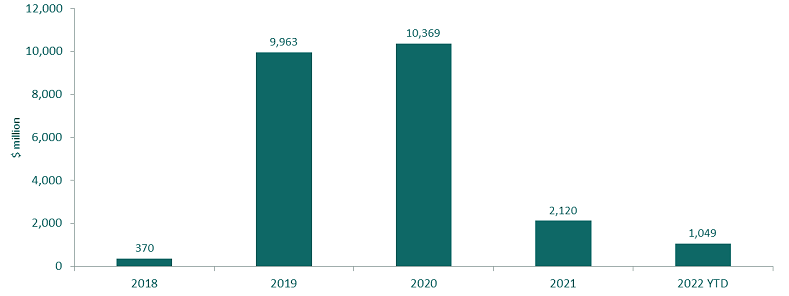

GlobalData’s Database reveals that the value of global investments in insurtech fell by 79.6%. This follows a consistent flow of stories of insurtechs struggling.

Lemonade cut Metromile’s staff by 20% after completing the acquisition of the insurtech in August 2022, having previously stated it would not reduce headcount.

Other high-profile insurtechs that have made similar moves in 2022 include Nova Benefits cutting 30% of its staff in June and Zego cutting 17% of its staff in July.

With several leading insurtech start-ups going bust or cutting staff, the COVID-19 pandemic and cost-of-living crisis are having a massive impact on the global insurtech industry.

At the end of July 2022 there had been $1 billion invested into the industry, which represents only 49.5% of the total annual 2021 figure. The report suggests growth is unlikely in 2022.

Global InsurTech Investments

These trends are likely due to a combination of factors. As highlighted, investment into the sector has dried up somewhat.

With the global stock market amid some of its worst days in recent history, the impact on InsurTechs and InsurTech investors is undoubtedly being felt. Since the beginning of 2022, through this most recent quarter (Q2), some $9.3 trillion of company value is estimated to have been wiped from the stock markets.

Funding rounds are essential to keep insurtechs running in the early stages before they become profitable, so reduced investment is a significant barrier.

Economic woes have also led consumers to turn to familiar and established brands, as they trust them more to survive and pay out claims, says GlobalData.

Many insurtechs focus on gadget or possessions insurance, states the report, which is not considered an essential purchase by consumers. As a result, it is a line that is always likely to be hit as disposable incomes decrease and consumers look to reduce their expenditure.

Insurtechs will need to focus on offering value to consumers, as that is what they will be looking for in the immediate future.

This can be achieved by relying heavily on artificial intelligence to cut processing costs, or by offering innovative products such as pay-as-you-drive and on-demand policies. The latter would allow consumers to control how much they pay or receive cover only when it is strictly needed.

According to Beinsure Data, Investment in the insurtech space in the 2Q of 2022 increased by 8.3% from the opening quarter of the year to $2.41 bn, as a rise in the average deal size masked a decline in the overall number of deals.

Key findings:

- InsurTech is showing signs of a small recovery, with Q2 funding up 8% on the prior quarter as total disclosed global InsurTech funding for the quarter reached an impressive $2.41 billion.

- Average deal size increased for the quarter by 18.3% — $22.11 million in Q2 compared to $18.72 million in Q1.

- The increase in average deal size is however overshadowed by a 7.7% decrease in total Q2 InsurTech deals. Q2 saw 132 InsurTech deals, compared to 143 InsurTech deals in Q1.

- Total disclosed funding for L&H InsurTech reached $918M in Q2. This reflects a 12.4% increase in funding from the prior quarter, as well as an increase in deals. There were 40 deals for L&H InsurTech in Q2 compared to 37 in Q1.

- $948 million was raised in six Q2 mega-rounds, including four based in the U.S.

InsurTech ecosystem has met a very interesting juncture; at a macro-level, be swept up in the downgrading of public value, or represent a viable investment alternative to an investor’s portfolio that is otherwise being dragged into generalised bearishness, and at a micro-level; either capitalise on the availability of lower-priced assets or struggle to survive.

by Peter Sonner